Now Reading: Building Missile Defense Readiness through Composites and Domestic Supply Chain Coordination

-

01

Building Missile Defense Readiness through Composites and Domestic Supply Chain Coordination

Building Missile Defense Readiness through Composites and Domestic Supply Chain Coordination

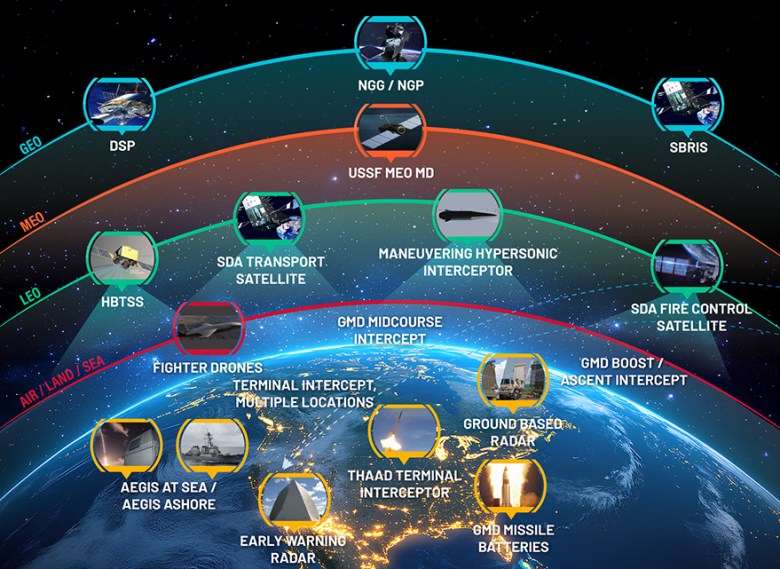

The defense landscape has entered a new era defined by technology readiness, adaptability, and heightened demand for all supply chain members to contribute to the Golden Dome for America (GDA) and similar initiatives that are rapidly taking shape. In this evolving environment, collaboration is no longer optional; it is essential. All domestic defense aerospace and defense adjacent partners must work seamlessly in a high-stakes setting, united to safeguard civilian and military assets across every domain and at every level of engagement, from anticipatory measures to real-time responses.

While defense leaders absorb what GDA ultimately needs from them, those within the sply chain do understand that they need to be prepared for a substantial increase in demand requirements, with some saying to expect five to six times their current capabilities and be prepared to develop and qualify materials for lower cost technologies to support “affordable mass”. Material suppliers play a critical role in ensuring the success of the GDA initiative because assurance of supply and confidence to support, sometimes unpredictable requirements, are imperative to mission success.

Mapping a Modern Defense Industry Ecosystem

Today, industry leaders are witnessing a balancing act between future-proofing existing defense systems against the risk of collapse and expanding support for the rapid deployment of next-generation aerial technologies. The United States’ GDA initiative is projected to cost between $161 billion and $175 billion over the next few years, according to the US Congressional Budget Office (CBO), with $25 billion dedicated to establishing the foundation for future advancements. “We learned from the Strategic Defense Initiative (SDI) what a huge investment of money and resources would be needed and really began to understand the massive technical challenges involved. We now have the technical means to execute Golden Dome, along with the launch capacity to position all the space-based resources that will be required. The technical know-how and general resources exist to bring Golden Dome to fruition. However, like any national imperative, past or present, the key challenges will be power, discipline, and funding,” observes Lloyd Nelson, Satellite Segment Leader at Toray Advanced Composites. As supply chains experience increased strain to keep pace in a demanding dynamic, Original Equipment Manufacturers (OEMs) and material suppliers recognize that they are facing their first hurdle: where to start when navigating the evolving industry.

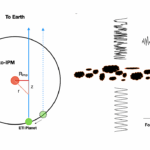

“At the material supplier level, what we’re already seeing when it comes to the [Golden Dome for America] defense initiative, is that primes and OEMs are trying to piece together a greater web of partners ready to feed the development immediately,” Nelson points out. Preparation for labor needs, capacity expansions, and the downstream requirements of raw materials necessitate significant cooperation from all levels of the supply chain and the program offices. In addition, from a technological perspective, the hardware elements of the Golden Dome system must be built using the most advanced material technology available to meet the demanding technical requirements of the various ‘layers’ of the system, from prototyping to full-scale production.

Eric Smith, Head of Business Development in Military and Defense Markets, Toray Advanced Composites, clarifies further, “There is a myriad of challenges that remain for the GDA to be an effective defense mechanism. This includes existing systems, such as THAAD and PAC-3, that are not necessarily proven in high-volume, real-world combat scenarios. An essential piece to bring a multi-layered domestic defense platform primed and ready to engage is to secure a supply chain of fully invested industry leaders with a wide breadth of knowledge, materials, and access to a greater global network—it can be half of the battle when effectively preparing for programs like Golden Dome.” Fortunately, carving a domestic supply chain route won’t be an intensive undertaking as initially suspected, especially when existing domestically established supply chain leaders are already available to support the defense industry and government agencies immediately. The Golden Dome for America and similar initiatives require a proactive collective of leaders with expanded capabilities, a proven material heritage, and responsive alternative supply chain routes, ready for action, to create an efficient and effective modern defense ecosystem.

Shaping America’s Path Forward

Toray Advanced Composites and Toray Composite Materials America (hereinafter referred to as Toray) is a domestic, vertically integrated supplier and manufacturer of a broad range of carbon fiber, thermoset, and thermoplastic prepreg materials. In addition, these facilities are supported by ITAR-compliant operations and robust cybersecurity, which reduces program risk and ensures steady delivery from raw materials to finished products, which gives defense programs the confidence that critical materials will be there when needed—no matter the scale.

Each Toray division operates its own domestic supply chain from materials to part manufacturing, integrated into a larger comprehensive network, and supported by a global team of experts with thorough knowledge in space & satellite, launch & missile, unmanned aerial vehicles (UAV), drones, radomes & antennas, rotorcraft, among other adjacent applications for rapid defense architecture deployment with decades of proven support within the defense sector. When it comes to the United States GDA program, Toray is one of the few US-based companies that has a large enough manufacturing capacity and the extensive portfolio of materials to cover the entire application set for Golden Dome.

“Toray brings a collaborative environment to understand better the program’s most critical areas that includes schedule, performance, cost and surge requirements,” reveals Smith, “And the breadth of Toray’s capabilities enables OEMs to partner with us for supply of all critical materials across one platform—from aircraft structures to low dielectric materials to ultra-high temperature materials, which helps bundle volumes for lower costs, reducing the demands on OEMs to qualify a large number of suppliers.” For multi-layered defense programs, such as the GDA initiative,supply chain readiness and rapid production scalability remain significant concerns, given the still-undefined quantities, timelines, and materials proposed in January 2025. With the right partner, schedule flexibility and scalable production for high-volume defense programs become essential to maintaining responsiveness and efficiency.

Within the US, Toray operates carbon fiber plants in South Carolina and Alabama, as well as thermoset and thermoplastic prepreg manufacturing sites in Washington, California, and Colorado. In fact, Toray’s nimble domestic supply chain happens to have the largest capacity in the world for producing materials critical to national defense. It is strategically positioned near several key prime defense partners. Being strategically positioned geographically is an expectation for suppliers within a competitive industry, but according to Nelson, that is not all that Toray is doing to prepare for increasing demand. Toray is also investing heavily in new technology and operations. Where new needs for materials are identified, Toray will apply proven ability to innovate and formulate solutions at scale to keep momentum strong.

“We have several unique materials in our development pipeline that could provide significant improvements in system performance. For example, we are developing a material that combines boron fiber with carbon fiber and a proprietary matrix resin, enabling airframe structures to be significantly reduced in weight (by 20% or more), which is a game-changing advancement for aircraft performance,” Nelson continues, “We are also scaling up our production capacity for carbon fiber and thermoplastic composite materials, which enable a much higher rate of production at lower costs compared to traditional thermoset composites, while maintaining improved mechanical properties.”

Equally essential are materials that are amenable to automated and additive manufacturing techniques. The ability to efficiently turn out high-quality structures in a short period of time will be key. Toray has always formulated and developed their materials with automated manufacturing methods in mind. More specifically, Toray has formulated carbon/carbon composite precursor resins and prepregs that require only a fraction of the process cycles, time, and expense needed for traditional carbon/carbon composites, a large step forward for hypersonic vehicle manufacturing technology.

By uniting with a domestic partner with a vertical, domestic supply chain and reinforcing multi-layered defense initiatives, such as GDA, it is better positioned to be responsive to changes in demand requirements. To ensure domestic defense initiatives remain agile and resilient, material selection must also be leveraged as a strategic enabler for both operational effectiveness and rapid scalability.

Proven. Trusted. Ready.

Due to the broad application breadth of the GDA program, proper material selection can significantly enhance the ability to influence range, payload capacity, radar signature, vehicle versatility, and producibility. Key criteria include performance, cost, quantity, weight, and availability. In some cases, new material formulation may be required to address specific challenges, however, manufacturability, scalability, and cost effectiveness may remain. And equally important are commercial availability, heritage, and possible obsolescence, which should be key up-front considerations for materials selected. It is hugely counterproductive to develop new materials only to find they will not be available in the required quantities or will be discontinued. Employing materials with heritage for the intended application will also save time and development and evaluation resources and avoid technical pitfalls that often emerge during the development phase of new material adoption.

One compelling example of this in action was the development of TC420 which resulted from collaboration with Lockheed Martin for the NASA Artemis campaign. When NASA learned that they would not be able to source the same materials that were used in previous manned mission re-entry vehicles a brand-new solution was needed. Toray formulated and reduced to practice an entire suite of high temperature resistant prepreg and ancillary materials for use in the new heat shield. By doing so, Toray was able to exceed Lockheed Martin’s design requirements late in the program’s projected timeline, at a critical point that significantly impacted their overall budget. They developed a game-changing toughened Cyanate ester system, from concept to pre-qualification, within less than nine months. The new material enabled Lockheed to reduce processing time by 25% and lower costs without compromising the ultra-high temperature performance required to return to the Moon. The Orion spacecraft has since then met the demanding re-entry conditions in the 2022 series of uncrewed flight tests and is now aiming to begin crewed flight test starting in 2026.

“We saw this again in work with a next-generation supersonic jet OEM that set extremely ambitious weight and efficiency goals while requiring resilience under significant thermal and mechanical stress,” Smith comments, “Through Toray’s close collaboration, the program achieved an aircraft design that was easier to fabricate and delivered better fuel economy than other competing materials on the market.” This case highlights the critical role of material suppliers in providing tailored solutions that address performance, cost, production, and similar challenges, enabling customers to not only meet program requirements but also secure a long-term strategic advantage.

Advancing next-generation materials is vital for GDA, but long-term success also depends on sustaining today’s program and navigating its fluctuating demand cycles. In-service fleets often return to base needing upgrades and ongoing support, which calls for partners who can provide a reliable and consistent inventory to keep aircraft mission-ready. Toray partners with those across the value chain to scale with demand and extend application lifespans when applicable. A clear example of this is with radome and antenna applications: both current and future fighter aircraft, such as the F-35 and the future F-47 jet, depend on the timely delivery of specialized materials to maximize operational availability. As a leading supplier of low dielectric structural radome materials, Toray delivers tailored solutions that meet stringent dielectric and structural requirements, ensuring aircraft operate longer in the skies.

Priorities for the Road Ahead

As Golden Dome for America and other domestic defense initiatives around the world are preparing to launch, the industry faces critical questions that will shape their success. Today, these initiatives remain in a highly speculative phase, with no official program of record specifically funding GDA. It is also unclear what, if any, funding will be available for capacity expansion, as well as what the expectations will be regarding rate readiness and surge events.

Yet, some supply chain leaders are already planning, positioning themselves to respond effectively when the call to action comes. “Toray is actively strengthening relationships at more senior levels within the OEM and DoD communities to gain this insight to inform our strategy, timing, required materials, and capital expenditure implications. We [Toray] believe that the OEMs are also addressing this in parallel with their DoD/USG customers, but the roadmap is not clearly defined yet,” highlights Smith.

To address rate readiness and the anticipated surge events, industry leaders will also need to become more comfortable with examining less conventional approaches when it comes to manufacturing materials for the final product. “Innovation will need to be accelerated by the OEM’s willingness to use new technologies and processes, rather than defaulting to legacy, 30+ year-old materials,” adds Nelson, “Given the various software and predictive-performance tools available today, engineers can now design around newer, more state-of-the-art material systems from Toray, and get them into production faster than ever before.”

Ultimately, suppliers need clear visibility into demand to scale efficiently and mitigate risk. At the same time, OEMs require partners with proven materials, expanded capabilities, and agile supply chains who are ready to hit the ground running from day one.

Pioneering Change for Modern Defense Initiatives

Multi-layered defense programs, such as Golden Dome for America, require vertically integrated material partners who are reliable, proven in collaboration, certified for compliance, and equipped with the technical expertise and future-ready innovation to deliver products from precursor materials through to finished products, with built-in redundancy. “Our partners have appreciated Toray’s proactive approach in sharing what we know about Golden Dome of America, clarifying likely material requirements, and showing how we can save time, reduce risk and expense, and position everyone for success,” summarizes Nelson. Toray ensures OEMs can integrate materials without disruptions or fluctuations in raw material availability.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly