Now Reading: AscendArc lands South Korea’s KT Sat as anchor small GEO customer

-

01

AscendArc lands South Korea’s KT Sat as anchor small GEO customer

AscendArc lands South Korea’s KT Sat as anchor small GEO customer

TAMPA, Fla. — Portland, Oregon-based AscendArc has sold its first small geostationary communications satellite to KT Sat, South Korea’s flagship operator.

The startup announced plans Sept. 4 to deliver the sub-1,000-kilogram spacecraft in the second half of 2027, after raising $4 million early this year to join the nascent market for compact, lower-cost alternatives to the massive multi-ton satellites that dominate geostationary orbit (GEO).

According to AscendArc founder and CEO Chris McLain, the satellite will provide 500 gigabits per second (Gbps) of capacity — comparable to EchoStar’s Jupiter-3, despite being about a tenth the launch mass of one of the heaviest commercial communications satellites in GEO.

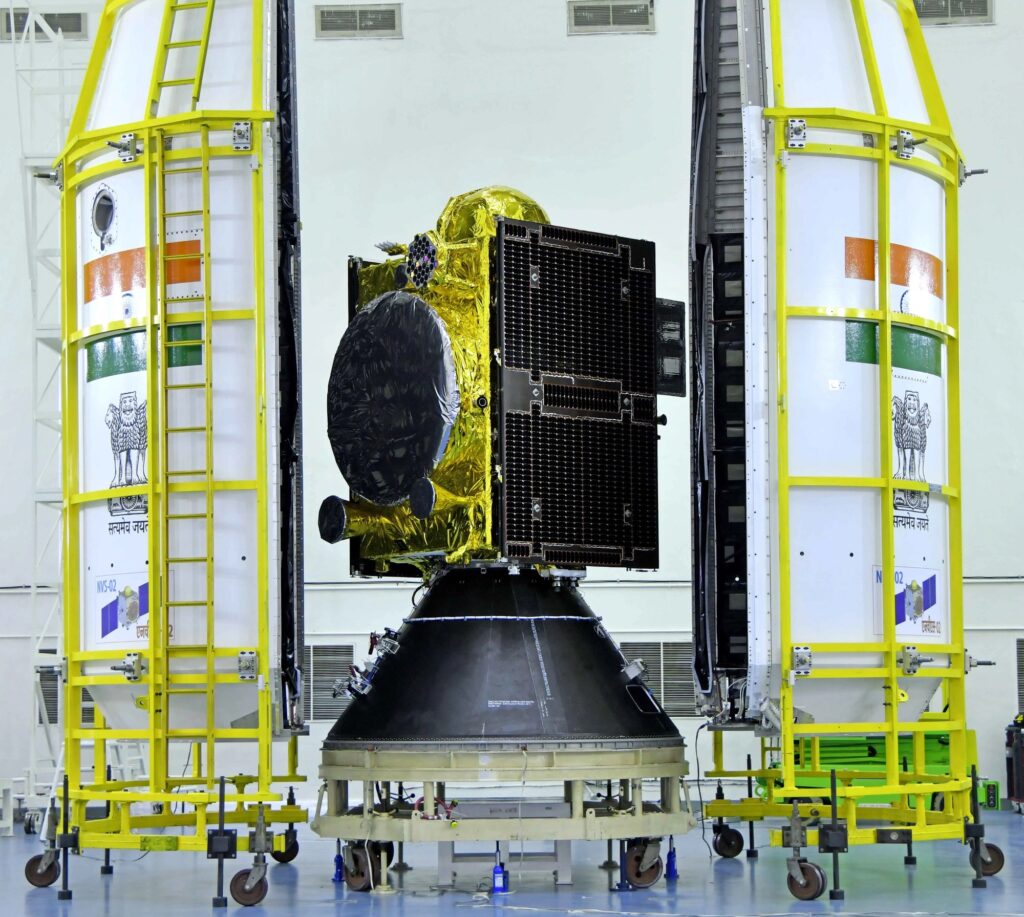

McLain, a former SpaceX principal engineer, said the performance comes from a proprietary antenna design that allows AscendArc to fit a 4.5-meter fixed reflector inside a Falcon 9 fairing, without relying on risky and expensive unfolding mechanisms.

“That allows us to have relatively low power [and] lightweight electronics,” he told SpaceNews in an interview.

Growing small GEO competition

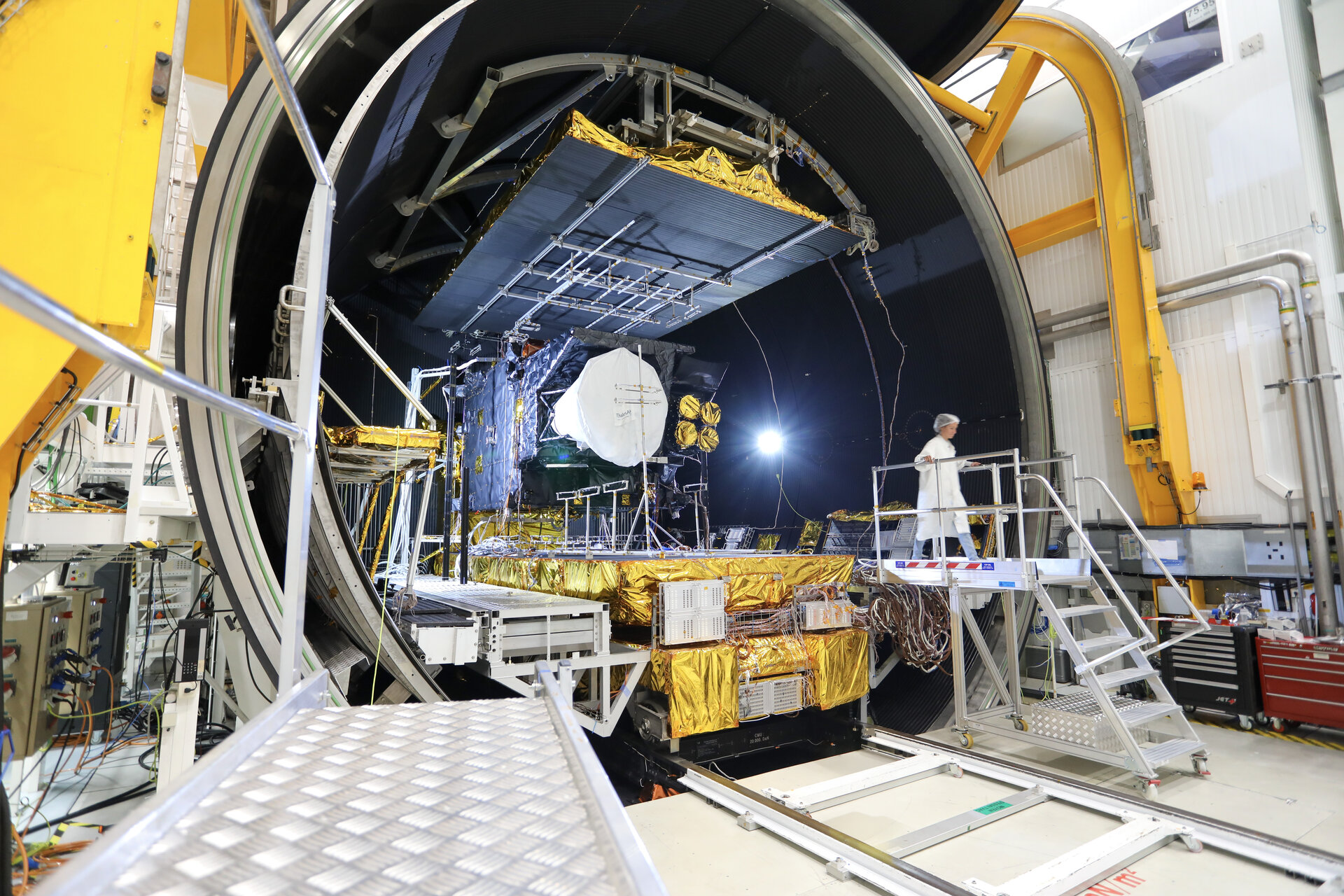

Rival small GEO specialists such as Astranis and Swissto12 design satellites to fit ESPA rideshare slots, McLain said, limiting them to antennas only a couple of square meters across and with lower capacity.

Designing satellites around larger antennas also allows AscendArc to avoid traveling-wave tube amplifiers (TWTAs), the specialized vacuum tubes traditionally used to boost radio-frequency signals.

“The payload is entirely solid state and so that allows you to move to much lower cost components that have shorter lead times,” McLain said, enabling AscendArc to “take advantage of manufacturing at scale, and so we end up with a payload that’s kind of an order of magnitude less expensive than a conventional TWTA-based payload.”

This translates into bandwidth delivered at a cost-per-megabit up to 20 times lower than existing satellite constellations, according to AscendArc.

The startup is positioning its satellites at prices comparable to or below other small GEO offerings, and at roughly a quarter of what legacy manufacturers such as Boeing, Airbus or Thales charge for a medium-sized high-throughput spacecraft.

AscendArc satellites have a 10-year design life, compared with 15 years for traditional GEOs, though the venture plans to load extra propellant into the all-electric propulsion system for KT Sat to support potentially extending its mission by five years.

The trade-off comes in coverage: while large GEOs can use their geostationary vantage point to serve a third of the globe, AscendArc’s satellites are optimized for continental-scale markets.

McLain said AscendArc is in talks with other regional operators, as well as larger fleet owners and nations seeking to bolster sovereign capabilities.

The startup is also preparing to compete for upcoming U.S. government missions, after securing a $1.8 million contract from the Air Force’s innovation arm to develop technology for high-bandwidth satellite communications.

Regional focus

The KT Sat order is the operator’s first high-throughput, data-oriented satellite, and would join an operational fleet of around six multi-purpose broadcast and communications spacecraft.

The South Korean operator said the AscendArc satellite will target underserved communities across the Asia-Pacific region, where hundreds of millions remain unconnected or under-connected due to infrastructure and affordability challenges.

“The goal for KTSat is not just to compete, but to dramatically expand access to the internet throughout the Asian region,” KT Sat CEO Young-soo Seo said in a statement.

“Over half of the world’s population has very limited or no access to the internet, and the primary reason is cost.”

He added that the cost of terrestrial fiber has stagnated, often resulting in a negative return on investment for connecting remote or poor regions.

“And while some recent new satellite options have helped, they simply do not lower the cost enough to penetrate as far as needed,” he added.

Thailand’s Thaicom ordered a small GEO satellite from Astranis last year as regional operators also face mounting competition from SpaceX’s Starlink broadband constellation in low Earth orbit.

Thaicom-9 was slated to launch this year to provide broadband to remote areas in Asia, but Astranis has not provided an update as it troubleshoots a propulsion issue on one of its four spacecraft launched in December.

For a deeper look at how smaller satellites are changing the economics of geostationary orbit, see our feature on the GEO market transformation, along with Q&As with the CEOs of Astranis and Swissto12.

Stay Informed With the Latest & Most Important News

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly