Now Reading: Airbus says space business turnaround going well

-

01

Airbus says space business turnaround going well

Airbus says space business turnaround going well

PARIS — Airbus executives say they are making good progress to turn around the company’s space business unit even as they consider combining it with those at two other European companies.

In briefings at the Paris Air Show, as well as at a separate “Business Update” event held in Paris June 18, executives said they were seeing signs of improvement in its space business after taking 1.3 billion euros ($1.5 billion) in charges in 2024 and 600 million euros in 2023.

“In one word, we are stabilizing,” said Alain Fauré, head of space systems at Airbus Defence and Space, during a media briefing at the air show June 16. “Now we are back on track.”

The problems at Airbus stemmed from poor cost and schedule performance on satellite programs, which company leadership said last year was linked to not properly evaluating technology risks on those programs and not being selective enough when making “bid/no-bid” decisions.

That included work on OneSat, a line of software-reconfigurable GEO communications satellites. “It was very challenging in terms of development,” Fauré said. “The team has really turned things around.” He added he was confident that Airbus would deliver the first OneSat satellite in 2026.

The efforts on OneSat are part of the broader turnaround plan that he said is focused on competitiveness, efficiency and profitability. “It’s really changing the way that we address the business to be more efficient,” he said.

Mike Schoellhorn, chief executive of Airbus Defence and Space, offered a similar assessment at the Business Update event. “The team is doing an excellent job with new leadership to turn the ship around and turn it into a profitable and growing business,” he said.

That turnaround includes eliminating more than 2,000 jobs in Airbus Defence and Space. “We are well progressed on that. We are ahead of the curve,” he said. Those jobs, executives said later, did not involve engineers but instead largely back-office positions.

That turnaround effort comes as Airbus continues negotiations with Leonardo and Thales Alenia Space about a potential combination of their space businesses. At a separate event at the Paris Air Show June 17, Roberto Cingolani, chief executive of Leonardo, said he expected the companies to make a “go/no-go” decision on proceeding with the merger by July.

“We’re currently in the due-diligence phase,” Schoellhorn said. “That will have to lead to a decision in the second half of the year, yea or nay.”

Even if the companies decided to proceed with a combination, antitrust reviews could take about two years, according to both Cingolani and Fauré. Schoellhorn said he was optimistic that the European Union would approve a deal, citing comments by Andrius Kubilius, the EU commissioner for defense and space, in a June 17 speech that endorsed consolidation as part of broader efforts to improve Europe’s military readiness.

“We participate in a global competition and if Europe wants to be a competitor on a global scale, we need to do something,” he said. “I think we have the right condition for success but we don’t have a guarantee.”

He also offered two years to close any deal, a timespan he said was only a “guesstimation,” driven by both regulatory reviews and the complexity of combining space operations at the three companies. “It could also go faster, but maybe I’ll stay on the conservative side.”

Fauré argued for the importance of consolidation of space in Europe. “In Europe, if we step back, there is a lot of fragmentation in terms of projects, fragmentation in terms of players as well,” he said. A combination would provide “critical mass” in terms of scale and volume, he said, creating a “European champion” in space. “We can have the strengths of the three companies.”

The combination “would be a gamechanger in terms of scale,” Schoellhorn said. “Not only having the technology that we all have today that is on par with the U.S., but also creating a scale that is then basically at the same level as the big U.S. players.”

That consolidation, he said later, is still needed even as concerns about Elon Musk having outsized influence on the current administration have waned.

“I still think the consolidation in Europe makes a lot of sense and is still needed because we do fight in the world market against very large players, not only SpaceX. If you look at the military market, you have Lockheed Martin, you have Northrop Grumman, you have Boeing. They’re all a lot bigger than any European company,” he said.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

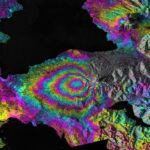

03How New NASA, India Earth Satellite NISAR Will See Earth

03How New NASA, India Earth Satellite NISAR Will See Earth -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly