Now Reading: Viasat sees orbital data center partnership opportunity

-

01

Viasat sees orbital data center partnership opportunity

Viasat sees orbital data center partnership opportunity

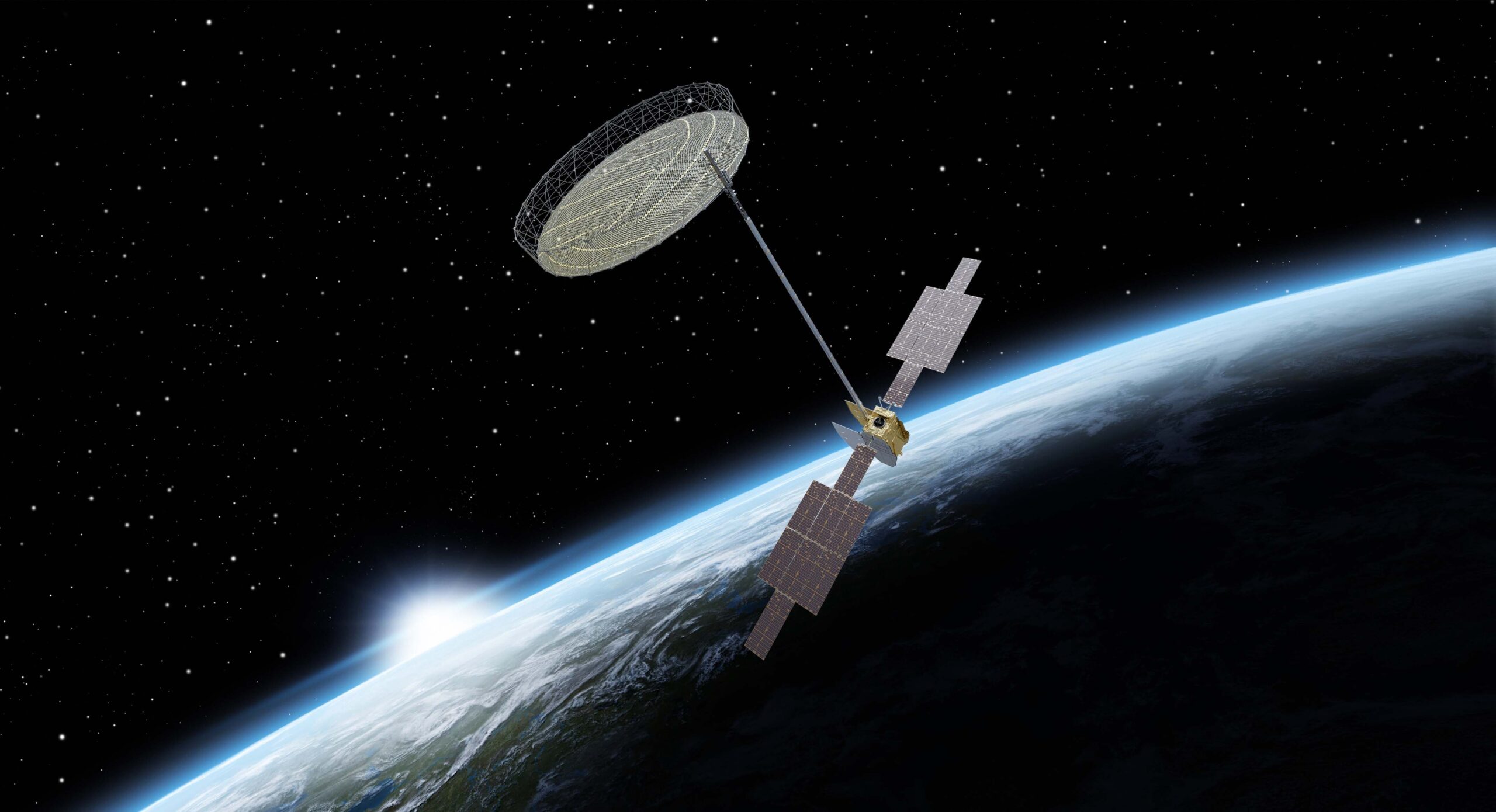

TAMPA, Fla. — While Viasat has no plans to join the rush to deploy orbital data centers, the satellite operator sees a role providing the communications links needed to connect such systems with users on Earth and other spacecraft.

“We’re certainly interested in partnering with others that might want to actually put the compute, storage resources in space,” Viasat CEO Mark Dankberg said Feb. 5 during an earnings call for the company’s fiscal third quarter.

Interest in space-based computing infrastructure is rising on the back of surging demand for artificial intelligence processing and constraints facing terrestrial data centers, including access to power, water for cooling and permits.

SpaceX, which champions a vertically integrated strategy where it builds rockets, spacecraft and terminals in-house, recently filed plans with the Federal Communications Commission for an orbital data center constellation of up to one million satellites. The company argues that near-continuous solar power in orbit could eventually enable computing at lower cost than on Earth.

The filing is one of many proposals from established space players, technology giants and startups that have pushed orbital data centers into the spotlight.

“I think that the entire premise really hinges on power generation in space,” Dankberg said on the call, and “will it ever make sense that you can generate power more cost-effectively in space than you can get it anywhere on Earth?”

He said two major technical hurdles are how efficiently satellites can generate power in orbit and how effectively they can dissipate the heat that comes with that.

“From our perspective, work in those areas is really helpful because it improves the productivity of communication satellites as well,” he added.

However, Dankberg also pointed to sustainability and debris concerns as potential constraints on large-scale orbital computing infrastructure, given the mass and surface area such systems could require.

He said optical space-to-ground communications technology, still in its infancy, will likely be needed to underpin orbital data centers at scale.

Viasat declined to elaborate on how it could support an emerging orbital data center market.

The operator already sells satellite networking equipment, including modems that can operate over third-party satellite systems, and is developing optical intersatellite communications terminals.

Closer on the horizon

Viasat remains focused on near-term growth opportunities tied to its next-generation ViaSat-3 geostationary satellite program and its L-band spectrum assets, which are behind a push into the emerging direct-to-device (D2D) market.

The company disclosed that the second of three terabit-class ViaSat-3s is now set to enter service in May, versus expectations following its launch in November of coverage over the Americas early in 2026.

The third, Asia-focused ViaSat-3 is due to enter service late summer, versus mid-2026 previously.

The first ViaSat-3 has been operating with less than 90% of its capacity after suffering an antenna issue shortly after launch in 2023.

In October, Viasat announced that the telecoms arm of the United Arab Emirates’ e& had agreed to collaborate on Equatys, the planned D2D infrastructure joint venture the U.S. company shares with Emirati satellite operator Space42.

Equatys aims to combine more than 100 megahertz of harmonized satellite spectrum for D2D within three years, distributed via a multi-tenant “space tower” strategy modeled on shared cellular tower infrastructure.

Dankberg said Viasat expects further updates on Equatys in the near future, but provided no additional details as SpaceX and other rivals ramp up investments aimed at improving D2D satellite connectivity.

Ongoing strategic review

Viasat is also continuing to evaluate strategic options that could significantly reshape the company, such as separating its government and commercial businesses.

Dankberg said the review includes “assessing the value of our portfolio of assets and resources, key dependencies including the entry into service of ViaSat-3 — flights two and three — macro secular trends in our target markets and the effects of achieving deleveraging targets and ongoing free cash flow generation.”

Analysts including William Blair’s Louie DiPalma say the review could ultimately lead to a separation or public listing of Viasat’s Defense and Advanced Technologies (DAT) business. DiPalma pointed to L3Harris’ planned IPO of its solid rocket motor missile solutions business as a possible precedent.

Viasat reported $1.2 billion in revenue for the three months to the end of December, up 3% year-over-year, driven primarily by 9% growth in its DAT segment.

The company also faces intensifying competition from SpaceX’s Starlink broadband constellation. DiPalma noted the company’s commercial aircraft installation backlog declined from 1,470 to 1,110 after several airlines switched to Starlink.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $387 million, down 2% from the prior-year period, reflecting a decline in its communication services segment, increased research and development spending and the effect of a U.S. government shutdown.

The company also said it is making progress on reducing leverage, reporting net debt of $5.1 billion at the end of the quarter, down from $5.7 billion a year earlier.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

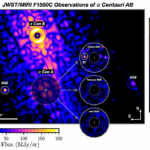

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits