Now Reading: U.S. satellite firms look abroad as foreign nations seek ‘sovereign’ eyes in the sky

-

01

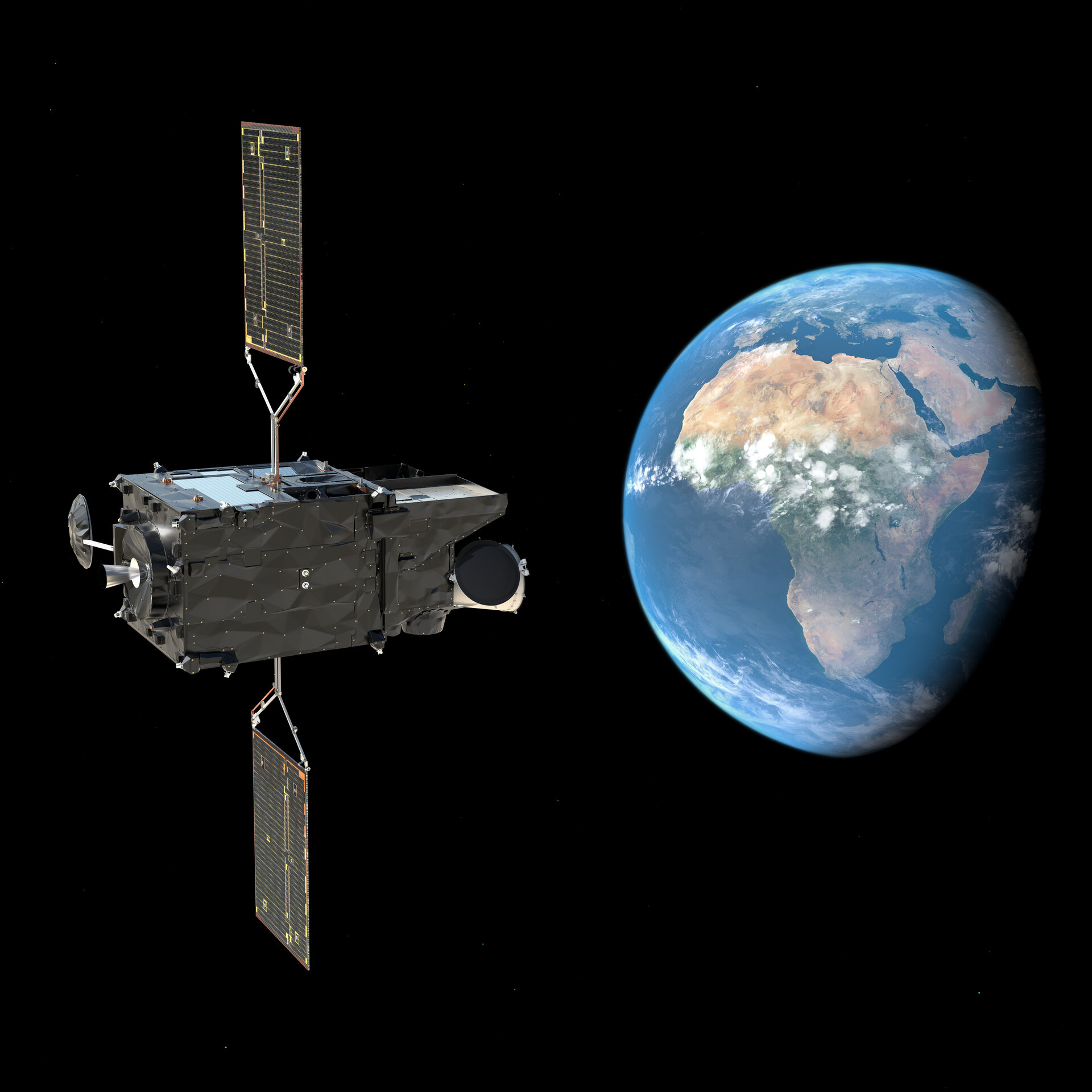

U.S. satellite firms look abroad as foreign nations seek ‘sovereign’ eyes in the sky

U.S. satellite firms look abroad as foreign nations seek ‘sovereign’ eyes in the sky

American satellite imaging companies are witnessing a boom in demand from unexpected customers: those based abroad.

Earth observation satellite operators such as Maxar Intelligence, BlackSky, Planet Labs and Capella Space are increasingly looking beyond traditional United States government customers and instead aiming to serve foreign nations who want their own surveillance capabilities. These companies, while still tethered closely to U.S. government contracts, are recasting themselves as global vendors of what they call “sovereign” space capabilities. As a result, they are striking high-value international deals that promise long-term revenue and access to new markets.

The move reflects the democratization of space-based Earth observation technology. It’s also a sign of broader geopolitical realignments.

Countries that have historically relied on American intelligence sharing are now saying they need their own eyes in the sky, said Dave Gauthier, a former U.S. National Geospatial-Intelligence Agency official who is the chief strategy officer at the consulting firm GXO Inc.

More nations, he said, are taking advantage of the fact that the remote-sensing industry, once dominated by classified government programs and limited to major powers, has evolved into an innovative and competitive commercial marketplace.

This recalibration of business outside the U.S. comes as the Trump administration enacts spending cuts across federal agencies, including those that have been reliable customers for Earth observation satellite firms.

As Washington pares back spending, U.S. companies are forced to diversify their clientele. Simultaneously, international demand for independent, space-based surveillance is accelerating in response to regional tensions and a growing skepticism about relying too heavily on American intelligence streams.

Collectively, “this is good for business,” Gauthier said.

The appeal of commercial space-based remote sensing extends far beyond traditional military and intelligence applications. While defense and intelligence represent the most obvious and sought-after uses of Earth observation satellites, Gauthier said countries are recognizing these assets can support critical industries such as energy, agriculture and oil and gas. Satellites can help identify promising areas for exploration by mapping geological features, enable real-time monitoring of crop health and soil moisture and support monitoring and maintenance of energy infrastructure such as power plants.

“The demand is driven by the fact that so many sectors in a nation can benefit from access to geospatial intelligence,” Gauthier said. “There’s broad utility to having geoint capabilities at your disposal.”

Challenges and confidentiality

The international satellite intelligence services market operates within a complex regulatory and security environment. Many contracts, especially with defense or intelligence agencies, remain confidential or undisclosed due to national security considerations. This opacity makes it difficult to quantify the international market, though the disclosed contracts suggest the scale represents hundreds of millions of dollars in annual business for U.S. firms.

Export controls and technology transfer restrictions also influence how these American companies can serve international customers. Companies must navigate domestic regulatory requirements, executives pointed out, while meeting customer demands for genuine sovereign capabilities.

One turning point has been the conflict in Ukraine. The war has served as a powerful demonstration of commercial satellite imagery’s military utility, showing how civilian space assets can provide battlefield intelligence. It’s also accelerated international interest in commercial capabilities.

The commercial satellite industry, meanwhile, has undergone dramatic changes over the past decade. What once required billion-dollar government programs and decades of development can now be accomplished with relatively modest investments and commercially available technology. This democratization has opened opportunities for nations that previously lacked the resources or expertise to develop space-based intelligence capabilities.

Maxar Intelligence in February completed the deployment of its WorldView Legion six-satellite high-resolution imaging constellation, offering what it calls dedicated capacity packages. This setup allow foreign governments to direct satellite tasking without the burdens of building or maintaining the infrastructure.

“It’s like having a sovereign capability,” said Anders Linder, who leads Maxar’s international government business operations from London. “Customers can buy their own antenna, reserve time on Maxar’s satellites and direct where they want pictures taken. That’s a simpler and much more affordable option than building, deploying and operating a constellation.”

To reinforce its global posture, the company brought in advisers such as retired U.K. Air Chief Marshal Sir Stuart Peach and Tadashi Miyagawa, the former head of Japan’s defense intelligence agency. Maxar now maintains personnel in London, Singapore, Sweden, India and Japan — with plans to expand into the Middle East.

The company recently announced an agreement with Sweden’s largest defense contractor Saab to develop geospatial intelligence products. In December 2024, Maxar secured $35 million in tasking contracts with two unnamed Asia-Pacific governments, granting them direct access to WorldView Legion and to synthetic aperture radar (SAR) imagery from partner Umbra Space. And in January 2025, leaders announced a $14 million deal with the Netherlands Ministry of Defense for on-demand imagery to support intelligence, mapping and military operations.

Demand is also growing beyond traditional defense needs. In a recent deal with a southern Asian country, Maxar’s data was used for civilian property surveillance to verify land use and enforce tax compliance.

“Europe is now catching up to be at the same level as the Middle East and Asia Pacific,” Linder said of the global appetite.

Long-term deals

More nations, some with limited space capabilities, are signing on to intelligence-as-a-service models, Brian O’Toole, CEO of BlackSky, said during a earnings call earlier this year. In many cases, these deals are long-term, a critical factor for commercial satellite firms looking for predictable revenue to reassure investors and shareholders.

“We’re getting international agreements for five and seven years,” O’Toole said. This arrangement gives the company predictability as it invests in next-generation satellites, he added.

BlackSky officials said they recently landed a $100 million seven-year subscription contract with an undisclosed foreign government, along with nearly $20 million in multi-year agreements to support India’s commercial Earth observation efforts. The company, which specializes in real-time imagery and analytics, is working with Thales Alenia Space to build a high-resolution optical satellite for India’s Nibe Ltd. — a major defense contractor. This satellite will anchor what is expected to become a constellation supporting Indian national security needs.

The BlackSky-Thales Alenia partnership in India follows a similar $50 million agreement with the Republic of Indonesia. “International opportunities today are tremendous,” O’Toole said. “U.S. companies are helping our allies accelerate their capabilities.”

Planet Labs is following a similar path. The company runs a constellation of over 200 satellites offering daily global imaging, is also diversifying its business and pursuing international deals.

In January, Planet signed a $230 million, seven-year agreement with an unnamed Asia-Pacific customer to build high-resolution satellites and provide commercial imagery.

The German government, meanwhile, inked a seven-figure deal for Planet’s full suite of geospatial products, which it will use for environmental monitoring, land-use tracking and socioeconomic research.

The power of SAR

SAR satellites, which can capture images through clouds and at night, complement optical satellites that require clear weather and daylight.

Frank Backes, CEO of Capella Space, a SAR imaging company recently acquired by the quantum computing firm IonQ, said the international demand for commercial SAR is growing.

“Our pipeline and our opportunities have improved significantly in the last two months,” he said in an interview, noting that Japan has become the firm’s second-largest government customer behind the U.S.

The company is also in talks with the United Kingdom and the United Arab Emirates to provide SAR satellites they can operate independently . “Sovereign control can mean different things to different countries,” Backes said. “Priority access is what a lot of countries are looking for.”

One of Capella’s primary competitors in the global SAR market is the Finnish firm Iceye, which has a U.S. subsidiary and is executing a global expansion strategy in response to the demand for sovereign Earth observation systems.

Iceye recently signed a $200 million deal to provide Poland with three SAR satellites and partnered with Germany’s Rheinmetall to create a joint venture for satellite manufacturing. In Japan, Iceye is working with IHI Corp. to build a 24-satellite SAR constellation and establish a domestic manufacturing facility. The company also opened a new office and production line in Athens, Greece.

From battlefield to balance sheet

Much of the recent success has been tied to the war in Ukraine, executives said.

“We’ve gone from a world where it took hours to deliver information to minutes,” said Maxar CEO Dan Smoot during a panel at the GEOINT Symposium. “The international community understands commercial is the path to have these solutions moving forward.”

The war underscored the agility of commercial satellite imagery, Smoot said. Unlike government systems, which can be bound by bureaucracy and slow procurement cycles, commercial systems offer on-demand tasking, constant updates and near-global reach.

“What we are seeing now is a speed to adoption in the international market that’s accelerating like I’ve ever seen,” Smoot said. “There’s been a major shift because of some of the recent policies to help open up the international markets.”

All of this rise in commercial satellite sovereignty marks a shift in global intelligence dynamics. What was once the exclusive domain of superpowers is now accessible, on-demand, to nations of nearly any size. That has been possible due to the innovation in the commercial space sector largely led by U.S. companies, and governments can now buy their way into space-based intelligence without building it from scratch.

Gauthier describes the landscape this way: “There’s a much more favorable market for U.S. commercial firms. Many countries don’t have established defense industries that work on space programs, so they are going to buy the best commercial capabilities they can.”

The convergence of cheaper launches, smaller satellites and rising geopolitical tensions points to one trend: international expansion isn’t a blip and will continue into the future, Gauthier said.

In May, industry and government executives told SpaceNews that the National Reconnaissance Office had privately warned space companies that they planned to shrink imagery companies by 30% this year, leading to a $130 million cut.

With U.S. government spending under pressure, American firms have no choice but to rely on foreign contracts to provide the steady, long-term revenue their investors expect.

This article first appeared in the June 2025 issue of SpaceNews Magazine.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

03Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

06Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly -

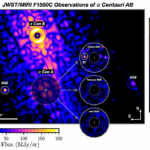

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits

07Worlds Next Door: A Candidate Giant Planet Imaged in the Habitable Zone of α Cen A. I. Observations, Orbital and Physical Properties, and Exozodi Upper Limits