Now Reading: L3Harris expands space manufacturing as companies vie for position in ‘Golden Dome’

-

01

L3Harris expands space manufacturing as companies vie for position in ‘Golden Dome’

L3Harris expands space manufacturing as companies vie for position in ‘Golden Dome’

WASHINGTON — The Trump administration’s Golden Dome initiative is creating new alliances and prompting industrial expansions in the defense sector as companies position themselves for roles in the ambitious missile defense program.

L3Harris Technologies announced this week a $125 million expansion of its manufacturing facility in Fort Wayne, Indiana, focused on increasing production of infrared sensing payloads – a central technology for the Golden Dome missile-defense shield that relies heavily on space-based capabilities.

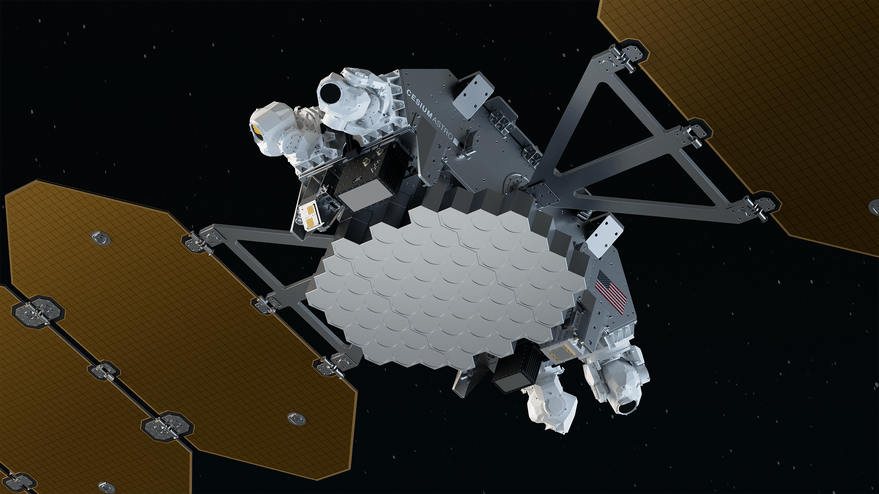

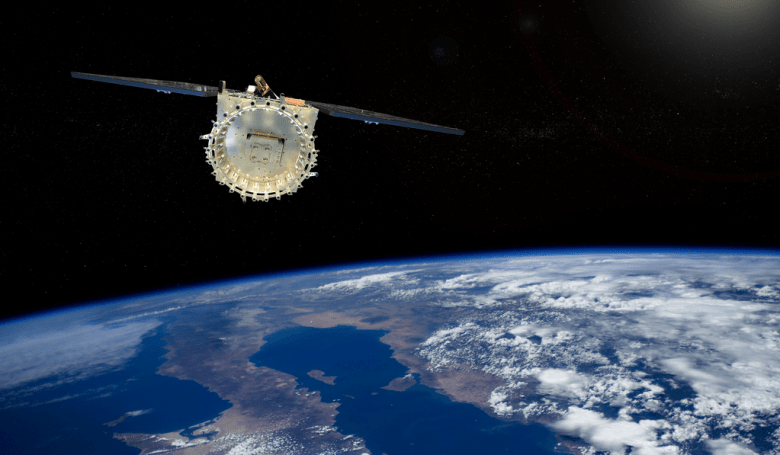

Established through executive order, the Golden Dome project aims to create a comprehensive shield protecting the United States against multiple missile threats, including ballistic, hypersonic and advanced cruise missiles. At its core, the initiative envisions a constellation of satellites equipped with advanced infrared sensors and potentially space-based interceptors capable of detecting and neutralizing threats, preferably during a missile’s boost phase.

L3Harris, which already holds more than $2 billion in missile-tracking satellite contracts from the Space Force’s Space Development Agency and the Missile Defense Agency, is looking to expand its industrial capacity to mass-produce payloads and satellites.

The total investment and scope of Golden Dome remain undefined. U.S. Space Force Gen. Chance Saltzman has cautioned against viewing Golden Dome as a traditional acquisition program, describing it instead as an integration of multiple systems — some already in development and others yet to be created. The system will combine terrestrial, naval, airborne, and space-based sensors and interceptors, along with non-kinetic defenses like directed energy weapons and electronic warfare capabilities. Saltzman emphasized that decision-making is still in early stages.

Even in this early phase, competition for contracts is already intensifying as defense companies maneuver to secure positions. Booz Allen has proposed a “Brilliant Swarms” constellation of 1,000–2,000 satellites, and has yet to announce partner companies that would support the different pieces of the architecture.

SpaceX a ‘leading contender’

According to Reuters, SpaceX has pitched a subscription-based model where the government would pay for access to the satellite network rather than owning the hardware outright. This approach represents a departure from traditional defense procurement methods and has generated both interest and concern within the Pentagon.

The SpaceX-led partnership has emerged as a leading contender, Reuters reports. In this arrangement, SpaceX contributes its considerable satellite launch and constellation deployment capabilities, with Palantir providing data analytics and software expertise, and Anduril bringing autonomous defense and drone technology. Their proposal includes 400 to over 1,000 satellites for global missile detection and tracking, complemented by approximately 200 “attack satellites” equipped with missiles or lasers that would aim to neutralize threats.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly