Now Reading: Beyond the horizon: cost-driven strategies for space-based data centers

-

01

Beyond the horizon: cost-driven strategies for space-based data centers

Beyond the horizon: cost-driven strategies for space-based data centers

As the space industry explores orbital data centers to meet growing demands for sovereignty, resilience and sustainability, one critical lens remains underutilized: cost. Not just launch cost or CapEx; but total cost of ownership, sourcing strategy and operational efficiency.

We think it would be helpful to reframe the conversation around space-based infrastructure from technical feasibility to economic viability. It outlines how solar power, autonomous systems and strategic sourcing can make orbital platforms not only possible, but profitable.

To help shift the narrative, policy makers should establish a clear investment framework and regulatory incentives to accelerate the commercialization or orbital infrastructure. Meanwhile, corporate and industry leaders should adopt cost-driven procurement and sourcing strategies that ensure orbital platforms deliver sustainable economic returns.

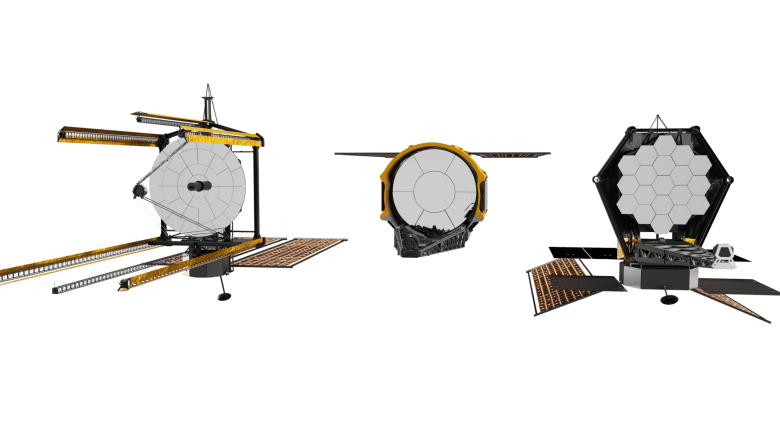

Solar power in orbit: a cost saving cornerstone

Energy is the largest operational expense for terrestrial data centers, often accounting for 40% to 60% of annual costs. Hyperscale facilities can spend $5 to 10 million per year on electricity alone.

In space, however, solar panels operate in near-perfect conditions that would drive these costs down:

Quantified example: Launching 1,000 kg of solar arrays at roughly $2,500/kg (Falcon 9 pricing) costs $2.5 million. That mass can deliver roughly 500 kW of orbital power capacity, translating to roughly $5,000 per delivered watt, competitive with terrestrial hyperscale facilities when lifecycle savings are factored in.

| Factor | Terrestrial Data Center | Orbital Data Center (Example) |

| CapEx per Watt | $10 per watt or ($10K per kW) | $5 per watt or ($5K per kW) |

| Annual OpEx | $5-10 million in electrical costs | $0 (Continuous solar once deployed) |

| Cooling | 4-5 million gallons of water per day | Radiative cooling, no water required |

| Regulatory | Zoning, land acquisition, environmental permits | ITU spectrum, orbital licensing frameworks |

| Lifecycle models | 3 to 5 year TCO focus | 10 to 20 year TCO focus |

What’s the strategic impact of moving data centers on orbit? Solar-powered orbital platforms can eliminate millions in annual energy and cooling costs while aligning with sustainability mandates.

Cooling without water: a hidden advantage

Terrestrial data centers consume up to 5 million gallons of water per day for evaporative cooling.

In orbit, cooling is achieved through radiative heat dissipation into the vacuum of space. No pumps. No towers. No water bills.

Radiators do add mass and face heat rejection limits. Modular radiator panels and advanced composites (graphene, carbon nanotubes) can improve efficiency while keeping mass manageable.

Estimated savings: millions annually per facility, especially in drought-prone regions or sustainability-sensitive markets. This should be looked at with an eye on 10 to 20 year Total Cost of Ownership (TCO) models as opposed to terrestrial three to five year models.

Real estate and regulatory relief

On Earth, data centers face land acquisition costs, zoning hurdles and environmental regulations.

In space, those costs don’t disappear — they shift. Orbital platforms operate under a different but more predictable regime of: ITU spectrum allocation, debris mitigation guidelines and licensing frameworks, representing a clear and navigable pathway towards deployment.

Built-in disaster resilience

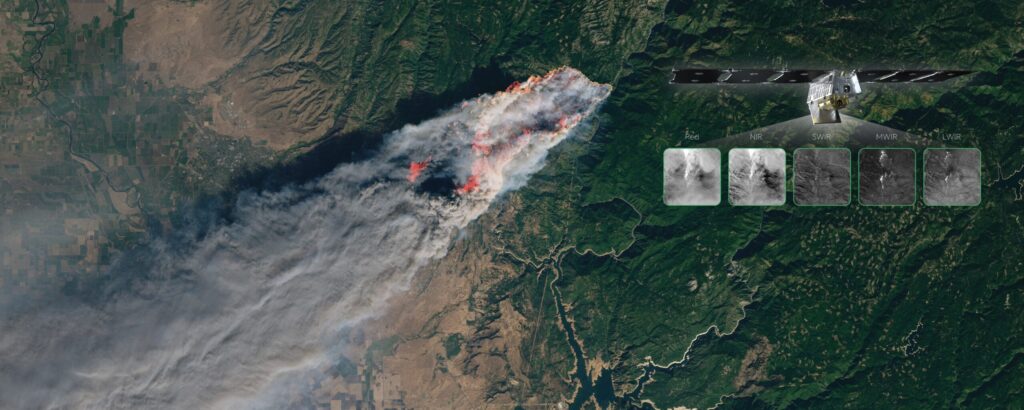

Redundancy and disaster recovery are expensive. Terrestrial data centers must duplicate infrastructure across geographies to mitigate floods, fires and geopolitical instability.

Orbital systems offer natural insulation from terrestrial threats. That’s not just a technical benefit, it’s a cost-saving one.

This could lead to savings by reducing the need for mirrored facilities, lowering insurance premiums and calling for fewer business continuity investments.

Space-based platforms benefit from physical isolation, reducing exposure to cyberattacks and insider threats. Additionally, hardware in orbit, protected from humidity, dust and mechanical wear, can last longer with fewer replacements. That makes for lower security infrastructure costs, reduced breach liabilities and extended depreciation cycles.

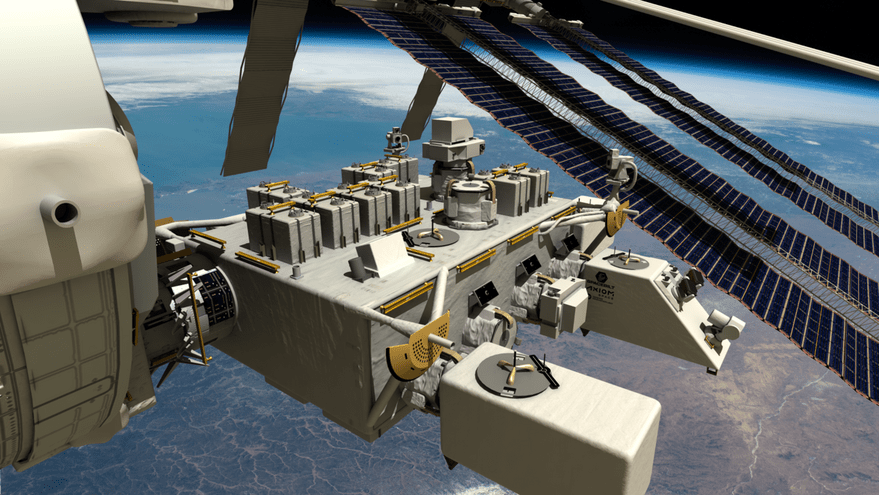

Strategic sourcing: the real cost lever

While feasibility of orbital data centers has been discussed in aerospace and cloud circles, the sourcing perspective remains underexplored, and it’s the missing piece to make feasibility into reality.

Having led hyperscale global sourcing initiatives for Workday, SAP Cloud and Meta, I’ve seen how procurement can shape innovation.

In space-based data centers, sourcing isn’t a back-office function, it’s a strategic enabler.

Procurement leaders must:

- Architect contracts that reflect orbital risk and lifecycle complexity,

- Consolidate vendors to unlock volume discounts,

- Use forensic analysis to eliminate spend leakage and

- Align sourcing strategy with uptime, sovereignty and sustainability goals

As an aerospace-specific example, SpaceX’s rideshare program, for instance, cuts per-kg launch costs by bundling payloads. Similarly, sourcing multiple subsystems through a single prime contractor can yield 30–50% savings compared to fragmented purchases. Terrestrial hyperscalers operate this way, leveraging vendor consolidation and bundled purchasing, RFP’s, forecasted bulk purchases, and collaborative long term contracts to unlock massive discounts and reduce complexity. Space must follow suit if orbital infrastructure is to become economically viable.

Counterpoints

Orbital data centers face notable challenges: current latency makes them unsuitable for real-time workloads though viable for batch and archival storage, strict sovereign data laws raise jurisdiction and compliance concerns, launch failures risk significant capital loss despite insurance and redundancy, and debris mitigation is a mandatory responsibility, requiring deorbit plans, shielding and avoidance maneuvers as part of responsible participation in the orbital ecosystem.

Actionable takeaways for the space industry

To make orbital infrastructure viable, the industry should design for modularity, model full lifecycles and replace water based cooling with radiative heat dissipation. Edge AI can cut bandwidth expenses, while centralized sourcing and hosting payload partnerships unlock vendors discounts and shared infrastructure benefits. Benchmarking against Earth-based costs, deploying solar panels to eliminate recurring energy costs, and leveraging strategic sourcing strategies across AI, robotics and hardware all drive efficiency. Finally orbital isolation and durability reduce cyber security risks and hardware replacement costs.

Grounding the vision in cost

The future of data may be off-planet, but its success will be grounded in how we manage cost, complexity and collaboration here on Earth.

Orbital data centers are not just technically feasible, they’re economically executable. But only if we treat autonomy as a cost-saving necessity, not a luxury. Only if we embed strategic procurement models into mission design. And only if we let sourcing strategy guide the way.

Within 10 to 15 years, as launch costs fall and AI energy demand rises, orbital platforms could shift from experimental to viable infrastructure. The roadmap is clear: cost strategy will be the difference between vision and viability.

John David Callison is a global strategic sourcing executive and civic leader with over two decades of experience negotiating and operationalizing technology infrastructure across hyperscale cloud platforms, AI ecosystems and mission-critical data environments, including landmark deals such as the first Westernized data center in Moscow. He has led global sourcing initiatives for Workday, SAP Cloud, Meta, Symantec, and Oracle, and served as a commissioner for the City of San José.

Joseph Minafra serves as Lead of Innovation and Technical Partnerships for the NASA Solar System Exploration Research Virtual Institute (SSERVI) at NASA Ames Research Center. With a diverse background spanning collaborative technology development, meteoritic and regolith studies, biology, robotics and software design, he has supported NASA projects for more than two decades. At SSERVI, Minafra oversees technology innovation to enable collaboration and communication among competitively selected science and research teams across the United States and internationally.

SpaceNews is committed to publishing our community’s diverse perspectives. Whether you’re an academic, executive, engineer or even just a concerned citizen of the cosmos, send your arguments and viewpoints to opinion@spacenews.com to be considered for publication online or in our next magazine. The perspectives shared in these opinion articles are solely those of the authors.

Stay Informed With the Latest & Most Important News

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

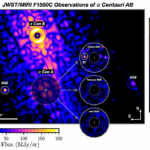

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits