Now Reading: Making seamless connections between D2D patchwork

-

01

Making seamless connections between D2D patchwork

Making seamless connections between D2D patchwork

Each year, SpaceNews selects the people, programs and technologies that have most influenced the direction of the space industry in the past year. Started in 2017, our annual celebration recognizes outsized achievements in a business in which no ambition feels unattainable. This year’s winners of the 8th annual SpaceNews Icon Awards were announced and celebrated at a Dec. 2 ceremony hosted at the Johns Hopkins University Bloomberg Center in Washington, D.C. Congratulations to all of the winners and finalists.

Huge Mobile Satellite Services (MSS) spectrum acquisitions by SpaceX and AST SpaceMobile show the value of these frequencies in the nascent direct-to-device (D2D) market. But they also add pressure on incumbents who were once confined to serving bulky, specialized handsets.

Although the same technology advances and standards driving mass-market D2D connectivity also benefit traditional MSS, legacy players are now up against SpaceX and the immense scale of its low Earth orbit (LEO) Starlink network.

That’s where an ambitious and technically complex partnership between geostationary MSS operators Viasat of the United States and Space42 of the United Arab Emirates comes in.

Their proposed Equatys joint venture would pool more than 100 megahertz of L- and S-band spectrum already allocated across more than 160 countries, aiming to create the world’s largest coordinated block of D2D frequencies in three years.

Equatys would evolve existing and planned MSS systems into a standards-based, open-architecture 5G network environment, if the operators can iron out the many finer details.

Notably, the joint venture is being set up as a neutral infrastructure entity, with an investment model similar to that used by cellular tower companies. The “space tower” strategy would integrate spectrum and satellites from multiple tenants to lower costs, offering operators a D2D capability in their home markets without having to build a global fleet.

“Operators would only essentially pay for the services that they can use in their region, and they wouldn’t be paying for dead time over other places,” Viasat chairman and CEO Mark Dankberg said Nov. 7. He was referring to how satellites’ coverage footprints can leave unused capacity elsewhere on the globe.

Viasat and Space42 are contributing their geostationary satellites as anchor tenants and are calling on others to join as they explore ways to add LEO capacity to the mix.

Discussions are underway with potential partners that include Europe, Dankberg also said on Viasat’s latest earnings call.

In October, the telecoms arm of UAE technology and investment group e&, formerly Etisalat, became the first mobile network operator to sign a Memorandum of Understanding with Equatys to explore how it could extend connectivity beyond terrestrial infrastructure.

Equatys is also being styled as a sovereignty-friendly D2D alternative to SpaceX, with executives emphasizing how it would work through existing national spectrum allocations to give governments more control over compliance and licensing.

Still, analysts remain eager for details on how Equatys would be structured and precisely how it would work with partners.

But while cross-border collaboration is common across the global space industry, Equatys represents a major shift in mindset for an industry long separated by proprietary systems.

This article first appeared in the December 2025 issue of SpaceNews Magazine.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

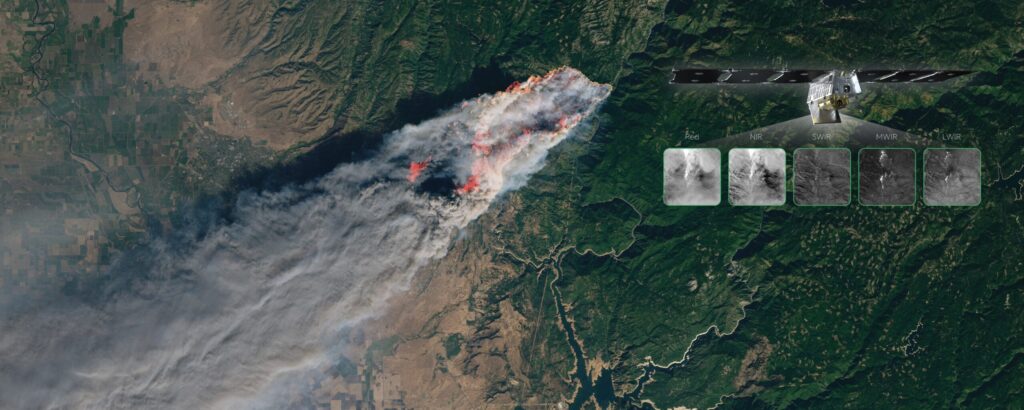

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

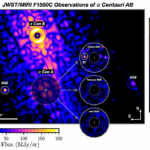

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits