WASHINGTON — An in-depth analysis of U.S. military efforts to deploy a proliferated, networked system of smaller satellites highlights the promise and potential pitfalls of the program.

In a report released July 25, the Aerospace Corporation examines the Space Force’s Space Development Agency’s initiative to transform the U.S. military space architecture using a disruptive approach to satellite acquisitions.

“The Space Development Agency and the Future of Defense Space Acquisitions” was written by Andrew Berglund, senior policy analyst at the Aerospace Corporation’s Center for Space Policy and Strategy. Aerospace is a nonprofit organization operating a federally funded research and development center focused on space and launch systems.

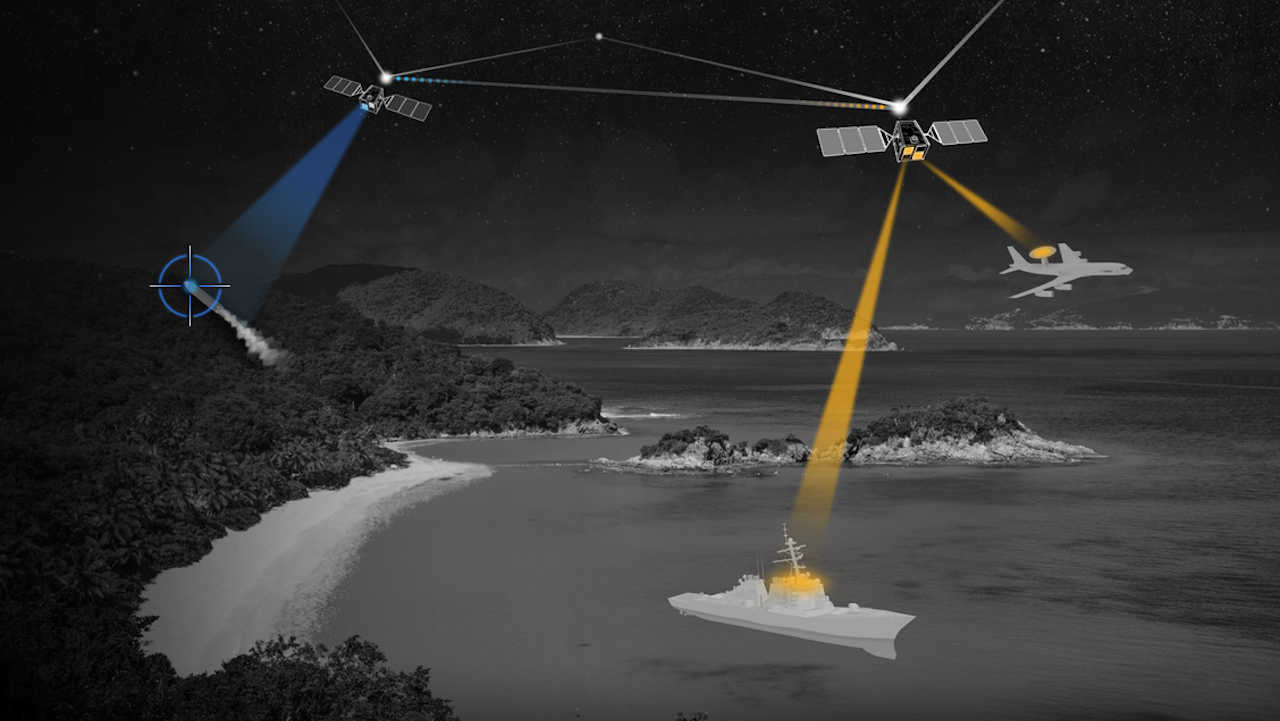

Berglund’s analysis delves into SDA’s approach to acquiring and deploying a vast network of low Earth orbit satellites. The agency set a goal to launch approximately 500 satellites within four years as part of a Proliferated Warfighting Space Architecture (PWSA), a move designed to enhance resilience against threats from anti-satellite weapons.

SDA is projected to invest about $9 billion every two years in the PWSA that includes a Transport Layer of data communications satellites and a Tracking Layer of missile-warning sensor satellites.

The paper credits the SDA for creating a distinct acquisition model that enables rapid delivery of new capabilities, breaking away from traditional, often slower procurement methods. This approach, Berglund argues, could have far-reaching implications for future defense space acquisitions.

However, the study also highlights potential hurdles the SDA must overcome. “While the SDA has shown early promise, it has yet to demonstrate its systems’ capabilities at scale,” Berglund writes. He emphasizes that proving the effectiveness of the proliferated satellite architecture is crucial for maintaining support and funding.

Another significant challenge identified in the paper is the agency’s ambitious launch schedule. “Managing this increased launch frequency without compromising on quality or encountering logistical bottlenecks will be a major challenge,” the report states.

Berglund also raises questions about the sustainability of SDA’s competitive industrial base and the agency’s ability to maintain its innovative approach as it scales up operations.

The paper notes that other defense acquisition organizations may face difficulties in adopting SDA’s model due to differences in operational structures and constraints. This observation underscores the unique position of the SDA within the broader defense acquisition landscape.

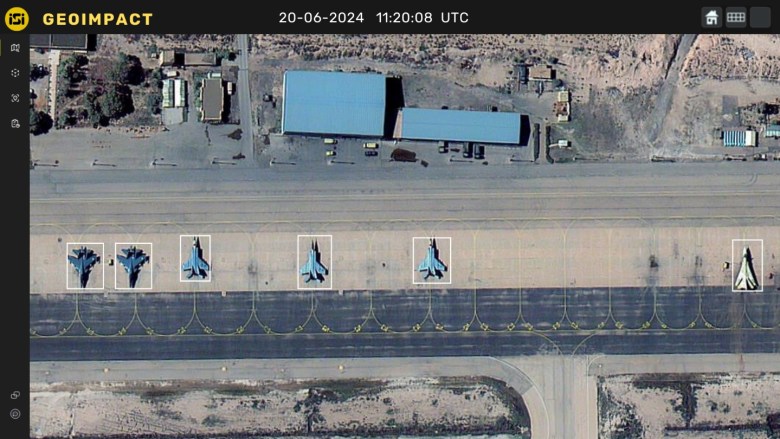

While the study commends the SDA’s progress, it also points out that relatively little is known about the performance of the agency’s 33 currently orbiting satellites. “Operational success will go a long way to validate SDA’s acquisition model and the flexibility the DOD and Congress have granted the organization,” Berglund concludes.

Competition concerns

The study also looks into the complexities of SDA’s strategy to foster competition by engaging multiple prime contractors, including commercial firms new to Pentagon satellite projects.

“Some of the acquisition challenges SDA is trying to address will benefit industry as well as DoD,” Berglund told SpaceNews. “But I expect a few challenges to emerge.”

One concern is whether SDA’s model will lead to sustainable competition, he said. “There will be an inherent tension between the most successful primes trying to maximize their share of the architecture and SDA trying to sustain a dynamic, competitive market.”

The analysis raises questions about the feasibility of integrating satellites from diverse manufacturers, a key aspect of SDA’s approach. “There is no precedent for a DoD space system that requires such seamless operational integration between so many vendors,” Berglund said. “Demonstrating and sustaining that integration is the biggest test of industry’s support for SDA’s goals and strategy.”

Supply chain issues have already disrupted SDA’s ambitious timelines, with manufacturers struggling to ramp up production quickly enough. Berglund anticipates these challenges will persist, particularly due to SDA’s schedules that compel vendors to rapidly secure parts and components after contract awards.

He suggests that vendors’ willingness to stockpile parts in advance will hinge on their confidence in winning contracts. “We will see whether approaches such as vertical integration provide an advantage, which may reduce the number of competitive primes.”