Now Reading: GHGSat announces $34 million in equity and debt financing

-

01

GHGSat announces $34 million in equity and debt financing

GHGSat announces $34 million in equity and debt financing

PARIS – GHGSat plans to expand its greenhouse gas monitoring constellation and analytic services with $47 million Canadian dollars ($34 million) in equity and debt financing announced Sept. 16 .

Yaletown Partners joined previous GHGSat investors Fonds de solidarite FTQ and BDC Capital in the equity portion of the funding round. The National Bank of Canada with support from Export Development Canada provided debt financing.

“The confidence from our investors, demonstrated through this new financing, underscores the growing global demand for emissions monitoring,” GHGSat CEO Stephane Germain said in a statement. “At GHGSat, we are laser focused on building the most operationally useful technology on the market, coupled with advanced analytics capabilities that transform raw data into emissions intelligence.”

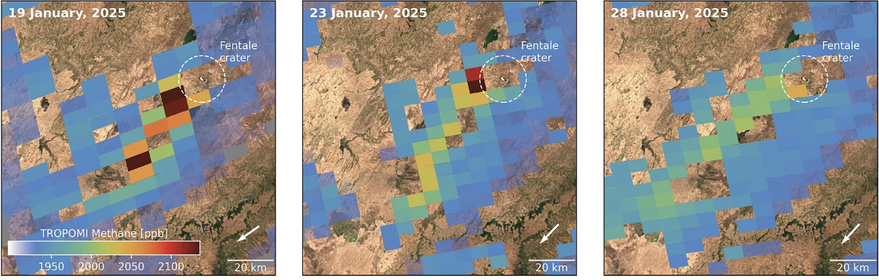

Montreal-based GHGSat was founded in 2011 to pinpoint emissions of methane, a potent greenhouse gas. Now, GHGSat monitors methane and carbon dioxide with 13 satellites.

“GHGSat created a technology that truly changed the way that we understand emissions today — moving from estimates to tangible and accurate measurements at a global level,” Sophie Gupta, Yaletown Partners head of responsible investing, said in a statement. “We are excited to partner together to keep moving the needle on methane, building the next phase of analytics capability and scale that embeds emissions data into the heart of strategic and operational decisions for carbon-intensive industries around the world.”

To date, GHGSat has tapped into 173 million Canadian dollars in equity and debt financing. Earlier this month, GHGSat announced a partnership with ExxonMobil Corp. to monitor and mitigate methane emissions for onshore operations in North America and Asia.

Stay Informed With the Latest & Most Important News

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06True Anomaly hires former York Space executive as chief operating officer

06True Anomaly hires former York Space executive as chief operating officer -

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors