Now Reading: Airbus, Leonardo and Thales agree to form new European company

-

01

Airbus, Leonardo and Thales agree to form new European company

Airbus, Leonardo and Thales agree to form new European company

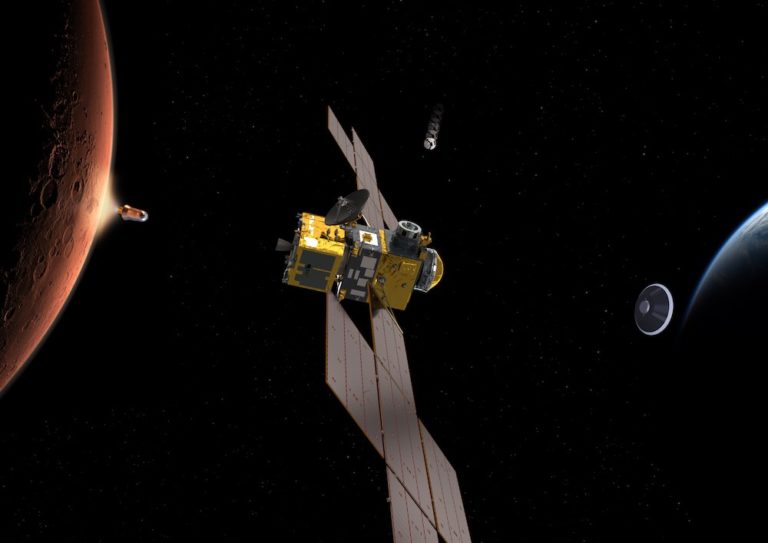

Legacy names in European spaceflight and defense, Airbus, Leonardo and Thales, announced a memorandum of understanding on Thursday to combine forces in a new entity designed to rival other aerospace juggernauts in this arena, like Boeing, Lockheed Martin and SpaceX.

The new, yet-to-be-named company aims to come online in 2027, pending regulatory approval and other logistics. Airbus would own a majority of this new venture with a 35 percent stake, with Leonardo and Thales owning 32.5 percent respectively.

In their joint press release, the companies said that they would pool the following resources:

- Airbus will contribute with its Space Systems and Space Digital businesses, coming from Airbus Defence and Space

- Leonardo will contribute with its Space Division, including its shares in Telespazio and Thales Alenia Space

- Thales will mainly contribute with its shares in Thales Alenia Space, Telespazio, and Thales SESO

“By pooling our talent, resources, expertise and R&D capabilities, we aim to generate growth, accelerate innovation and deliver greater value to our customers and stakeholders,” said the CEOs of Airbus, Leonardo and Thales in a joint statement. “This partnership aligns with the ambitions of European governments to strengthen their industrial and technological assets, ensuring Europe’s autonomy across the strategic space domain and its many applications.

“It offers employees the opportunity to be at the heart of this ambitious initiative, while benefiting from enhanced career prospects and the collective strength of the three industry leaders.”

Individually, these three companies have been involved in many key spacecraft and human spaceflight endeavors, from manufacturing the European Service Module for the Artemis program missions to helping build modules for the International Space Station to working with international teams on the commercial space stations of the future.

The corporate trio said their goal with the proposed merger would be to “strengthen Europe’s strategic autonomy in space, a major sector that underpins critical infrastructure and services related to telecommunications, global navigation, earth observation, science, exploration and national security.”

While not proposing any specific undertaking, like announcing a new satellite constellation, the trio said the new company “will pool, build and develop a comprehensive portfolio of complementary technologies and end-to-end solutions, from space infrastructure to services (excluding space launchers).”

The company is expected to have a workforce of about 25,000 people spread across Europe, with a gross revenue of roughly €6.5bn (end of 2024, pro-forma) along with “an order backlog representing more than three years of projected sales.”

Following the conclusion of the 337th meeting of the European Space Agency’s (ESA) Council in Paris, France, ESA Director General Josef Aschbacher said this potential combination is something that the council has been watching closely and discussing intently, saying that “this will change the landscape of (the) European space industry quite significantly.”

He said because of the timing and analysis needed, ESA and its member states will not have a formal response before the annual ESA Council at the Ministerial Level in November. Aschbacher said more of their work concerning oversight of the proposal will be done early next year.

“ESA’s mandate and ESA’s objective is to support European industry and this is what we have done for the last 50 year and what we will do for the next 50 year,” Aschbacher said. “We are developing European capacities, European industry and we want a strong European industry and mergers among companies happen.”

Airbus, Leonardo and Thales sign Memorandum of Understanding (MoU) to create a leading European player in space by combining their respective activities in satellite & space systems manufacturing and services.

This project aims to strengthen Europe’s strategic autonomy in… pic.twitter.com/mJ09NWiqWQ

— Airbus Newsroom (@AirbusPRESS) October 23, 2025

Aschbacher argued that mergers are good because it will help the new proposed company be “more competitive on the world market” as well as strengthening the space industry as a whole. He also addressed a question from the press regarding how this proposed industry consolidation would potentially impact the ability for others in Europe to compete.

“It will change the landscape in terms of competition and we will take this into account in our industrial policy and the procurements we take,” he said. “So certainly, this is something that we will take very serious and we will work very deeply, very closely with the three companies that are merging, very closely working with the other companies that are not part of this merger to make sure that we remain to have a very competitive industry across Europe and the different countries and making sure that overall, the European space sector is strengthened through this move.”

Pressed further on the area of competition, Aschbacher said that he is not “concerned in terms of diversity and competition.”

“We will certainly adapt to the new situation. We will support them in their buildup of the new company,” Aschbacher said. “This is part of our responsibility, but we also help other companies that are not part of this consortium to succeed, as we have always done, and we will continue to do that.

“Whether I’m worried? No, I’m not worried. I think it’s very good news, it’s interesting news and say, I see new challenges coming and we will tackle them head on and certainly make sure that Europe becomes even stronger than before.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly