Now Reading: L3Harris reaffirms commitment to space business amid missile sector expansion

-

01

L3Harris reaffirms commitment to space business amid missile sector expansion

L3Harris reaffirms commitment to space business amid missile sector expansion

WASHINGTON — The Pentagon’s $1 billion investment in L3Harris Technologies’ missile business has turned a spotlight on the company’s munitions growth, even as analysts look for signals about the future of its space operations.

The investment, announced earlier this month, will help expand L3Harris’ capacity to produce solid rocket motors and missile subsystems through a planned spinoff of its Missile Solutions business. Under the agreement, the Pentagon will invest through a convertible preferred security that would turn into equity only if the missile unit completes an initial public offering, now planned for the second half of 2026.

During a Jan. 29 earnings call, chief executive Christopher Kubasik said the government would hold a “single digit ownership stake in the business” after the IPO. Executives have projected that Missile Solutions could generate at least $4 billion a year in revenue, making it L3Harris’ fastest-growing and most capital-intensive segment, with unusually strong government backing and long-term demand visibility.

That contrast has prompted analyst questions about the rest of the company. Missile programs are expanding as the Pentagon rushes to replenish weapons stockpiles and prepare for potential high-end conflict, while space programs face longer timelines and rising competition. Analysts asked on the call whether management attention, investment and strategic focus might increasingly follow the missile business.

The Missile Solutions spinoff is built largely around assets inherited from Aerojet Rocketdyne, which L3Harris acquired in 2023. Its backbone is solid rocket motors — the propulsion units that power many U.S. missiles and interceptors and the capacity the Pentagon is explicitly targeting with its $1 billion investment. The unit also includes divert and attitude control systems used in missile defense interceptors, along with other maneuvering and missile-adjacent subsystems.

With roughly 7,000 employees and operations across 11 states, executives said the business is large and distinct enough to stand alone as a publicly traded company. Kubasik emphasized that the Pentagon’s role would be limited to an “economic stake” and that the government would not hold board seats or management roles, despite being both a customer and a prospective shareholder.

The structure is being closely watched across the industry, not only because of its unprecedented nature but also because it underscores the Pentagon’s willingness to act as a capital partner to shore up constrained parts of the defense industrial base.

Investment in satellite production

Kubasik, however, pushed back on the notion that the missile push signals a retreat from space. He told analysts that the company remains committed to its space business, pointing in particular to its large operations in Palm Bay, Florida, and Fort Wayne, Indiana.

At those facilities, L3Harris is producing infrared sensor satellites for the Space Development Agency’s Tracking Layer within the Proliferated Warfighter Space Architecture, a planned constellation of satellites in low Earth orbit designed to detect and track ballistic and hypersonic missiles.

“We’ve talked about building new factories for space,” Kubasik said. “The SDA win is a big win for us,” citing four consecutive orders since 2020 for a total of 72 satellites.

The company is also positioning itself for follow-on work with the Missile Defense Agency under the Hypersonic and Ballistic Tracking Space Sensor, or HBTSS, program. L3Harris delivered one HBTSS prototype satellite, launched in 2024, designed to provide fire-control-quality tracking data for missile defense interceptors. Unlike SDA’s Tracking Layer, which emphasizes broad tracking and resilience, HBTSS is meant to feed directly into interceptor systems.

“HBTSS is coming. We have a lot of classified work,” Kubasik said. “I think we’re well positioned.”

The Missile Defense Agency has said L3Harris’ prototype completed a successful demonstration, but it has not yet disclosed whether or when it plans to procure additional satellites.

Waiting for Golden Dome orders

Looking further ahead, Kubasik pointed to Golden Dome, a missile defense initiative aimed at protecting the U.S. homeland from missile and aerial threats, as a major opportunity for the space business. Elements of Golden Dome could include space-based interceptors, an area where L3Harris hopes to supply technology rather than necessarily act as a prime contractor.

“We are taking a merchant supplier approach with space-based interceptors,” Kubasik said. “We have some great technologies that everybody wants … our strategy allows us to prime, sub or be a merchant supplier.”

Kubasik said he has been briefed on the emerging architecture for space-based missile defense and argued that the company has already invested to respond quickly. “We’ve invested. We built the facilities … to crank out these satellites,” he said.

“We envision increased revenue in both of those factories,” he added, referring to Palm Bay and Fort Wayne. “We’re looking forward to getting HBTSS, for however many satellites that program turns out to be.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

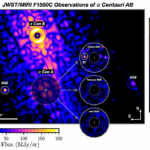

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits