Now Reading: Blue Origin plans bespoke high-speed Starlink rival

-

01

Blue Origin plans bespoke high-speed Starlink rival

Blue Origin plans bespoke high-speed Starlink rival

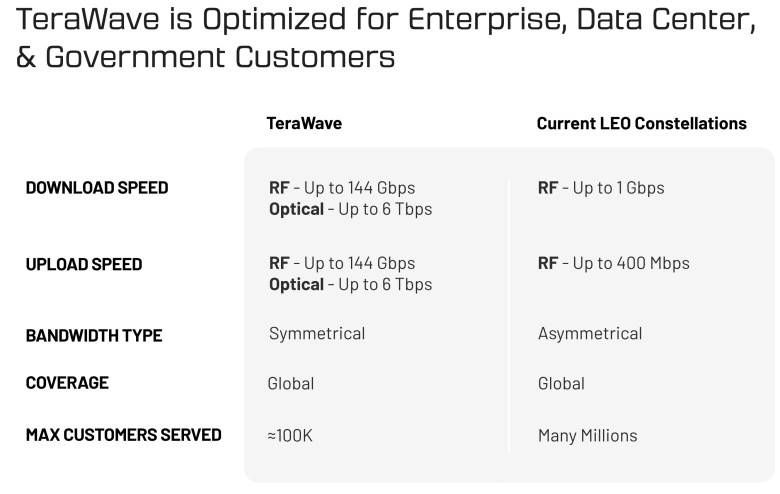

TAMPA, Fla. — Blue Origin is seeking approval to start deploying more than 5,400 satellites from late next year for its own Starlink broadband competitor, targeting up to 6 terabits per second (Tbps) capacity for enterprise, data center and government customers.

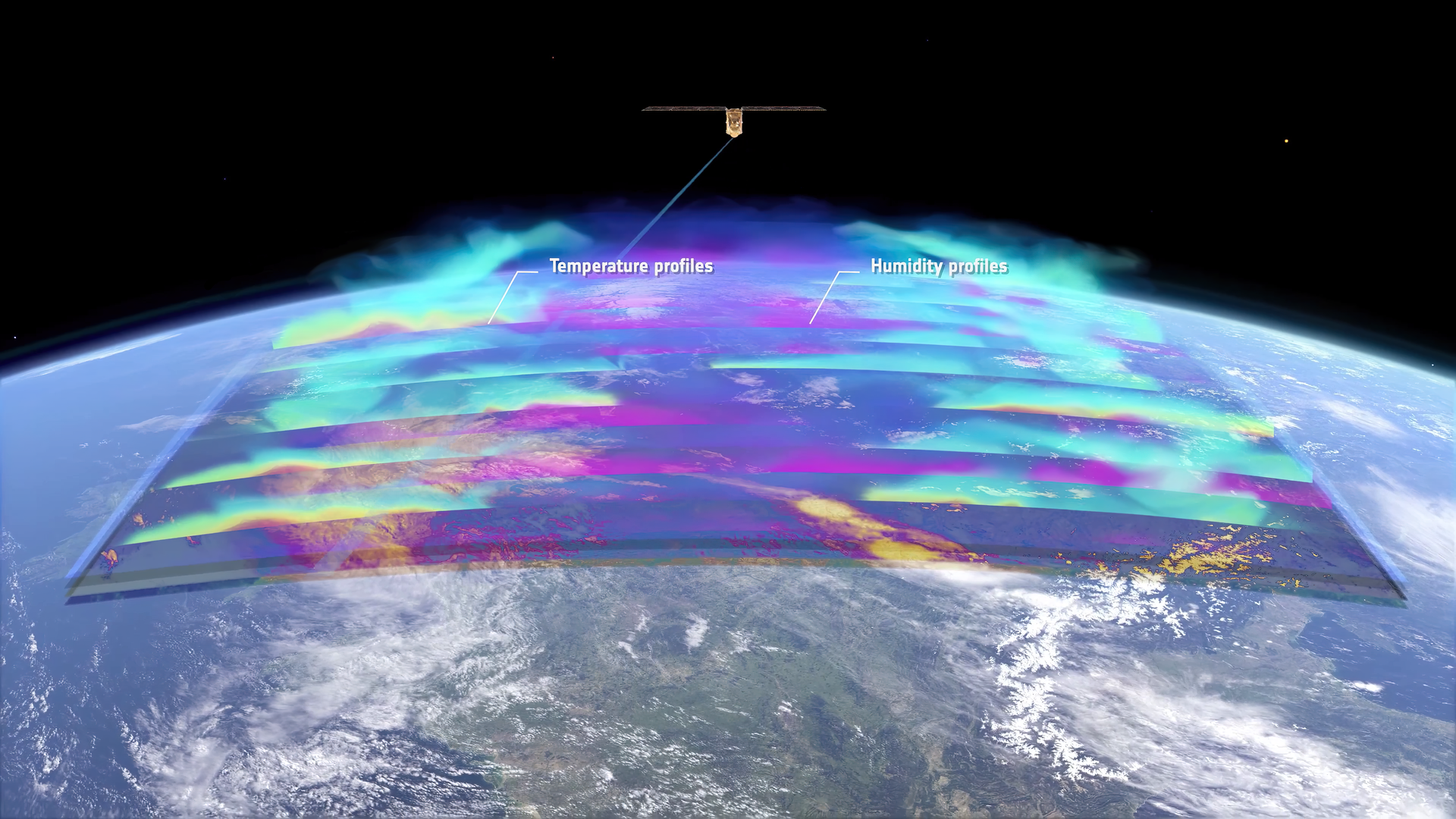

Comprising 5,280 low Earth orbit (LEO) satellites and 128 in medium Earth orbit (MEO), the TeraWave network would use a mix of radio frequency and optical links to support point-to-point connectivity and data-intensive global routing.

TeraWave is separate from the 3,232-satellite LEO constellation being rolled out by Amazon, which was also founded by Jeff Bezos but, unlike Blue Origin, is not fully owned by the billionaire.

And unlike Amazon Leo and SpaceX’s Starlink, TeraWave is styled as a bespoke, non-consumer service that would be capped at about 100,000 customers worldwide.

“Globally distributed customers can each access up to 144 Gbps of capacity through Q/V-band links from LEO satellites, while up to 6 Tbps point-to-point capacity can be accessed through optical links from MEO satellites,” Blue Origin CEO Dave Limp said Jan. 21.

“This provides the reliability and resilience needed for real-time operations and massive data movement. It also provides backup connectivity during outages, keeping critical operations running. Plus, the ability to scale on demand and rapidly deploy globally while maintaining performance.”

According to regulatory filings, TeraWave’s LEO segment would be split across three orbital shells at altitudes ranging from 520 to 540 kilometers.

SpaceX, which recently announced plans to lower some Starlink satellites from about 550 kilometers to 480 kilometers in a move that would improve performance and space safety, is cleared to operate next-generation spacecraft at altitudes as low as 340 kilometers.

TeraWave’s MEO segment would span five orbital shells ranging from roughly 8,000 kilometers to 24,200 kilometers.

Diversification and vertical integration

While Amazon is building its satellites in-house and has deployed about 180 of them to date using SpaceX and United Launch Alliance rockets, Blue Origin today focuses on rocket engines, reusable launch vehicles, lunar landers and other specialized space systems, rather than large-scale spacecraft manufacturing.

“Blue Origin has shown commitment to each of its programs through investment in next generation facilities and by hiring and developing the best talent to support our ambitious mission,” the company told the FCC.

“Leveraging the experience we have gleaned through the design, development, and execution of these programs, TeraWave is a logical progression for Blue Origin.”

According to the company, its “existing infrastructure and experience in space operations provide a robust foundation for deploying a dependable communications network and our engineering teams bring expertise to develop state-of-the-art satellites and ground terminals.”

Blue Origin also said growing AI workloads and cloud-based services are driving demand for higher-capacity, more resilient links for data centers and other high-capacity users.

Bezos has recently predicted that gigawatt-scale data centers could eventually be deployed in space over the coming decades, an idea also being explored by SpaceX and others.

TeraWave requires multiple regulatory waivers, including relief from the FCC’s constellation processing-round framework, which groups satellite applications for collective review rather than processing them individually.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly