WASHINGTON — AT&T is prepared to provide more funds to help get AST SpaceMobile’s direct-to-smartphone constellation plans off the ground.

AST SpaceMobile raised $155 million from AT&T and other investors in January, but the satellite operator needs more capital to provide 5G connectivity globally from low Earth orbit to phones and other devices outside cell tower coverage.

While AT&T is a conservative company that does not generally provide venture funding, Chris Sambar, head of network for the U.S. telecoms giant, said March 20 its investment in AST SpaceMobile is unlikely to be its last.

Despite only investing recently, Sambar said during a Satellite Conference panel here with AST SpaceMobile CEO Abel Avellan that the telco has been working with the satellite operator for six years.

AT&T is excited about the potential of a service aiming to deliver “texting, voice, and true broadband capabilities” globally to unmodified phones already in circulation, he said.

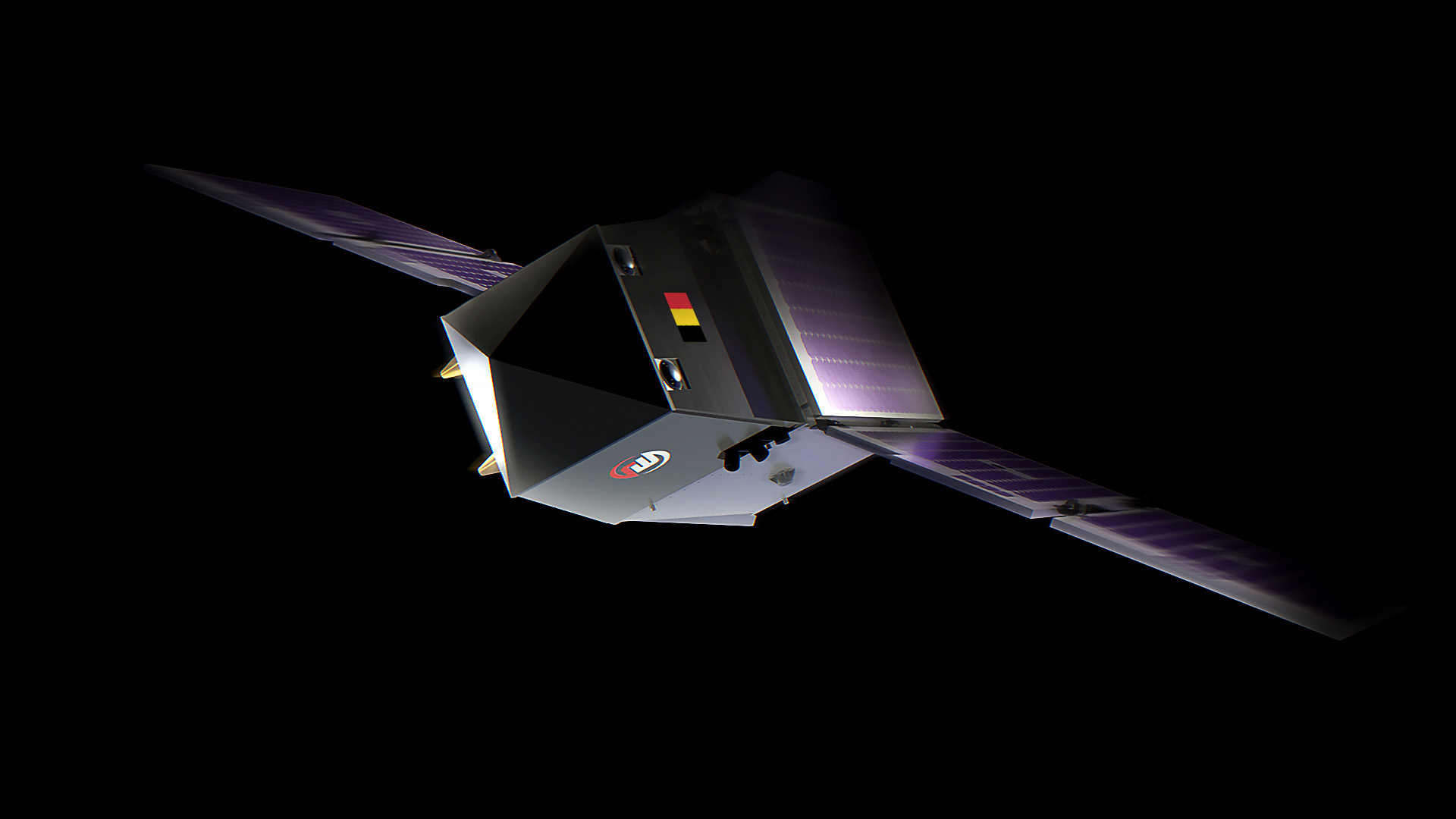

According to AST SpaceMobile, download rates of around 14 megabits per second were achieved during tests with ordinary phones in September using BlueWalker-3, the Texas-based venture’s 1,500-kilogram prototype that has been in LEO for nearly two years.

Avellan said on the panel that AST SpaceMobile’s first five commercial BlueBird satellites, similar in size to BlueWalker-3 and known as Block 1, are slated to launch together on a SpaceX Falcon 9 rocket in the coming months.

Block 2 BlueBird satellites currently in development would be twice as big as Block 1 and have 10 times the capacity.

Avellan said between 45 and 60 satellites are needed to enable continuous coverage in the United States, but stopped short of saying when the companies plan to start providing full commercial services in the country.

Service charge?

AT&T is still exploring ways to monetize space-based connectivity, such as whether to add the service at no extra cost for premium mobile customers.

“I think it will all depend on the value of the service,” he said, and “what we think the monetization opportunity is, based on what we’re offering. We’re very bullish on the technology.”

In addition to financial support, he said AT&T has spent a “significant amount of lobbying capital” to help get the regulatory permission AST SpaceMobile would also need to provide commercial services in the United States.

These efforts reached a major milestone March 14, when the Federal Communications Commission voted unanimously in favor of ground rules for allowing satellite operators to use radio waves from terrestrial mobile partners.

Avellan added that the spectrum AST SpaceMobile aims to use from AT&T is also valued at billions of dollars.

The companies have not provided details about any financial arrangements between them.

Other AST SpaceMobile terrestrial partners include Vodafone, one of Europe’s largest telcos with a significant presence across Africa, and Japanese technology conglomerate Rakuten — both are also investors.

Rakuten’s mobile operator business announced plans Feb. 20 to launch a satellite-to-mobile broadband service with AST SpaceMobile in Japan from 2026.

SpaceX and Lynk Global have also been signing spectrum leasing partnerships with terrestrial partners to connect devices from space.

Meanwhile, satellite operators including Iridium, Viasat, and Omnispace plan to use spectrum already licensed for use from space to connect with upcoming smartphones using the latest telecoms standards, following the services Globalstar has been enabling on Apple’s latest iPhones since late 2022.