Now Reading: SpaceX IPO may suck oxygen from market before unleashing broad capital surge

-

01

SpaceX IPO may suck oxygen from market before unleashing broad capital surge

SpaceX IPO may suck oxygen from market before unleashing broad capital surge

TAMPA, Fla. — Space investors and dealmakers anticipate SpaceX’s planned initial public offering (IPO) this year will trigger a surge of capital across the industry, but not without the risk of pulling investor attention away from other companies in the run-up.

SpaceX already sees strong demand from “tourist investors” buying its shares through private secondary transactions to enter the space sector, Patrick Beatty, U.S. managing director at Beyond Earth Ventures, said Feb. 11 during SmallSat Symposium in Mountain View, California.

“So IPOs timed around the SpaceX IPO are great,” he continued. “People want to access that stuff, so I think it’s only going to be helpful.”

SpaceX is expected to raise tens of billions of dollars at a valuation exceeding $1.5 trillion in a public listing that could take place as soon as this summer.

However, AE Industrial Partners principal Tyler Letarte and others on the panel cautioned that investor attention could be pulled away from other opportunities ahead of the IPO, though it would ultimately amplify interest in space overall.

He said “the sheer amount of supply tied to this IPO will force everyone in the investor universe, globally, to look at this, and it will then force certain individuals, institutional investors, retail investors, etc., to understand what is space and why they want to invest in SpaceX.”

Incoming M&A boom?

DCVC operating partner Matt O’Connell said he anticipates the buzz resulting from a SpaceX listing would lead to more mergers and acquisitions than IPOs in the sector.

“There’s a huge supply of capital right now and it’s got to go somewhere,” he said.

Karl Schmidt, managing director of KippsDeSanto & Co., also agreed SpaceX’s planned public offering would be a net positive for the sector, though not for companies competing too closely with Elon Musk’s space behemoth.

“Like all things SpaceX, you probably don’t want to be competing directly with them,” he said, “and so you don’t want to be in that timeframe of the vortex of that IPO.”

Orbital data center opportunity

Still, GH Partners managing director Noel Rimalovski pointed to how SpaceX’s plans to deploy up to a million orbital data centers could lift competing launchers, as rivals seek to build out their own space infrastructure.

“They’re going to have to buy a lot of launch from people other than SpaceX to even put a dent in that,” he said. “So, great opportunity for launch providers.”

SpaceX’s entry into public markets could also benefit existing publicly traded space companies, according to Rimalovski, as analysts and institutional investors look for comparable opportunities.

“Wall Street research analysts, equity investors, are economic beasts,” he said.

“They will be looking at SpaceX and relative valuation to other public peers — and a lot of those public peers, which have great businesses, will look like deep value plays.

“So I think there will be a good amount of flow into other companies that are public in the space sector.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

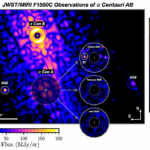

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits