Now Reading: Satellite manufacturers see emerging market for ‘mini-constellations’

-

01

Satellite manufacturers see emerging market for ‘mini-constellations’

Satellite manufacturers see emerging market for ‘mini-constellations’

MOUNTAIN VIEW, Calif. — Manufacturers of small satellites that lack opportunities to build very large constellations say they are seeing growing interest from customers seeking smaller systems tailored to specific needs.

During a panel at the SmallSat Symposium here Feb. 10, executives from several smallsat manufacturers described demand for “mini-constellations” of dozens to a few hundred satellites for governments and companies that do not want to rely exclusively on megaconstellations such as Starlink.

“There’s definitely a market in large constellations, and a couple of companies are working hard to achieve that, but there’s a lot of value also in what we call mini-constellations with five, 10 or 20 satellites,” said Jan Smolders, chief commercial officer at Space Inventor, a Danish small-satellite manufacturer.

Those constellations could provide specialized services for customers that are not available from existing systems or that could be delivered more effectively through customized designs. “That’s something that we see and are working on,” he said.

Rusty Thomas, chief executive of Endurosat USA, the U.S. subsidiary of Bulgarian small-satellite manufacturer EnduroSat, said he expects interest from companies and governments that may not want to rely on another company’s large constellation for critical communications or other services.

One example, he said, would be a country seeking resilient communications through a system of 100 to 200 satellites. “A lot of countries realize that they don’t want to rely on the megaconstellations for all of their communications,” he said.

Similarly, some large companies may find that custom constellations better meet their needs. “Bigger companies will realize they don’t need to pay the megaconstellations for all their data services and could potentially put up 100-, 200- or 300-satellite constellations,” Thomas said.

“What drives business today is sovereign constellations and the realization for a lot of national players that they can no longer rely on global constellations,” said Slava Frayter, chief executive of GomSpace North America, a subsidiary of Danish small-satellite company GomSpace.

Thomas said a system of 50 to 60 satellites would be sufficient to provide “constant custody,” or continuous coverage over a specific area, based on the experience of systems such as Iridium and Orbcomm.

Even smaller mini-constellations are possible. Tina Ghataore, global chief strategy and revenue officer at Belgian manufacturer Aerospacelab, said a tailored system could provide rapid-revisit imaging of a specific region. “Thirty satellites will do it for you,” she said.

Mini-constellations also offer manufacturers a chance to move beyond one-off satellite projects, given that many of the very large constellations are built in-house by operators, as SpaceX has done with Starlink and Amazon is doing with Amazon Leo.

The overall smallsat industry is “not up to the standards and the scale that we need to maximize the opportunities that are out there in space currently,” said Peter Krauss, president and chief executive of Terran Orbital, a small-satellite manufacturer owned by Lockheed Martin. He said the company’s top priority is developing economies of scale in small-satellite production.

“Where we’re focused right now is that scalability, to change once and for all this notion of one-off, bespoke, beautiful things,” Krauss said. “Instead, it’s about how we build things really and genuinely at scale: dozens of something, hundreds of something.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

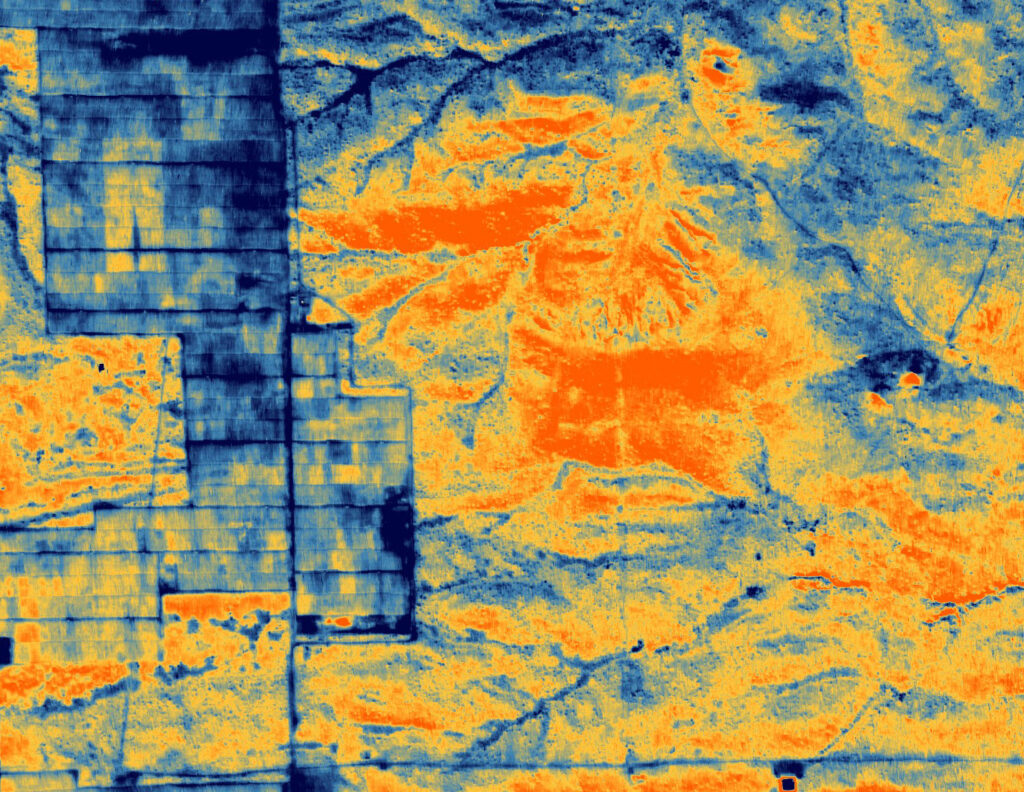

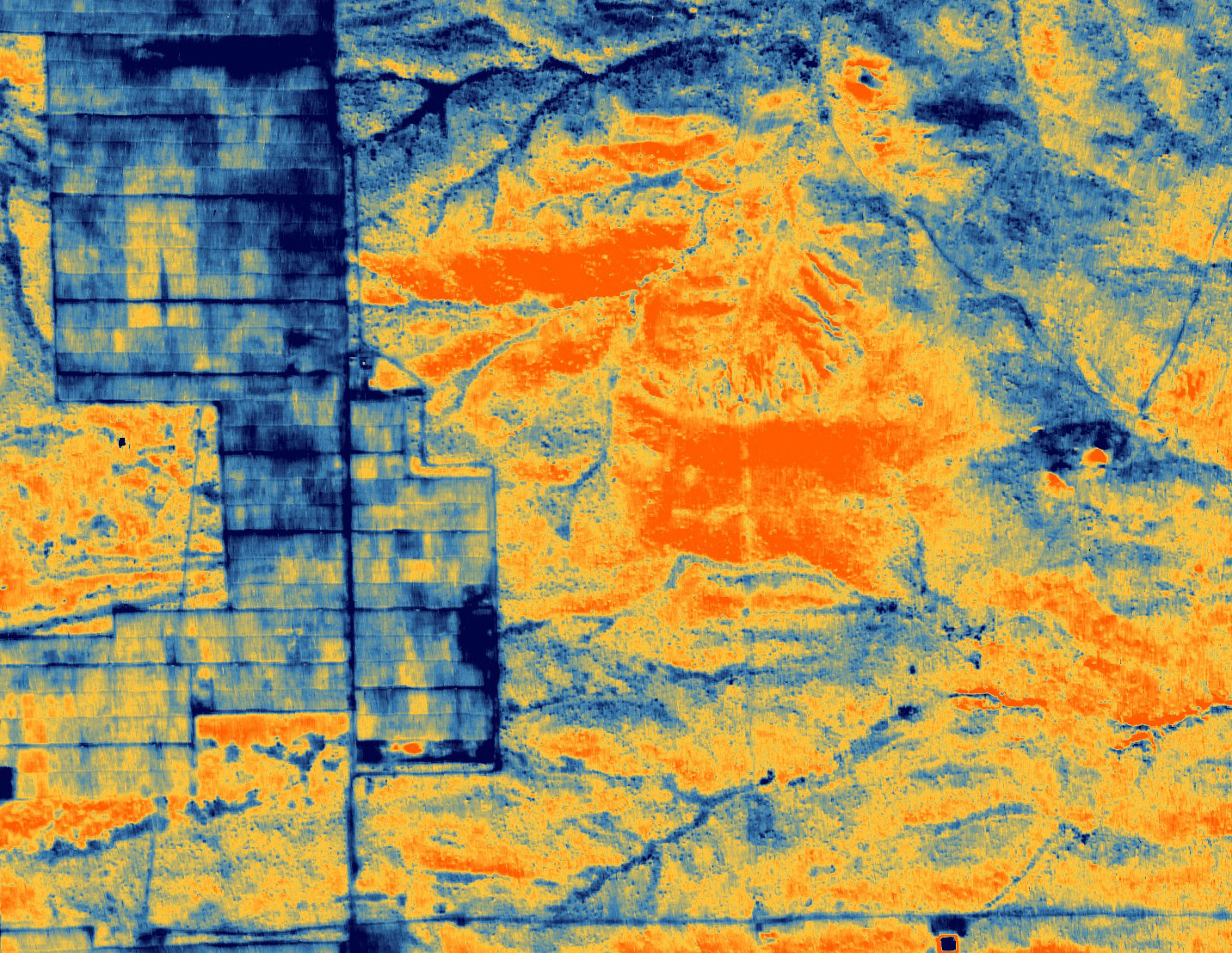

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

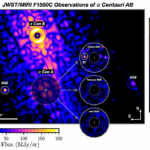

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits