Now Reading: Teaming up to create multi-orbit broadband

-

01

Teaming up to create multi-orbit broadband

Teaming up to create multi-orbit broadband

Each year, SpaceNews selects the people, programs and technologies that have most influenced the direction of the space industry in the past year. Started in 2017, our annual celebration recognizes outsized achievements in a business in which no ambition feels unattainable. This year’s winners of the 8th annual SpaceNews Icon Awards were announced and celebrated at a Dec. 2 ceremony hosted at the Johns Hopkins University Bloomberg Center in Washington, D.C. Congratulations to all of the winners and finalists.

SES completed its long-anticipated acquisition of Intelsat this summer, 15 months after agreeing to combine and create the scale needed to take on Starlink’s growing broadband dominance in low Earth orbit (LEO).

Their union had long been the subject of industry speculation, which intensified as Starlink’s rapid expansion raised existential questions for legacy, geostationary-heavy satellite operators.

The two companies finally confirmed early talks in March 2023, only to abandon them three months later amid a fierce legal spat over how billions of dollars in U.S. C-band spectrum-clearing proceeds should be split between them.

SES ultimately agreed to pay $3.1 billion in cash for Intelsat, along with contingent payments tied to future monetization of those frequencies.

By setting aside their differences, SES has gained unprecedented reach with around 120 satellites above LEO, a low-latency orbit that it can still access via Intelsat’s capacity partnership with Starlink rival OneWeb.

Roughly 90 of those satellites are in geostationary orbit (GEO), about one third more than GEO rivals Eutelsat, Viasat and Telesat combined.

And about 30 of them sit in a medium Earth orbit that SES sees as a sweet spot for low-latency, high-throughput connectivity. SES is also in the middle of rolling out its next-generation O3b mPower constellation to expand that network.

SES pioneered the industry’s first multi-orbit strategy, long before it became a strategic imperative for GEO operators seeking an edge over LEO-only Starlink.

Joining forces also diluted SES’ exposure to a declining satellite TV market, with more than 60% of revenue across its media, government, aviation and maritime businesses now coming from growth areas.

Still, while the company reported an increase in revenue Nov. 6 in its first earnings results since closing the deal in July, they missed analyst expectations as integration continues and legacy headwinds persist.

The acquisition also raised SES’ net debt to roughly 6 billion euros ($6.9 billion), which the company aims to bring down through disciplined capital allocation and cost synergies.

SES’ leadership says the company is on track to realize 70% of an expected 2.4 billion euros in synergies within three years. That comes primarily from overlapping contracts, IT consolidation and satellite fleet rationalization.

With greater scale, SES also hopes to seize new opportunities in hosted payloads and the fledgling D2D market, where it has invested in Starlink challenger Lynk Global.

Whether this consolidation will be enough remains to be seen as the company bets that size, orbit diversity and disciplined integration will help it thrive in a rapidly changing satellite industry.

This article first appeared in the December 2025 issue of SpaceNews Magazine.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

04Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

05Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

05Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

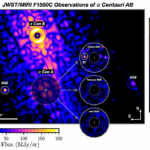

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits