Now Reading: Defense and security agencies propel demand for Earth-observation data

-

01

Defense and security agencies propel demand for Earth-observation data

Defense and security agencies propel demand for Earth-observation data

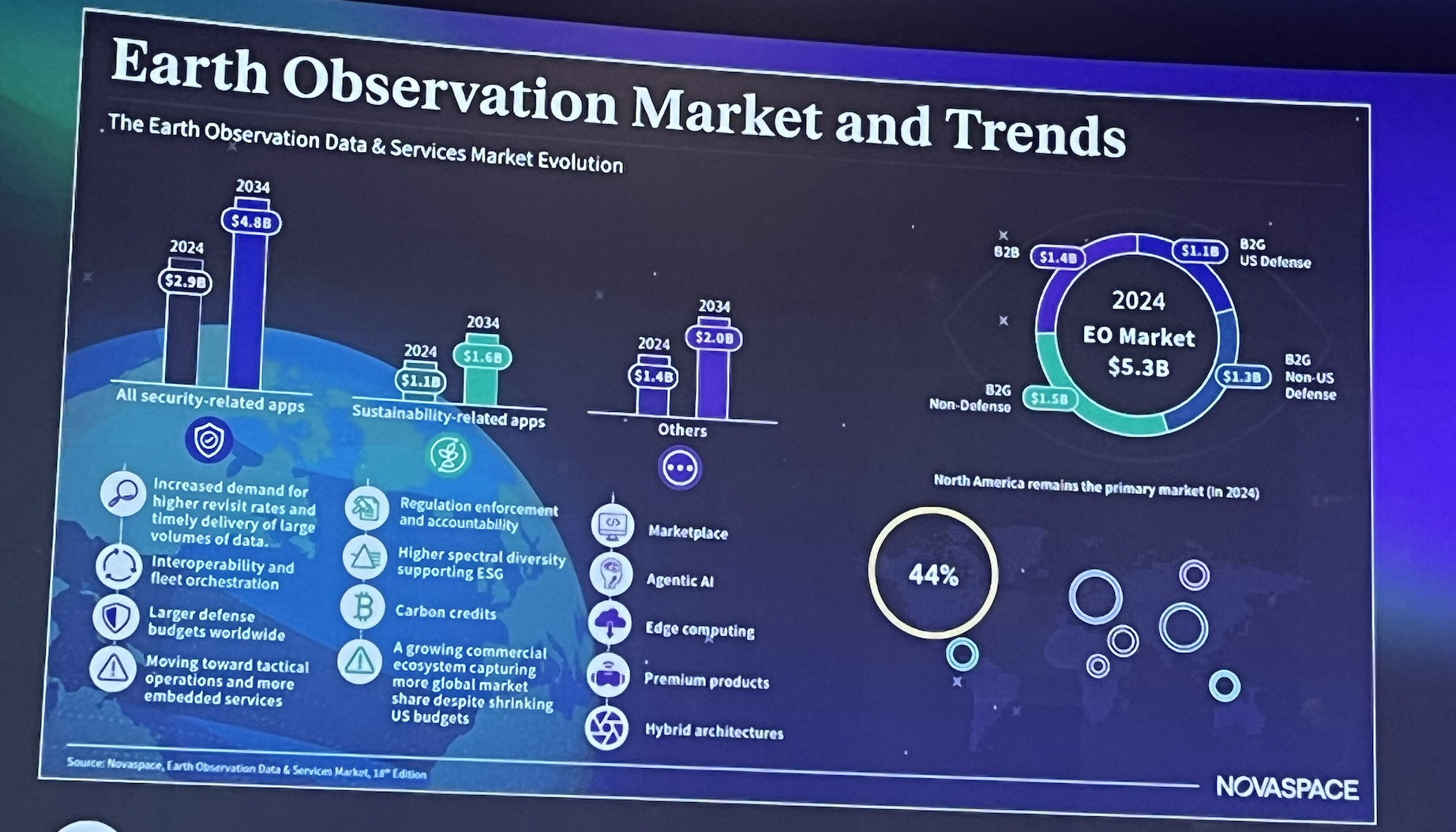

PARIS – Defense and security applications provided almost half of the revenue generated by Earth-observation satellites in 2024, Novaspace principal Annekatrien Debien said at the Summit on Earth Observation Business.

While commercial and civil demand for satellite data continues to expand, “the main catalyst remains rising geopolitical tension, which has revealed the strategic importance of space-based capabilities in securing national sovereignty and ensuring strategic autonomy,” Debien said Sept. 18. “As a result, those missions are expected to dominate the market in terms of value,” accounting for 54% of the total revenue from 2025 to 2034.

Over the next decade, Novaspace anticipates rising demand for Earth-observation imagery with a resolution of 30 to 50 centimeters per pixel or even less, services that promise to frequently revisit sites of interest and speedy information delivery supported by edge computing.

Another key trend Novaspace sees is data fusion. Increasingly, electro-optical imagery will be paired, for example, with synthetic aperture radar and hyperspectral data plus signals intelligence.

Civil and commercial markets

Commercial demand for Earth-observation data, a $6 billion market in 2024, is growing rapidly. The commercial market will nearly triple to $17 billion in the next decade to account for 12 percent of Earth-observation revenues, compared with 6 percent in 2024, according to Novaspace.

Another interesting trend revealed in the Novaspace report was the importance of the largest Earth-observation satellites in producing revenue. High-end optical satellite systems like Maxar’s WorldView Legion and Airbus Pléiades Neo accounted for about 30 percent of the 2024 commercial market value.

Overall, Novaspace notes a shift toward heavier, more capable small satellites to meet stringent performance demands. That’s a change from the recent past when companies tended to focus on establishing and expanding cubesat constellations.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

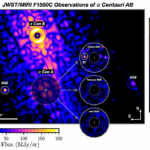

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits