Now Reading: EchoStar bets on TV amid FCC mobile scrutiny

-

01

EchoStar bets on TV amid FCC mobile scrutiny

EchoStar bets on TV amid FCC mobile scrutiny

TAMPA, Fla. — EchoStar has ordered another geostationary satellite for its Dish Network TV broadcast business, even as the company signals the possibility of seeking bankruptcy protection amid a regulatory probe into its spectrum licenses.

Maxar Space Systems said June 2 it aims to deliver ES XXVI in 2028 and will base the satellite on its 1300 platform, the largest in the manufacturer’s lineup at up to 6,800 kilograms.

Like the ES XXV satellite ordered from Maxar in 2023, ES XXVI is designed to provide broadcast services across the United States and Puerto Rico, ensuring continuity of coverage currently provided from a mix of around 10 owned and leased payloads.

Regulatory uncertainty

With the satellite TV market slowly declining, EchoStar and the Dish business it acquired in 2023 (both previously backed by billionaire Charlie Ergen) have been pushing into connectivity services, including the deployment of a 5G network under the Boost Mobile brand.

However, the U.S. Federal Communications Commission recently began reviewing EchoStar’s compliance with terrestrial buildout obligations in the AWS-4 band, as well as its use of adjacent 2 GHz spectrum for satellite services.

The investigation follows pressure from rivals such as SpaceX, which in April claimed data from its Starlink broadband satellites showed the company had not satisfied a 70% buildout commitment in the AWS-4 band by the FCC’s Dec. 31, 2023, deadline.

While EchoStar strongly denies this claim, the company said May 30 it will not make a $326 million interest payment on debt backed by spectrum licenses due to the uncertainty.

“This uncertainty over our spectrum rights has effectively frozen our ability to make decisions regarding our Boost business,” EchoStar said in a regulatory filing, “including continued network buildout and adversely impacts our ability to implement and adjust our overall business plan and requires us to re-evaluate the deployment of our resources.”

The decision puts EchoStar into a 30-day grace period for the debt, which analysts characterize as a move to increase the company’s negotiating leverage with the FCC.

“To catalyze a resolution to the ongoing uncertainty, EchoStar appears to be signaling that it is willing to file for bankruptcy protection, a move that could provide the company with the benefits of the automatic stay and potentially stall or block FCC efforts to modify or revoke its spectrum licenses,” said Adam Rhodes, a senior telecom analyst at Octus.

Even if EchoStar files for bankruptcy protection, Rhodes said he expects the company’s pay-TV business to remain in operation since it still generates roughly $3 billion in annual EBITDA, or earnings before interest, taxes, depreciation, and amortization, despite long-term subscriber losses and broader declines in the satellite TV market.

“Bankruptcy by itself would not affect the need to order a replacement satellite,” he told SpaceNews via email.

“However, we still expect that, at some point, the pay-TV operations will combine with [U.S. rival broadcaster] DirecTV, so I think the timing is a little more interesting from that perspective.”

EchoStar reported $2.54 billion in first quarter revenues for its pay-TV business, comprising Dish TV and its Sling TV online streaming service, down nearly 7% year-on-year. Although wireless sales increased more than 6%, total quarterly revenues slipped 3.6% to $3.9 billion.

EchoStar did not respond to requests for comment.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

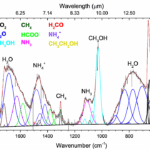

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Φsat-2 begins science phase for AI Earth images

03Φsat-2 begins science phase for AI Earth images -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

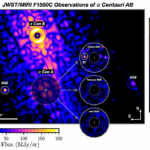

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits