Now Reading: Silicon as strategy: the hidden battleground of the new space race

-

01

Silicon as strategy: the hidden battleground of the new space race

Silicon as strategy: the hidden battleground of the new space race

In the consumer electronics playbook, custom silicon is the final step in the marathon: you use off-the-shelf components to prove a product, achieve mass scale and only then invest in proprietary chips to create differentiation, improve operations, and optimize margins.

In the modern satellite communications (SATCOM) ecosystem, this script has been flipped. For the industry’s frontrunners, custom silicon is the starting line where the bets are high, and the rewards are even higher, not a late-stage luxury. Building custom silicon is just a small piece of the big project when it comes to launching a satellite constellation and the fact there are very limited off the shelf options.

The shift toward custom silicon is no longer a theoretical debate; it is a proven competitive requirement. To monetize the massive capital expenditure of a constellation, market leaders are already driving aggressive custom silicon programs for beamformers and modems from the very beginning. The consensus is clear: while commercial off-the-shelf (COTS) and field-programmable gate arrays (FPGAs) served as useful stopgaps, they have become a strategic liability that compromises price and power efficiency. If the industry is to scale to the mass market, operators must commit to bespoke silicon programs now — or risk being permanently priced out of the sky by competitors who have already optimized their hardware for the unit economics of space.

The Physics of profit: throughput per watt

The strategic necessity of custom silicon begins with the fundamental constraint of the space segment: power. In orbit, the electrical budget is finite and expensive, driven by two critical physical realities.

First, sustainable power relies on battery capacity; higher power consumption demands larger, heavier batteries, which directly inflate launch mass and cost. Second, every watt of power consumed creates heat. In the vacuum of space where there is no air to provide natural cooling, dissipating this heat requires complex thermal heat spreaders and radiators.

Therefore, the Holy Grail of payload electrical design is throughput per watt, or put simply: moving the maximum number of bits for the minimum amount of power.

General-purpose chips struggle with the heavy lifting required for high-speed satellite links. Custom silicon is no longer an optional optimization. By stripping out unnecessary logic and architecting the hardware exactly to the tasks like forming thousands of beams concurrently or handling gigabit-class signals, custom ASICs achieve a level of spectral and power efficiency that COTS components simply cannot touch. The satellites are platforms, but the application is high performance internet and data services. In a business where capacity and speed equal revenue, operators must prioritize custom chip architectures for best power efficiency or accept that their networks will be slower, more expensive and ultimately second-tier..

The 1% investment that defines the network

Critics often point to the high non-recurring engineering costs of ASIC design, tens of millions of dollars, as a barrier. However, in the context of a low Earth orbit (LEO) megaconstellation, this view is a bit narrow-minded.

Consider the math of a modern LEO constellation deployment, which often runs a CAPEX bill of roughly $5 to $10 billion across launches, satellites, payloads, ground segments, etc. A custom silicon program might cost $50 million. This represents a mere 1% of the total budget.

Yet this 1% investment dictates the capability that leads to monetization of the other 99%. A custom chip can increase the total throughput of the constellation by an order of magnitude or double the number of simultaneous users supported. Investing 1% to radically multiply the value and capacity of a $5 billion asset is the only logical strategic move.

The “Get-Go” strategy

This economic reality drives the “Get-Go” strategy. Companies like Amazon and AST SpaceMobile didn’t wait for millions of subscribers to design their own chips. They recognized that unlike consumer segments, SATCOM custom silicon is the key enabler of unique technologies.

AST SpaceMobile’s mission to connect standard smartphones directly from space, for example, demanded processing capabilities and power efficiencies that no existing chip possessed. They had to build the “brain” before they could build the body.

The secret war: inside the industry’s silicon investments

The SATCOM industry is notoriously secretive. Companies keep silicon details confidential because they view these designs as their core intellectual property and competitive differentiator. However, publicly known implementations by industry leaders confirm that custom silicon is now the standard for success.

The adoption of custom silicon by industry frontrunners marks a shift in how satellite networks are architected and valued. Moving beyond the performance ceilings of off-the-shelf components, these companies are securing capabilities and unit economics that standard hardware and legacy FPGAs simply cannot support. This approach necessitates a new economic perspective: the return on investment is no longer tied to the volume of chips shipped, but to the exponential value created across the satellite constellation. By allocating just about 1% of the total constellation CAPEX to custom silicon, the entire network gains a decisive revenue advantage through expanded bandwidth and capacity, As the sector matures, custom silicon is proving to be less of a technical luxury and more of a fundamental lever for scalability and long-term competitiveness.

Elad Baram is the product marketing director of the Mobile Broadband Business Unit at Ceva.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

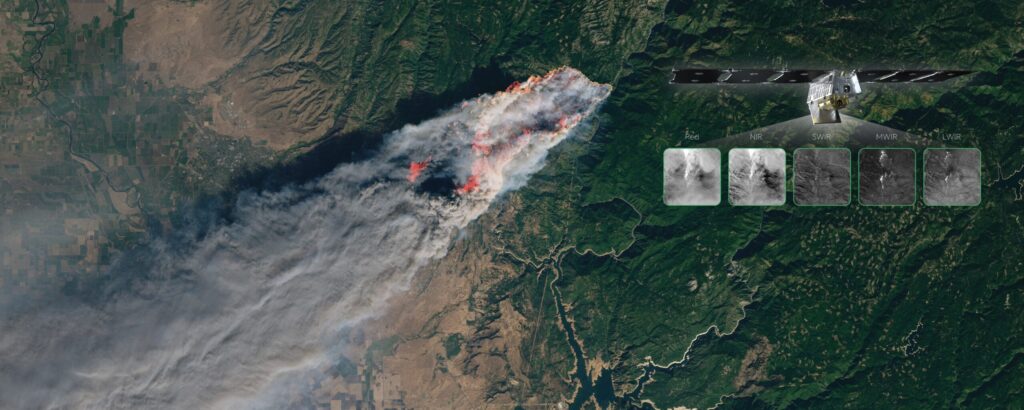

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

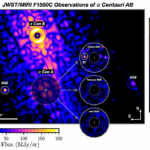

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits