Now Reading: Satellites keep breaking up in space. Insurance won’t cover them.

-

01

Satellites keep breaking up in space. Insurance won’t cover them.

Satellites keep breaking up in space. Insurance won’t cover them.

Airplane passengers crossing the Indian Ocean who peered out their windows on Oct. 19, 2024, might have seen what looked like a fast-moving star suddenly flash and fade. Above their heads, a $500 million satellite was exploding.

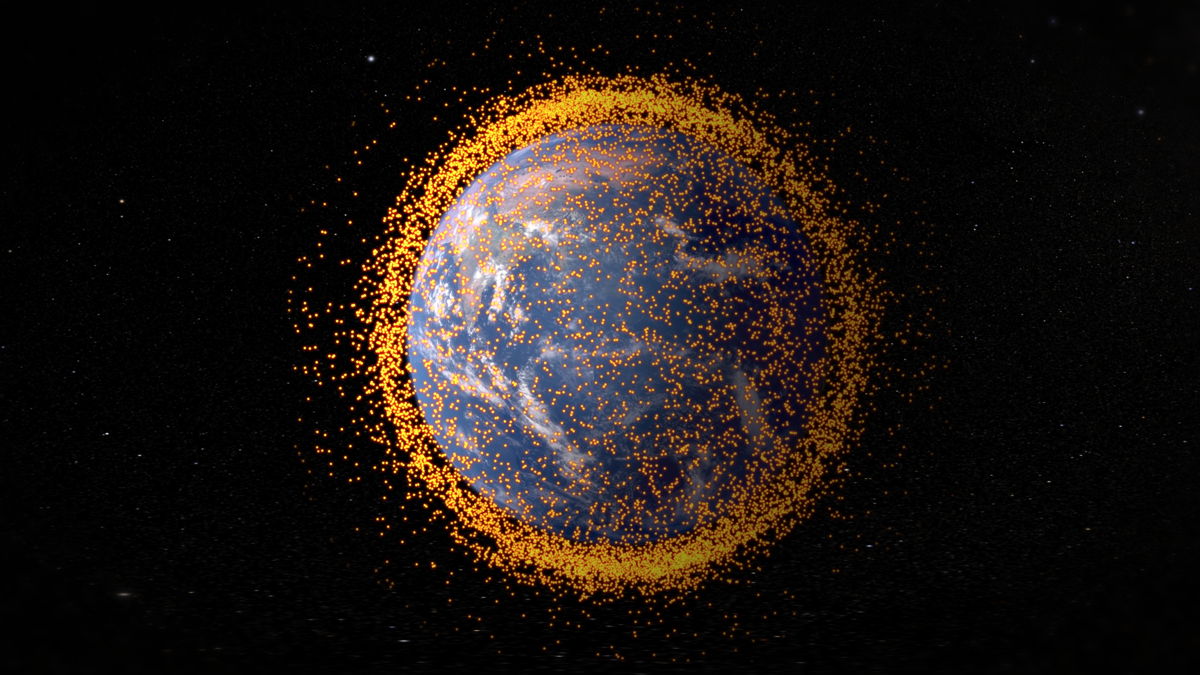

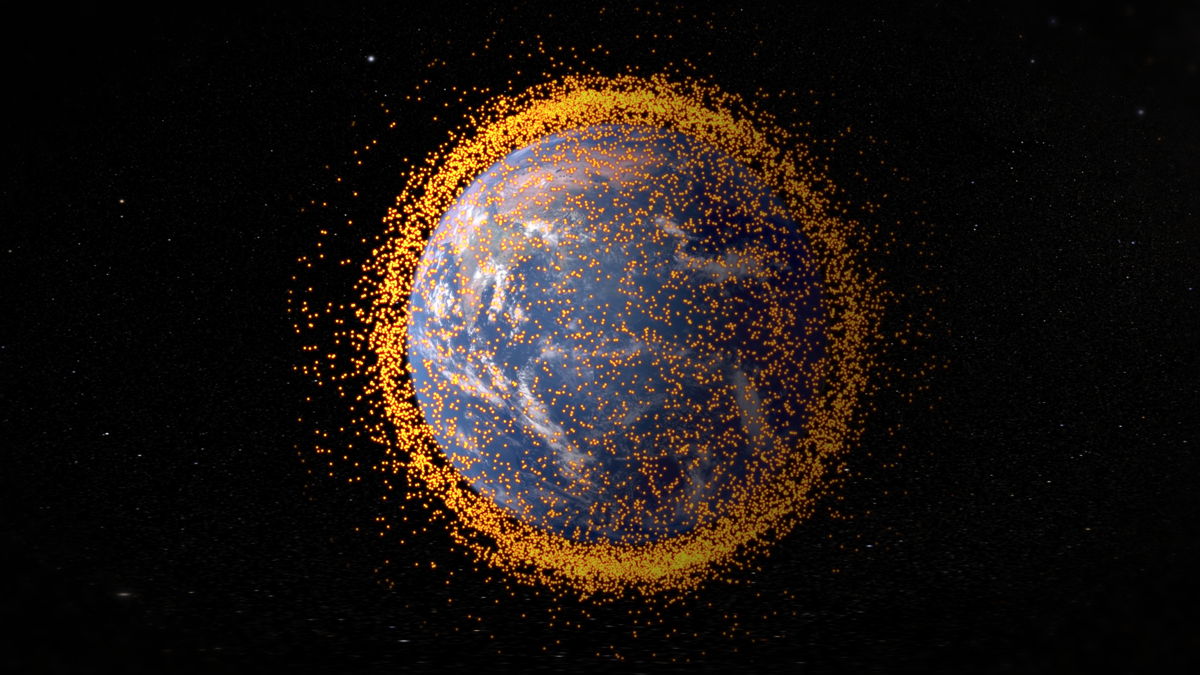

Operators confirmed the destruction of the Intelsat-33e satellite two days later. There was a bright flash as the satellite’s fuel ignited, followed by the flickering of the debris cloud as it fragmented into at least 20 pieces. Those satellite parts are now zooming around Earth, along with around 14,000 tonnes of space debris. The satellite wasn’t insured.

As space junk increases, more operators are choosing to launch without any insurance at all. To compensate, companies are cutting back on the cost of satellites and launching more of them at faster rates, thus creating a feedback loop as the cheaper satellites break up more easily and add to the problem.

“I don’t think it’s sustainable,” said Massimiliano Vasile, an aerospace engineer and professor at the University of Strathclyde Glasgow.

Behind the predicament are two vectors moving in opposite directions: The cost of launching satellites is falling, while the cost of insuring them continues to soar.

Even as record-low-cost launches are improving internet coverage and cell service, they’re worsening the space junk problem. Low Earth orbit, where most communications satellites are circling, is becoming increasingly crowded.

Satellite insurance, meanwhile, has never been more expensive. 2023 was likely the worst ever for the market, with reports suggesting satellite insurers faced loss claims of more than $500 million. 2024 may have been even worse, according to Insurance Insider.

Satellite operators are responding predictably, by foregoing coverage. There are 12,787 satellites above the Earth as of the time of publication, according to the website Orbiting Now, which tracks active satellites, but only about 300 are actually insured for in-orbit accidents, David Wade, an underwriter at Atrium Space Insurance Consortium, told Data Center Dynamics.

European and UK operators are legally required to insure their satellites, which puts them at a cost disadvantage compared with India, China, Russia and the U.S. American companies such as SpaceX have also been able to reduce launch costs because of reusable rocket parts. Europe’s upcoming Ariane 6 rocket program, for example, is expected to cost between $80-120 million per launch, compared with SpaceX’s Starship program which is anticipated to cost between $2-10 million per launch because of its reusable rockets.

In the U.S., launchers are required by law to procure liability insurance for launch, but once the satellite is in orbit, insurance is no longer needed. SpaceX, for example, is self-insured, meaning it seeks third-party insurance for almost none of its Starlink satellites.

“Typically, the launch cover is literally just for that [launch] stage, and once a satellite gets into orbit, you are off risk,” said Steve Evans, owner of insurance data provider Artemis (which is unaffiliated with NASA’s lunar program of the same name). The satellite “either makes it, or it doesn’t,” he told Space.com.

The space insurance market began in 1965, when Lloyds Bank insured Intelsat I, which broadcast the Apollo 11 moon landing. The first known satellite failures occurred in 1984, though some later recovered, including the $87 million Intelsat 5 ($2.82 billion in today’s money).

The industry has generally hovered around a 5% failure rate since 2000, with Data Center Dynamics reporting that there have been only 165 claims for more than $10 million across the history of the industry.

The 2019 failure of a military observation satellite for the United Arab Emirates, called the Vega rocket, led to $411 million in claims — the largest such loss in history, Reuters reported. That year, total satellite insurance losses became greater than insurance premiums for the first time, according to Bloomberg. Insurers were hoping to claw that money back in following years, but Reuters reported in 2021 that Assure Space and AmTrust Financial were both stopping insurance due to collisions.

Insurers were looking for a payout in 2023, but instead, that year saw close to $1 billion in claims and some $500 million in losses. For many long-standing insurers, it was the last straw; Brit, AGCS, AIG, Swiss Re, Allianz and Aspen Re all exited the space insurance market. Canopius, a specialist space insurance provider acquired by Lloyds in 2019, told Space.com via email that it was no longer underwriting space business.

Of the satellites in Earth orbit, around 42% are inactive, according to Seradata. The number of active satellites increased by 68% from 2020 to 2021 and by more than 200% from 2016 to 2021. Much of space insurance is modeled off the aviation industry, but space premiums are 10 to 20 times aviation premiums, Reuters reported in 2021.

A satellite in low Earth orbit typically needs $500,000 to $1 million of coverage, whereas a satellite in geostationary orbit requires $200 million to $300 million, according to the same report.

Behind the rush to exit the satellite insurance industry is a fundamental problem with satellite insurance: There’s usually no way to determine who was at fault. When a house burns down or a car crashes, insurers often send investigators to verify a claim before approving a payout. But in the dark reaches of space, they can’t operate that way.

“In the event of a loss and a claim by the insured, it is almost impossible, if not entirely impossible, for insurers to investigate the cause of the loss, whether total or partial, and thus determine the amount to compensate the insured,” José Luis Torres Chacón, a professor in the department of economic theory and history at the University of Málaga in Spain, told Space.com. “I think this is where the root of the problem lies.”

Liability insurance is problematic for satellites, too, since it’s extremely difficult to tell whether a satellite broke up because of an internal explosion or because of a collision with someone else’s space junk. And if the latter, it’s very hard to identify where the debris came from.

“At the moment, it’s not possible to say it was actually a fragment from that original explosion or collision that damaged the satellite,” Vasile said. “So, in terms of insurance, it’s a bit of a nightmare.”

Vasile believes the market is moving toward legal liability for any operator responsible for creating space debris at all. “I think the government needs to set the rules, precisely as the government sets the rules for road traffic or shipping,” he said.

But a switch to stricter liability could create big problems for an increasing number of launch companies that are moving to cubesats — cheaper, short-duration satellites that are eventually abandoned by their operators as gravity slowly pulls them into Earth’s atmosphere.

Some climate satellites are in danger of colliding with space junk. Analysis of data from NASA’s Land Data operation Products Evaluation, which tracks research satellite maneuvers, reveals at least seven occasions where NASA’s Terra and Aqua climate satellites lost data while having to avoid space debris.

Spacecraft in low-earth orbit are already under continuous threat. On Nov. 19, 2024, the International Space Station shifted its orbit to avoid another piece of space debris — this time, from a destroyed meteorological satellite. “Even a speck of paint is enough to destroy a satellite,” Jakub Drmola, who studies the politics of satellite and missile defense systems at Masaryk University in the Czech Republic, told Space.com.

The worst-case scenario is Kessler syndrome, a chain reaction in which the breakup of a few satellites cascades into a wipeout of everything in orbit. Some researchers think Kessler syndrome is already happening, only very slowly, and that we’ve already reached the stage where the cost of cleaning up space far outstrips the benefits.

“The world has now begun to depend on space in ways that we never thought were going to be possible,” said Gen. C. Robert Kehler, former head of Air Force Strategic Command, speaking to reporters at the 2024 Outrider Nuclear Reporting Summit in Washington DC. He favors introducing a regulatory system similar to air traffic control. “We need rules of the road,” he said.

RELATED STORIES

The problem isn’t staying above our heads. On March 8, 2024, a discarded piece of hardware from the International Space Station fell through the Florida home of Alejandro Otero, shaking the whole house. His 19-year-old son was inside. NASA had jettisoned the spare battery carrier, assuming it would either burn up or land in the Gulf of Mexico. But the agency’s calculations were wrong.

If the debris had landed just a few feet away, someone likely would have been seriously hurt or killed, according to Mica Nguyen Worthy, an attorney who is now litigating the first-ever case of property damage from space debris against NASA.

Nguyen Worthy described space debris litigation as the “next frontier” of outer space law. Without a clear set of rules, she said, future satellites launches and space travel itself could become impossible. “I think it’s important for the space community, and why they do take it so seriously, because they don’t want there to be a situation where we have trapped ourselves on Earth, [and] we can’t get out.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

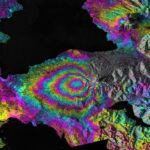

03How New NASA, India Earth Satellite NISAR Will See Earth

03How New NASA, India Earth Satellite NISAR Will See Earth -

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

04Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly