Now Reading: EchoStar sells more direct-to-device spectrum for bigger SpaceX stake

-

01

EchoStar sells more direct-to-device spectrum for bigger SpaceX stake

EchoStar sells more direct-to-device spectrum for bigger SpaceX stake

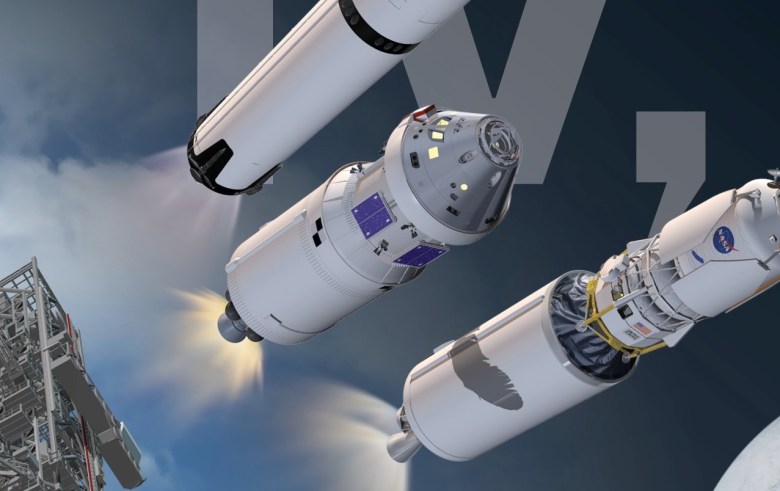

TAMPA, Fla. — Geostationary satellite operator EchoStar is selling another batch of radio frequencies to help improve SpaceX’s direct-to-cell services in the United States, in return for $2.6 billion worth of the company’s stock.

EchoStar said Nov. 6 it has agreed to sell 15 megahertz (MHz) of nationwide, unpaired AWS-3 uplink spectrum licenses to SpaceX, subject to regulatory approvals.

In September, SpaceX sought regulatory approval to buy EchoStar’s 50 MHz of paired (uplink and downlink) AWS-4 and H-block spectrum, including related international authorizations, in a $17 billion deal comprising a mix of cash and stock. SpaceX has also arranged about $2 billion in interim financing to cover EchoStar debt interest payments.

Combining the licenses “with the rocket launch and satellite manufacturing capabilities from SpaceX accelerates the realization of powerful and economical direct-to-cell service offerings for consumers and enterprises worldwide, including our Boost Mobile customers,” said Hamid Akhavan, who is handing the reins as EchoStar CEO to chairman Charlie Ergen as part of a management shakeup.

EchoStar has a long-term agreement with SpaceX to enable Boost Mobile subscribers to access next-generation Starlink direct-to-cell services, which involve up to 15,000 upgraded satellites designed to deliver a 20-fold increase in throughput.

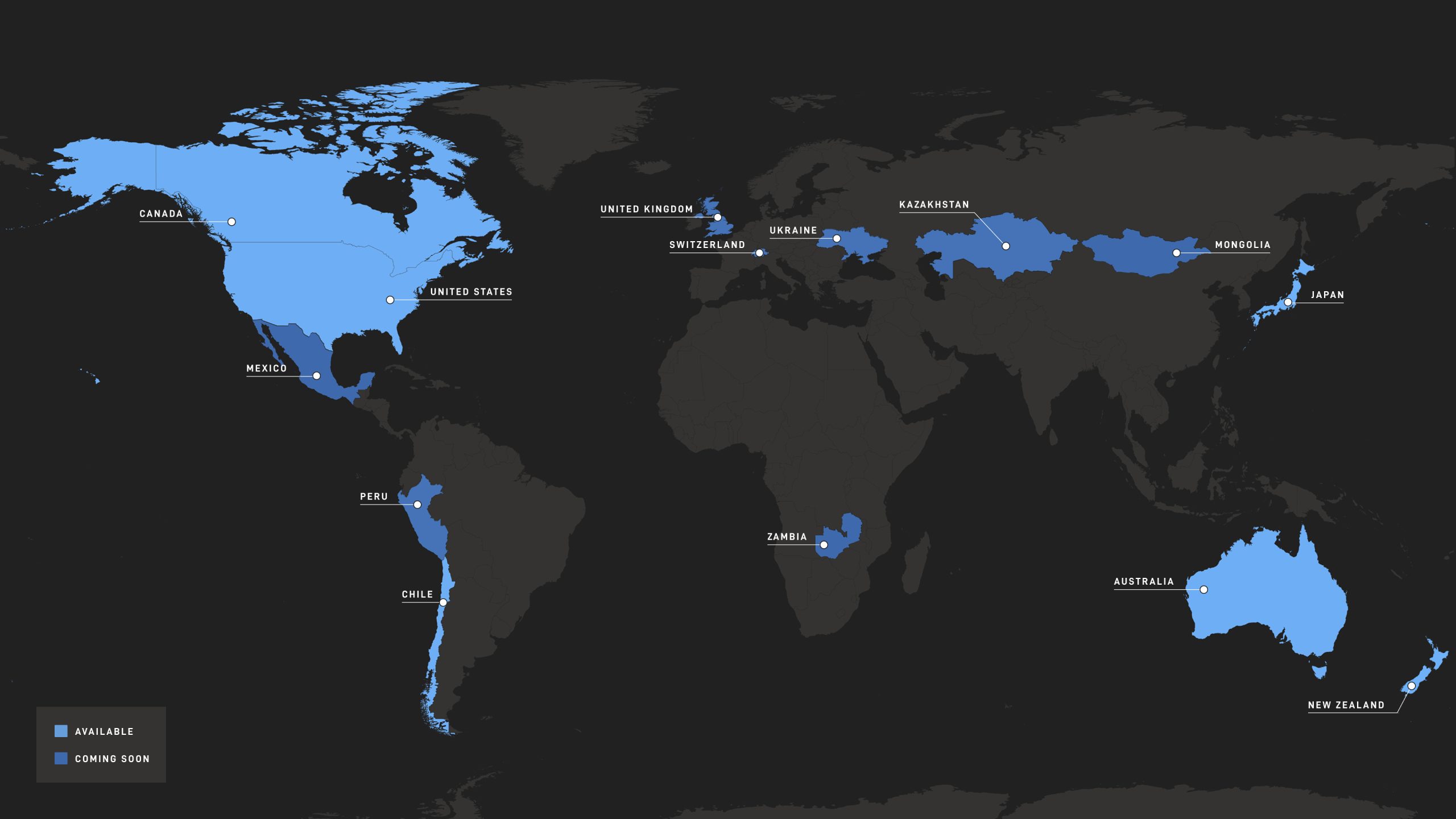

The service is currently delivering data, voice, video and messaging to mobile dead zones across the U.S., Canada, Chile, Japan, Australia and New Zealand, according to Starlink.

“Since first activating service earlier this year, more than 8M people and counting have relied on Starlink Direct to Cell to stay connected when terrestrial service is unavailable,” the company said Nov. 4.

EchoStar reported $939 million in revenues over the three months to Sept. 30 for its wireless division that predominantly comprises Boost, up 4.5% year on year.

However, revenues for its pay-TV unit that includes Dish Network fell 10.6% to $2.3 billion amid an ongoing decline in the satellite broadcast market.

EchoStar’s broadband and satellite services division, which includes Hughes, saw revenues drop 10.6% to $346 million as competition from SpaceX’s broader low Earth orbit Starlink service continues to mount.

Overall, revenues fell 7.1% to $3.6 billion. Adjusted OIBDA, or operating income before depreciation and amortization, declined 27% to $231 million.

Ready for more deals

EchoStar announced a new division Nov. 6 called EchoStar Capital, which will hold its equity in SpaceX and be responsible for investing in complementary growth opportunities as an “asset-light” company.

Akhavan was appointed EchoStar Capital CEO and will also continue to lead Hughes. Ergen is assuming operational responsibility for the company’s pay-TV and wireless businesses.

While Akhavan said it is too early to discuss potential investments, he said they would leverage the company’s 45-year institutional heritage.

“We certainly don’t intend to be purely passive investors,” he said during the company’s earnings call, and “even when we make a passive investment, it will be strategic for us.”

That includes potential acquisitions to support Hughes as it retreats from the consumer satellite broadband market to focus on enterprise and government customers.

Potential areas for mergers and acquisitions include aerospace, space, enterprise services, defense and manufacturing.

Akhavan said “all of those are areas where we have green shoots and a good understanding of the trends,” and if EchoStar Capital “finds opportunities in any of those domains that would enhance Hughes’ position, we’ll take advantage of that.”

During the earnings call, Ergen also described the company’s remaining paired AWS-3 block of licenses as the most valuable in its spectrum portfolio.

U.S. telecom giant Verizon is likely interested in the frequencies, Raymond James analyst Brent Penter said in a note to investors.

In August, EchoStar agreed to sell about $23 billion of U.S. cellular spectrum to AT&T, marking the end of its bid to operate as a traditional mobile carrier with a physical network.

Instead, Boost will primarily use AT&T’s towers, with its own software-based 5G core, while retaining some access to T-Mobile’s network.

The spectrum sales followed U.S. Federal Communications Commission investigations, which have since dropped, into whether EchoStar was underutilizing its frequencies, after complaints from SpaceX and others.

EchoStar recorded a one-time, non-cash impairment charge of $16.5 billion related to the abandonment of parts of its 5G network that will not be part of its hybrid mobile model.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly