Now Reading: Orbex collapse raises concerns for UK’s space industry and European launch competitiveness

-

01

Orbex collapse raises concerns for UK’s space industry and European launch competitiveness

Orbex collapse raises concerns for UK’s space industry and European launch competitiveness

The collapse of UK-based rocket company Orbex has raised concerns over the future of the United Kingdom’s independent space endeavors while highlighting the competitive landscape in the European small satellite launch sector. On February 11, 2026, Orbex announced that it had initiated a process akin to Chapter 11 bankruptcy in the U.S., after exhausting efforts to secure new investment or merge with other companies.

Founded in 2015 and headquartered in Scotland, Orbex had been viewed as a key player in establishing the UK’s sovereign orbital launch capabilities. Despite receiving substantial government backing, including £26 million in taxpayer-supported loans, the firm was unable to secure necessary Series D funding or finalize a potential acquisition by French startup The Exploration Company. Earlier setbacks included the closure of its Danish rocket engine operations and the layoff of 90 employees in January, with the latest developments threatening an additional 150 jobs primarily in Scotland.

Orbex was developing the Prime microlauncher, a 19-meter two-stage rocket designed for small satellite missions. This vehicle distinguished itself with an environmentally friendly design, using bio-propane fuel and liquid oxygen to achieve a reduction in carbon emissions of up to 90% when compared to traditional rocket propellants. The company aimed to conduct initial test flights from the SaxaVord Spaceport in Scotland’s Shetland Islands later in 2026, alongside plans for a larger rocket named Proxima.

The company had also made strides in infrastructure, having begun construction on the Sutherland Spaceport in late 2022. However, work at this site was halted indefinitely in late 2024, redirecting resources to SaxaVord, which remains partially developed.

In response to Orbex’s downturn, rival Scottish company Skyrora expressed interest in acquiring some of its assets, including the lease for the Sutherland Spaceport. Skyrora signaled its intent to invest as much as £10 million, pending due diligence and the approval of administrators, asserting that maintaining the capability for UK launches very important for national interests.

Currently, Skyrora is the only UK firm with a domestic vertical orbital launch license and manufacturing operations based in Cumbernauld. The company hopes to build upon Orbex’s legacy and safeguard already invested taxpayer resources.

The fallout from Orbex’s failure poses challenges for the European Launcher Challenge, a strategic program initiated by the European Space Agency (ESA) to stimulate competitive launch services and reduce dependence on non-European providers. Following Orbex’s collapse, the initiative now has four remaining participants, including PLD Space, MaiaSpace, Rocket Factory Augsburg, and Isar Aerospace, which have until 2027 to demonstrate launch capability to maintain eligibility for ESA funding through 2030.

Amidst these developments, Isar Aerospace recently completed a successful initial flight of its Spectrum rocket, while Rocket Factory Augsburg announced advances in its RFA One vehicle, including near-completion of its launch infrastructure at SaxaVord. Set to conduct the UK’s inaugural vertical orbital launch, RFA aims to schedule its maiden flight later in 2026.

The challenges highlighted by Orbex’s failure underline the difficulties facing new entrants in the small-launch market, where substantial development costs, regulatory hurdles, and fierce competition from established players like Rocket Lab complicate the landscape. Nevertheless, the continued funding of the European Launcher Challenge and the ongoing progress by remaining competitors suggest that Europe’s aspirations for a resilient and competitive space industry persist despite this setback. In the coming months, the fate of Orbex’s assets, including its intellectual property and infrastructure, will be pivotal in determining the future of the UK’s launch capabilities.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

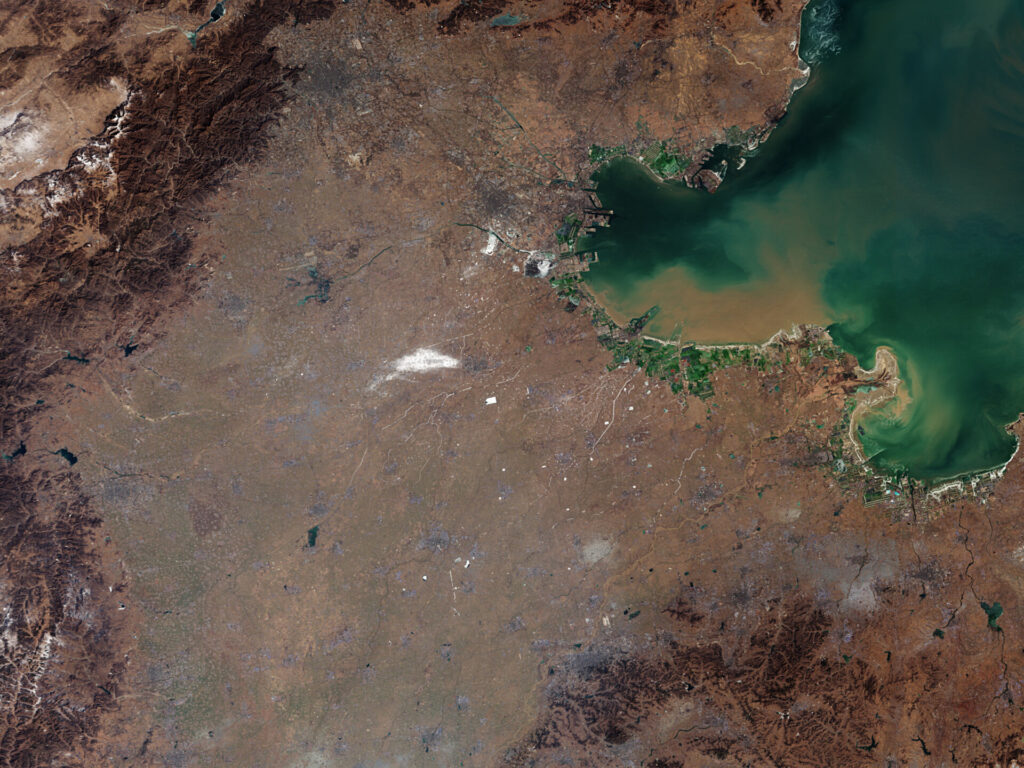

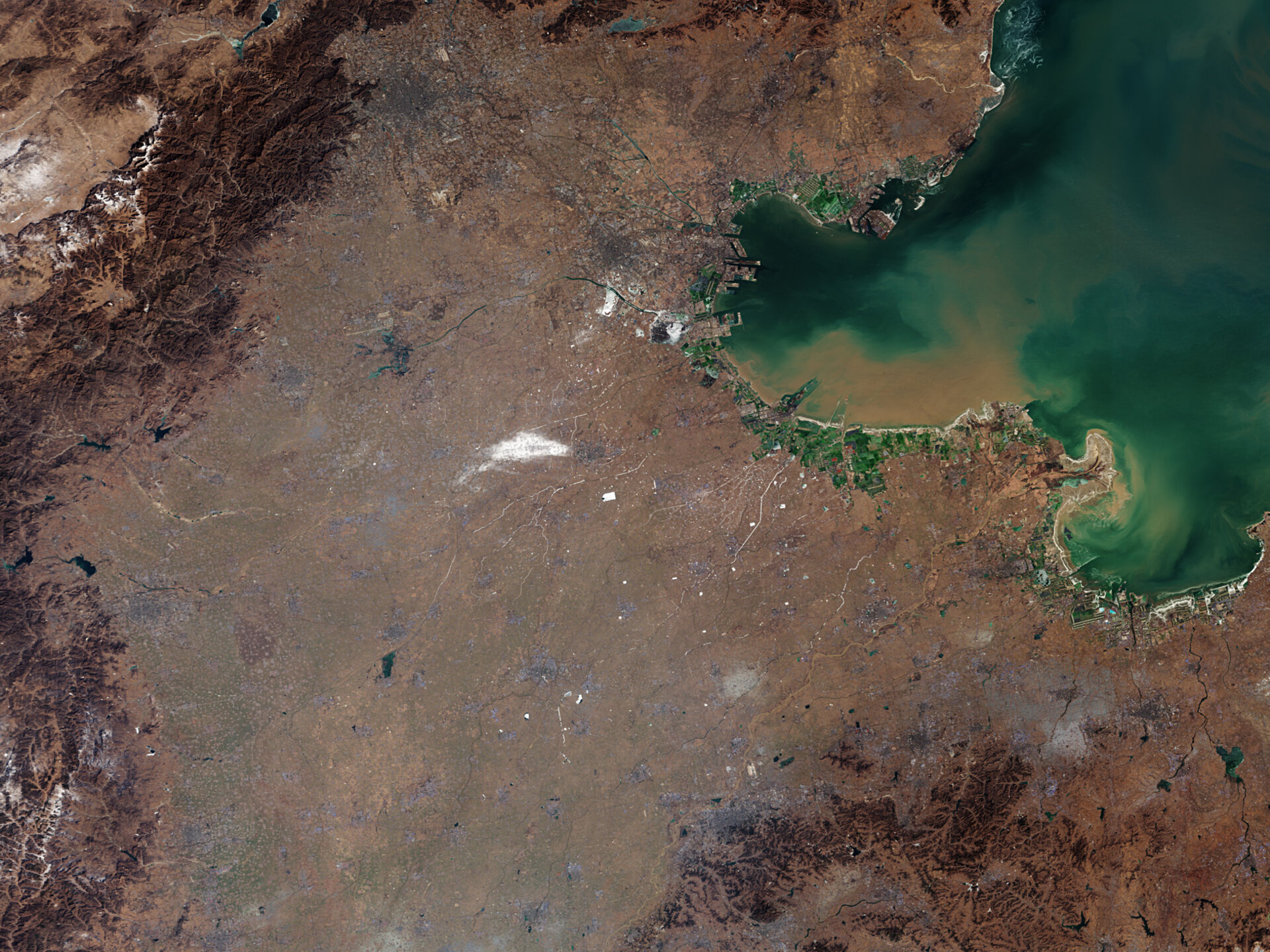

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

06Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly