TAMPA, Fla. — EchoStar plans to aggressively expand its satellite and terrestrial mobile broadband services after shedding debt and its video distribution business.

Amid a series of transformative transactions announced Sept. 30, EchoStar agreed to sell satellite TV broadcaster Dish and online streaming service Sling TV to U.S. pay-TV rival DirecTV for $1, along with the transfer of around $10 billion of debt.

Meanwhile, investment firm TPG Angelo Gordon agreed to buy the 70% it does not already own of DirecTV from U.S. telecoms giant AT&T, which stands to get $7.6 billion from their deal.

EchoStar also announced about $5.5 billion in new capital for its remaining business, mostly via debt tied to its spectrum licenses.

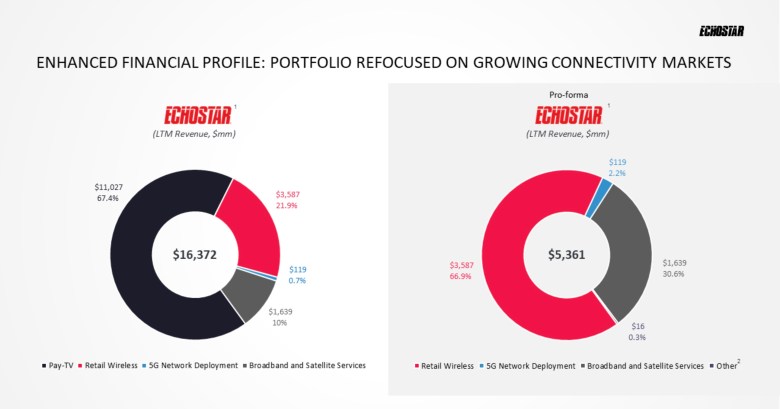

Pay-TV revenue currently represents about two-thirds of EchoStar’s business, following its acquisition last year of broadcast and terrestrial wireless operator Dish Network and its debt load.

If debt holders and regulators approve EchoStar’s plans to downsize and refocus on connectivity, retail wireless would make up about 67% of its remaining business, while broadband and satellite services from Hughes Network Systems would account for about 31%.

EchoStar aims to complete the transactions before the end of 2025.

Scaled for growth

While EchoStar CEO Hamid Akhavan said in a Sept. 30 call with investors that the company is prioritizing expanding its wireless network in the United States, he said the restructuring opens up other opportunities for the company, such as direct-to-device (D2D) satellite services.

“We think this is one of the greatest, if not the single greatest, opportunity left in the space right now,” Akhavan said, “in terms of impact on consumers and global relevance and also financial return. So we’re very focused on it.”

Akhavan said deploying a D2D constellation “is capital intensive so as a result of that we do expect to work with partners,” although he added that the capital EchoStar’s restructuring is raising would enable the company to do it alone if necessary.

New Street Research analyst Jonathan Chaplin said: “The far bigger outcome of these deals for us is that it has wiped any prospect of a restructuring off the table for at least the next three years, and likely forever.”

If EchoStar is unable to build a successful wireless business in the next three years, Chaplin said the company could divest spectrum assets worth at least $58 billion to fuel other parts of its business.

“Some investors who are skeptical of the business prospects and are looking for value through the spectrum may be disappointed that a potential sale has been pushed out by three years,” he added.

“We never thought a sale was likely before 2026 or 2027, and so this series of transactions doesn’t change the timing much from our perspective; it just removes all of the uncertainty over the next three years.”

Despite falling 12% after the announcement, EchoStar shares remain up around 150% from November 2023 lows, noted Raymond James analyst Ric Prentiss.

Prentiss highlighted how EchoStar must continue to build out its terrestrial wireless network to meet regulatory conditions tied to its spectrum license while working to get the multiple approvals needed to complete its restructuring plans.

Meanwhile, EchoStar’s Boost Mobile wireless network has struggled “with customer losses, and the Hughes satellite business has seen significant headwinds and competition from SpaceX Starlink.”

Satellite TV bet

Combining DirecTV and Dish would create a company accounting for nearly a quarter of global satellite-pay TV service revenues, according to Novaspace managing consultant Dimitri Buchs.

The combined entity would also “become by far the largest revenue-generating satellite pay-TV platform worldwide,” Buchs added.

However, Novaspace expects the number of U.S. satellite pay-TV subscribers to continue to decline in coming years amid an ongoing shift to online streaming services.

Buchs said the deal should nonetheless improve the viability of the combined pay-TV platform by generating efficiencies through shared infrastructure and reduced operating costs.

Antitrust regulators blocked an attempt to merge Dish and DirecTV more than 20 years ago; however, analysts see a more favorable regulatory environment this time because of the decline in the satellite TV market.