Now Reading: Azimut Group invests $128 million in D-Orbit

-

01

Azimut Group invests $128 million in D-Orbit

Azimut Group invests $128 million in D-Orbit

SAN FRANCISCO – Italy’s Azimut Group invested $128 million in italian space logistics specialist D-Orbit, directly and by buying out an existing investor.

The investment — $53 million in new funding and a $75 million buyout of an existing D-Orbit investor — is the first tranche of investment in D-Orbit’s Series D round. D-Orbit raised $168 million in a 2024 Series C round.

“This funding will enable strategic acquisitions, accelerate the build-out of D-Orbit’s orbital logistics infrastructure, expand in-orbit transportation services, scale industrial capacity for ION missions and advance new operational capabilities required for a congested orbital environment,” Luca Rossettini, D-Orbit founder and CEO, said in a statement.

D-Orbit’s mergers and acquisitions strategy “envisages further strategic acquisitions in the near future, building on the validated business integration model successfully implemented with Planetek in 2025,” Rossettini told SpaceNews by email. (Planetek, an Italian Earth-observation, geospatial-analytics and mission-software firm, was acquired by D-Orbit in 2025.)

“Our M&A approach maintains a pan-European focus, driven by regulatory considerations and operational integration requirements,” Rossettini said. “We aim to contribute to the consolidation of the European space services market, while ensuring full alignment with ESA frameworks and the national security requirements of EU Member States.”

Beyond Europe

D-Orbit also will expand beyond Europe by establishing local organizations and joint ventures like D-Orbit USA. This model “enables us to access markets with specific regulatory barriers while retaining the flexibility needed to comply with local requirements, particularly in the defense sector and national government programs,” Rossettini said.

As the current bottleneck in launch opportunities eases with more vehicles coming into the market, D-Orbit will focus on “strengthening and expanding our position in space logistics, including orbital transportation and satellite manufacturing, in-orbit servicing, in-orbit space cloud infrastructure and data analytics, while also evaluating other strategic segments of the space value chain that are essential to advancing our long-term roadmap,” Rossettini said.

D-Orbit, founded in 2011, operates the ION Satellite Carrier, which has provided last-mile delivery for 137 satellites and hosted 77 payloads over 21 missions. Customer demand for those services as well as hybrid services, like adding D-Orbit satellites to constellations, is growing. The demand has created pressure on D-Orbit and its supply chain that the company’s expansion strategy is designed to address.

Multi-Orbit Logistics Infrastructure

The latest investment also will help D-Orbit move toward its goal of creating an interplanetary logistics infrastructure by providing funding for “larger-scale” mergers to “consolidate our leadership in space infrastructure, intelligence and services,” Rossettini said.

In addition, the funding will bolster D-Orbit’s campaign to support the growth of space ecosystems in new markets, while continuing work in current markets including the United States and Saudi Arabia. And D-Orbit will develop new spacecraft. The General Expansion Architecture, which D-Orbit is developing with European Space Agency funding, will be a “highly versatile and modular platform” with applications in low-Earth, medium-Earth and geostationary orbit, Rossettini said.

“These initiatives strengthen the technological, geographic, and industrial foundations required to progressively scale from today’s orbital logistics capabilities toward a fully integrated, multi-orbit, and ultimately interplanetary logistics infrastructure,” Rossettini said.

Correction: D-Orbit did not obtain $128 million in additional investment as stated in a previous version of the article.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

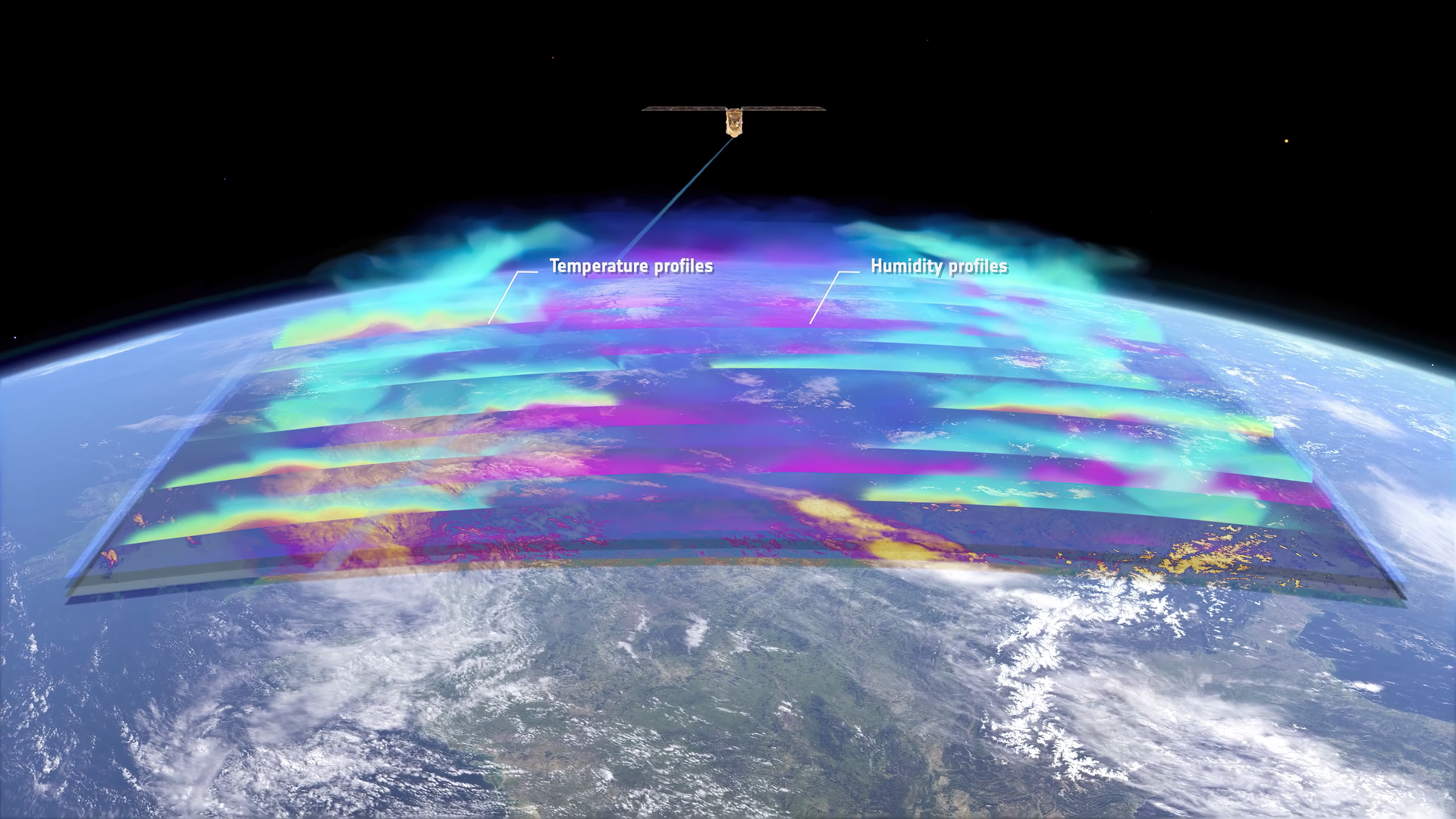

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

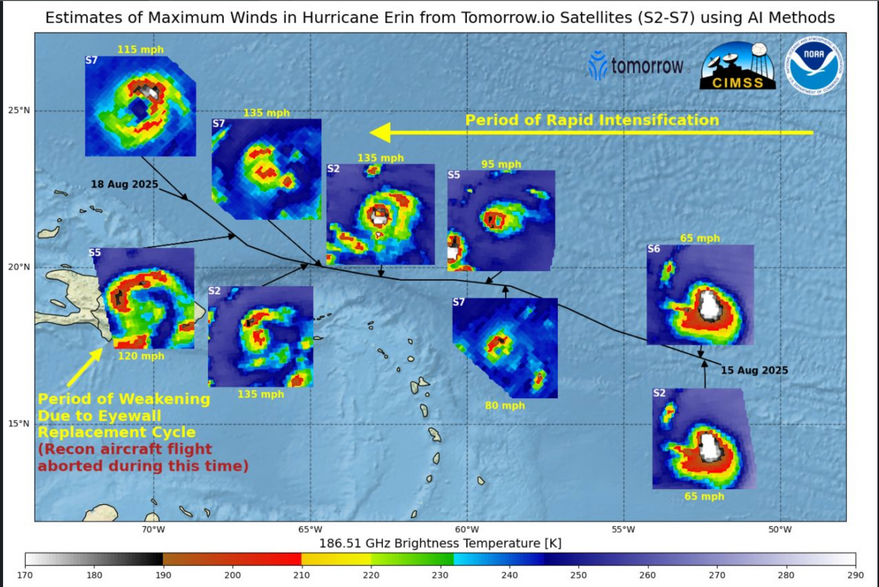

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

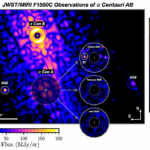

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits