Now Reading: Space startups find more paths to liquidity as investors warm to maturing sector

-

01

Space startups find more paths to liquidity as investors warm to maturing sector

Space startups find more paths to liquidity as investors warm to maturing sector

TAMPA, Fla. — Young space companies are gaining more ways to cash out or raise larger pools of capital as the industry matures and investors grow more comfortable with the sector.

“Up and coming companies today have a lot of options,” Joe Dews, managing director of investment bank Craig-Hallum, said Feb. 12 during SmallSat Symposium in Mountain View, California.

Multiple routes are now open for companies to access the public markets, Dews said, while selling to established aerospace and defense contractors is another potential route amid increasing strategic interest in commercial space.

“Selling to a newspace player, or an AI [or] data center player” are also options in the current environment, he continued. “So, good place to be.”

SpaceX recently sought regulatory approval for an orbital data center constellation of up to one million satellites, underscoring growing investor interest in the intersection of space infrastructure and artificial intelligence.

Preston Dunlap, managing partner of investment firm Arkenstone Capital, labeled the trend SPANGO, riffing on the Wall Street acronym MANGO (Microsoft, Anthropic, Nvidia, Google DeepMind and OpenAI), which reflects the rise of AI-driven tech giants as the market’s new growth leaders.

Still, expanded access to capital and exit routes doesn’t necessarily mean companies need to use them.

“I think what’s been interesting over the last 10 years with venture is the ability of the private capital market to continue funding companies until the cows come home,” said Mike Collett, managing partner at early-stage investor Promus Ventures.

“There’s just zero reason for many [space] companies to actually go out,” he added. “There are many of them right now that could be out … they’re continuing to get very, very large sums of money, and will continue to build on their models.”

Patient capital

That money increasingly includes government-backed funds, a critical factor in such a capital-intensive sector.

“The amount of capital that is needed far exceeds the equity pots that early-stage companies have available,” Collett said.

This is beginning to shift, he added, as larger venture rounds and alternative financing sources expand the capital available to space startups, though the sector’s long development cycles still require sustained backing.

Long development cycles and high upfront costs necessitate years of support before technical risk is reduced and revenue stabilizes, said Sara Jones, principal investor at national security-focused not-for-profit In-Q-Tel.

Government funding plays a key role in providing that runway as “patient capital is essential for this industry,” she said.

Shoring up fundamentals

As the sector matures, panelists said access to capital is increasingly tied to the strength and structure of underlying contracts.

“I think we’re in a period now where the industry has been maturing,” said Alexis Sáinz, partner at law firm Hogan Lovells.

She pointed to the growing emphasis on long-term revenue agreements and the ability to monetize those contracts as critical to unlocking debt and larger pools of institutional capital.

Recent BryceTech analysis shows non-venture investment in space startups surged in 2025, reaching its highest level since a 2021 spike driven by special purpose acquisition company (SPAC) mergers, fueled this time by traditional IPOs and greater reliance on debt.

New financing models are also emerging in the sector. Space Leasing International (SLI), an asset-financing specialist, is betting satellite operators will increasingly lease spacecraft rather than buy them outright, using an approach common in aviation.

SLI general counsel Robert Benton said the industry’s rapid pace of innovation is clearing the way for more sophisticated financial tools, noting that space has historically relied on a narrow set of funding mechanisms compared with other capital-intensive sectors.

“Government contracts, that’s your gold standard,” he said.

But even as venture, sovereign and structured finance mechanisms broaden the funding landscape, panelists said public markets continue to offer the greatest scale.

“There’s a massive opportunity here, all across the capital stack,” Dews said, “and ultimately, at the end of the day, the public capital markets … are the deepest source of capital.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

04Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

05Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

05Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

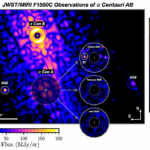

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits