Now Reading: How much is vertical integration squeezing the smallsat opportunity?

-

01

How much is vertical integration squeezing the smallsat opportunity?

How much is vertical integration squeezing the smallsat opportunity?

TAMPA, Fla. — As SpaceX and other vertically integrated space giants expand their reach, questions are growing over just how much room other small satellite companies have to build scalable businesses.

The number of satellites in orbit is projected to grow from 10,000 to anywhere between 100,000 and a million by 2035, Deloitte U.S. space practice lead Brett Loubert said Feb. 10 during SmallSat Symposium in Mountain View, California.

That growth trajectory has recently been accelerated by interest in space-based data centers and orbital computing concepts, which proponents say could help meet surging global data demand.

“It drives a ton of use cases,” Loubert said, as the need for significantly greater data delivery and storage becomes sharper in an era of artificial intelligence and autonomy.

Abhishek Tripathi, director of mission operations at the University of California’s Space Sciences Lab, argued that the rise of orbital data centers means the industry should broaden the definition of a small satellite to encompass anything “that has a solar array that’s smaller than a football field long.”

Excluding orbital data centers this way, Tripathi said, would help companies and investors focus on the business opportunities that remain below that threshold.

“Even as far as four years ago, I didn’t think there was going to be as big of a market for small [satellites] the size of a couple of monitors,” he added.

Vertically integrated stranglehold

However, satellites of all sizes slated for large constellations are increasingly being built, operated and — in SpaceX’s case — launched in-house.

The shift toward megaconstellations and deeper vertical integration is already squeezing smaller and mid-sized satellite operators as Amazon follows SpaceX’s lead, warned Armand Musey, a satellite industry analyst and founder of Summit Ridge Group.

As dominant players internalize more of the value chain, it becomes harder for independent operators to compete on cost, scale or access to customers.

“I think it’s going to be a tough time for some of the smaller [and] mid-sized operators,” he said.

According to Boston Consulting Group principal Charlotte Kiang, this does not necessarily mean smaller players are shut out entirely.

“I don’t think necessarily all hope is lost if you’re not the SpaceX of the market,” Kiang said, adding that she expects companies will increasingly focus on standardized satellite platforms that support multiple missions and customers.

Smaller players are also likely to continue consolidating to gain scale and “constellation-level economics,” she added.

Room for partnerships?

Kiang also said orbital data centers could create partnership opportunities for smaller companies that are not building the platforms themselves, particularly those positioned to provide connectivity layers, ground infrastructure or other enabling services that sit downstream of large space-based compute systems.

Musey was more skeptical that the industry is heading toward deeper collaboration.

“I think we’re seeing in the industry, the successful players are increasingly vertically integrated,” he said, as they move toward proprietary technology and in-house capabilities.

“I’m seeing maybe less cooperation than more,” he added.

Carving out a niche

Still, as the industry pushes toward mass production and constellation-scale deployment, Tripathi said gaps are being opened for companies capable of delivering specialized spacecraft that large manufacturers increasingly deprioritize.

“When you do that, you lose the ability to service the one-offs,” he said, “and I think there’s a tremendous opportunity … to be able to be a high-quality provider of … mission-specific satellites.”

The rapid push toward space-based computing could also revive interest in parts of the smallsat supply chain that have struggled to attract capital in recent years, he added, such as propulsion and other satellite components.

It remains to be seen whether niche opportunities can translate into meaningful growth for the broader smallsat sector.

“It’s going to be a little business,” Musey said. “Some of these niches are just very small and are not really going to move the needle in terms of the growth of the overall satellite sector.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

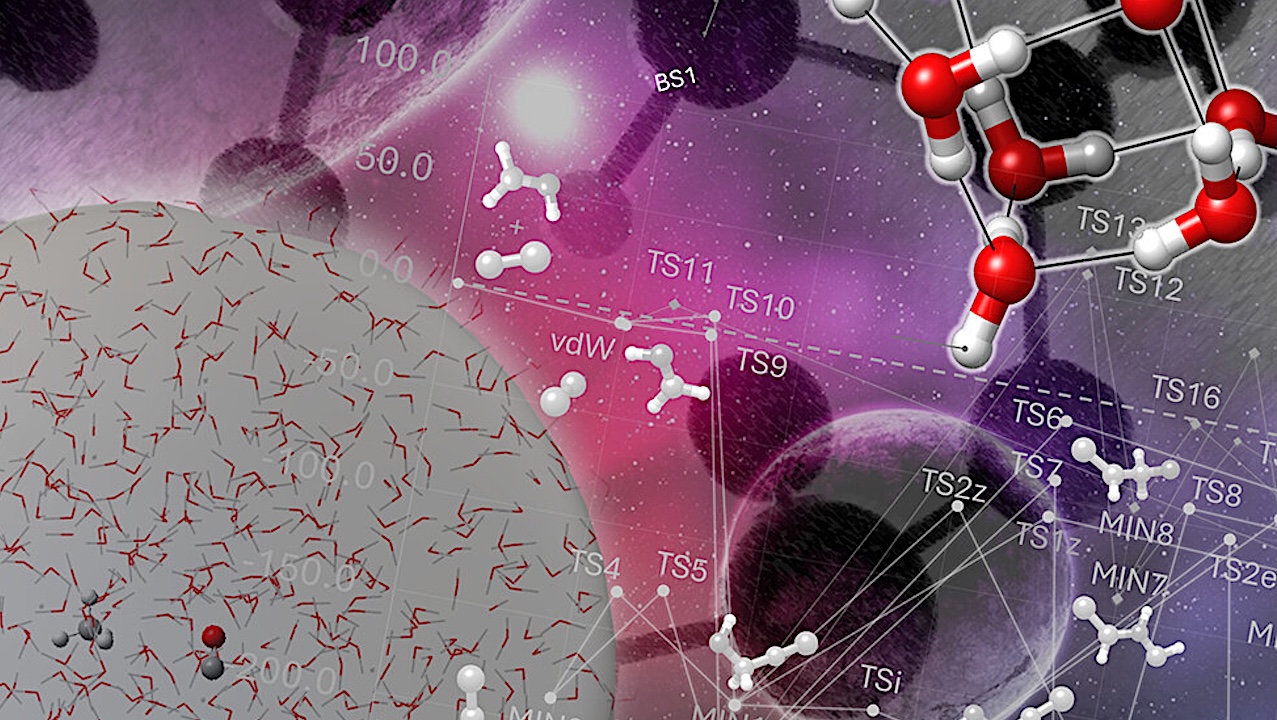

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

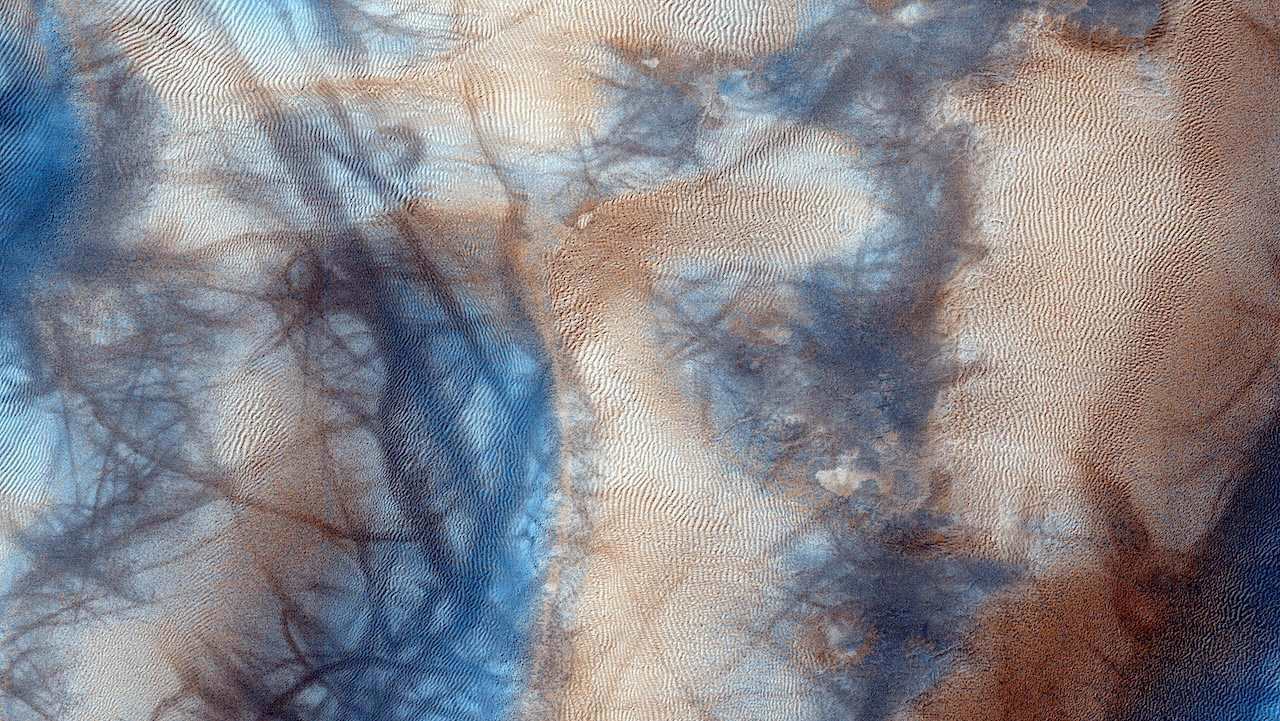

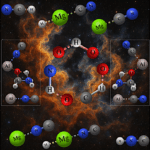

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

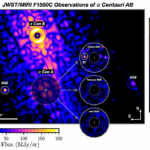

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits