Now Reading: Lynk Global and Omnispace to merge in race for direct-to-device satellite spectrum

-

01

Lynk Global and Omnispace to merge in race for direct-to-device satellite spectrum

Lynk Global and Omnispace to merge in race for direct-to-device satellite spectrum

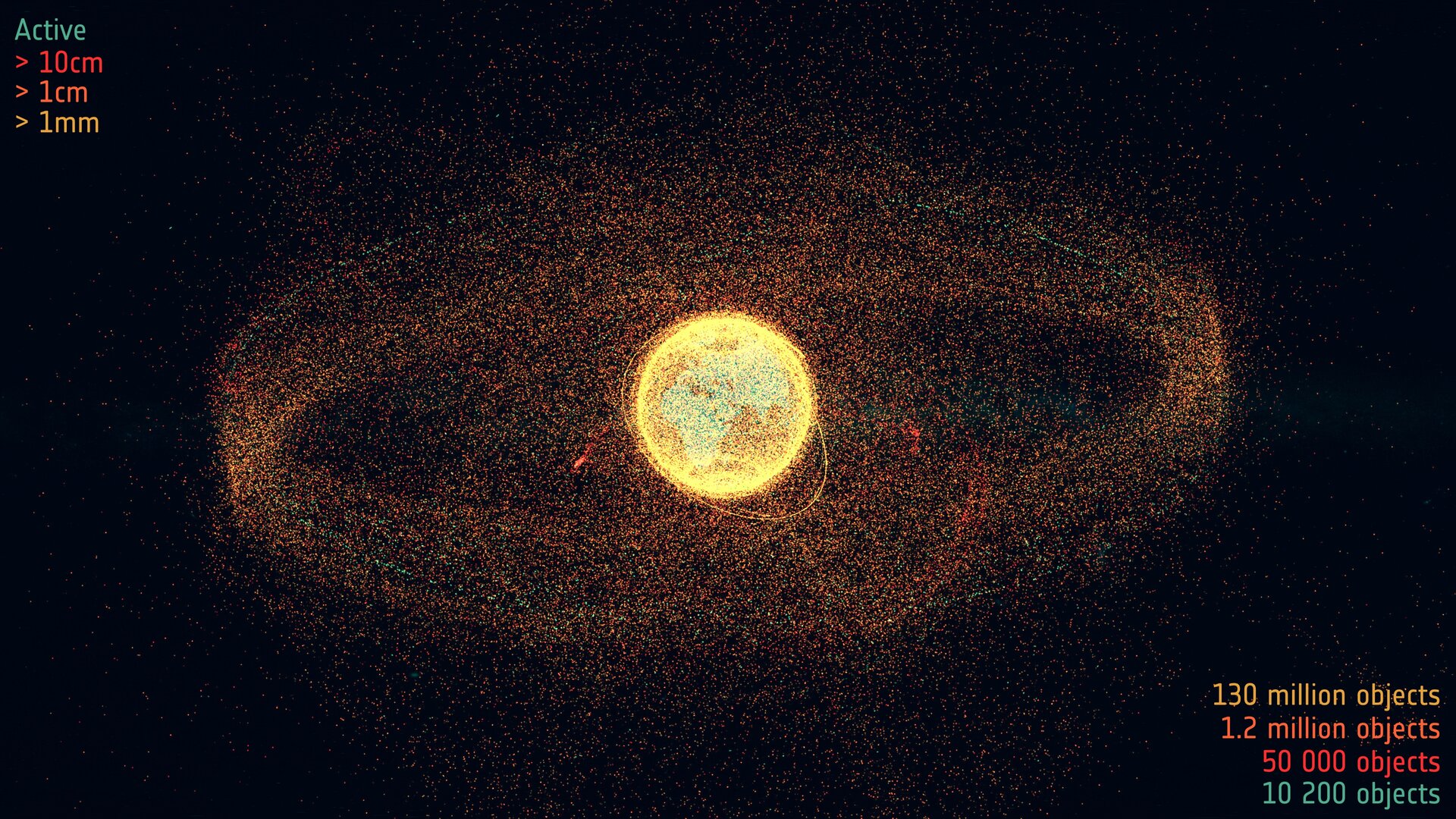

TAMPA, Fla. — Lynk Global plans to merge with Omnispace to upgrade its direct-to-device (D2D) services with globally coordinated S-band spectrum, joining SpaceX and AST SpaceMobile in shoring up satellite frequencies after initially relying on cellular partnerships.

Luxembourg-based multi-orbit operator SES, which has invested in both companies, will become a major strategic shareholder in the combined group, they announced Oct. 22 in a joint news release that offered few details.

The merged entity would combine Omnispace’s 60 megahertz of S-band spectrum with Lynk’s D2D platform, which is currently providing intermittent messaging and alert services in a handful of island nations with five small satellites in low Earth orbit (LEO).

Omnispace had planned to use the spectrum for a D2D constellation of more than 600 satellites, after deploying experimental spacecraft in low and medium Earth orbits.

However, the Washington, D.C.-based venture’s efforts stalled amid its claims of interference from SpaceX’s D2D service.

The interference issue was specific to the United States, Omnispace vice president of strategy and marketing George Giagtzoglou said via email, where part of the T-Mobile cellular spectrum used by SpaceX overlaps with Omnispace’s S-band frequencies. He said a recent regulatory request to the Federal Communications Commission could help ease the conflict by aligning its frequency use with international S-band allocations.

“This merger unlocks the full potential of our global S-band spectrum assets and positions us at the forefront of D2D,” Omnispace CEO Ram Viswanathan said in the announcement.

Ramu Potarazu, CEO of Falls Church, Virginia-based Lynk, said: “We now have the right mix of technology, spectrum and leadership to extend mobile connectivity where and when it’s needed most.

“This merger will enable us to accelerate our efforts in delivering seamless, reliable messaging, voice and data services — serving [mobile network operators (MNOs)], as well as consumer, commercial and industrial vehicles, and government and utility sectors worldwide.”

The deal comes months after Lynk abandoned an attempt to raise capital for its constellation by merging with Slam Corp., a publicly listed shell company led by former MLB star Alex Rodriguez.

Potarazu outlined plans last month to instead lean on SES and the operator’s network in geostationary and medium Earth orbit to provide a global, continuous D2D service by 2027.

The company plans to launch a pair of satellites in February to validate new technology, including a multi-orbit relay capability with SES.

The companies expect to close the merger late this year or early next, pending regulatory approvals. Potarazu would serve as CEO of the combined entity, with Viswanathan as chief strategy officer.

The spectrum pivot

Meanwhile, SpaceX is awaiting regulatory approval to acquire S-band spectrum from geostationary broadband operator EchoStar in a deal worth more than $17 billion.

SpaceX leverages more than 650 Starlink D2D satellites in LEO to provide services that are currently limited to text messaging, emergency alerts and certain apps in the U.S., New Zealand and Japan.

In the U.S., the company is using about 10 megahertz of similarly situated terrestrial spectrum from T-Mobile, but plans to boost its D2D capacity twentyfold with a second-generation service that would integrate 50 megahertz of EchoStar’s spectrum.

AST SpaceMobile only has five BlueBird satellites in LEO, but it aims to deliver continuous coverage in the U.S. and other key markets after ramping up launches over the next 18 months.

The Texas-based venture has partnered with AT&T and Verizon in the U.S. and is seeking approval to access L-band spectrum in North America from bankrupt satellite operator Ligado Networks.

Alongside a deal for global S-band spectrum, subject to country-by-country approval, AST says satellite frequencies are key to its plan to enable broadband speeds of up to 120 megabits per second from space.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly