Now Reading: MDA Space raises SatixFy offer by 43% to counter competing bid

-

01

MDA Space raises SatixFy offer by 43% to counter competing bid

MDA Space raises SatixFy offer by 43% to counter competing bid

TAMPA, Fla. — Canada’s MDA Space has increased its offer for SatixFy by 43% following a competing bid for the Israeli satellite chipmaker, bringing the total value of the deal to around US$356 million.

MDA originally announced plans April 1 to buy SatixFy for $2.10 per share, representing a 75% premium over its March 31 closing price, in addition to paying off the company’s $76 million in debt.

However, during a 45-day “go-shop” period in their agreement, SatixFy received a rival offer from an undisclosed third party valued at $2.53 per share. The counterproposal included a mechanism to limit the impact of stock price fluctuations.

While MDA said May 20 it disputed the validity of that acquisition proposal, it nonetheless raised its own offer to $3 per share.

The amended deal, backed by investors representing 57% of SatixFy’s shares, prevents the company from considering further acquisition proposals.

A shareholder meeting to approve the transaction, initially scheduled for May 20, has been postponed to May 23 to give more time to consider the revised offer.

MDA said acquiring SatixFy would bolster the company’s supply chain as it scales up its satellite constellation manufacturing facilities.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

01From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

02Two Black Holes Observed Circling Each Other for the First Time

02Two Black Holes Observed Circling Each Other for the First Time -

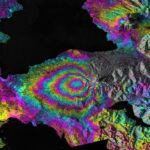

03How New NASA, India Earth Satellite NISAR Will See Earth

03How New NASA, India Earth Satellite NISAR Will See Earth -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly