Now Reading: Maxar retires its name, rebrands as Vantor and Lanteris

-

01

Maxar retires its name, rebrands as Vantor and Lanteris

Maxar retires its name, rebrands as Vantor and Lanteris

Maxar Technologies, the space and satellite company formed in 2017, has shed its name. On Oct. 1, the company unveiled new identities for its two businesses: Maxar Intelligence will now operate as Vantor, while Maxar Space Systems will go by Lanteris.

Maxar Intelligence and Maxar Space Systems started operating as separate entities after private-equity firm Advent International acquired the publicly traded Maxar Technologies for $6.4 billion in 2023.

Both Vantor and Lanteris will remain portfolio companies of Advent International.

The rebranding reflects the companies’ desire to establish clear, independent identities. Having two separate companies named Maxar created confusion, with many assuming they were divisions within the same company rather than distinct entities.

Vantor to focus on ‘end-to-end’ intelligence

Vantor’s new name signals a strategic pivot from primarily providing Earth imagery from satellites and data analytics to becoming what executives describe as a software and data-focused company centered on intelligence solutions. The shift mirrors industrywide trends showing that while owning and operating satellites remains foundational, the real growth lies in harnessing vast amounts of Earth observation data and applying artificial intelligence and machine learning to exploit the raw data.

“We’re not just a satellite imagery provider. We’re delivering end-to-end solutions capable of connecting sensor data from every domain, providing a unified intelligence picture that can turn into a competitive advantage,” said Dan Smoot, chief executive of Vantor, based in Westminster, Colorado.

The company, which employs more than 2,000 people including over 1,000 software engineers in the U.S. and overseas in India, Japan, Singapore, Sweden and the United Kingdom, is seeking to position itself as a provider of intelligence about any place on Earth using data from satellites, drones, ground-based sensors and other sources — not just satellite imagery.

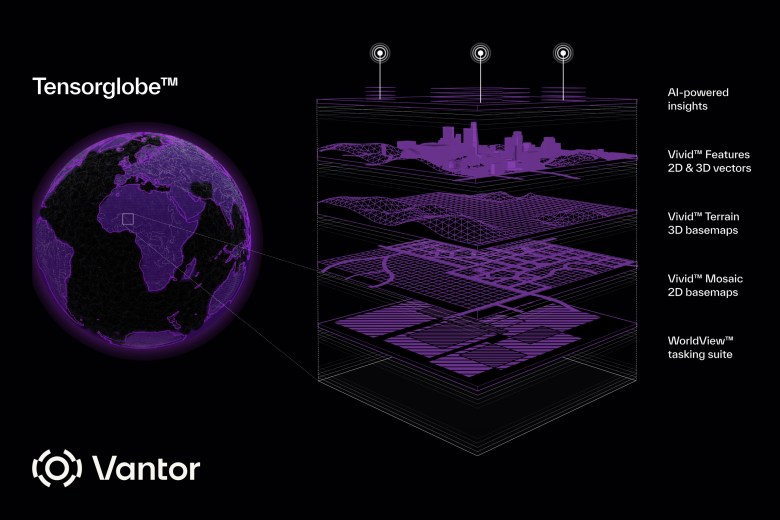

Vantor on Wednesday also announced the launch of Tensorglobe, an AI-powered intelligence software platform that is integrated with a digital twin of Earth.

“Historically, companies in our sector only sell finished intelligence and give you access through a web portal,” said Peter Wilczynski, Vantor’s chief product officer. “We’re changing the game by productizing core operational technologies that we’ve built to run our own operations — from tasking to data fusion to 2D/3D data production to data hosting. Now, customers can use these tools to build more advanced systems of their own.”

New products introduced by the company in recent years include navigation tools that allow drones to navigate using terrain maps, global-scale persistent monitoring and 3D mapping for defense applications.

“The future is going to be ‘all domain’ and it’s going to be about integrating across domains, tipping and queuing across the ground, air and space domains,” Wilczynski told SpaceNews. “And I think the space domain has a lot to offer, but it’s not always obvious to people working in the other domains how they would leverage space.”

Despite the software focus, Vantor plans to continue operating imaging satellites. The company operates legacy DigitalGlobe Earth observation satellites and WorldView Legion, a new constellation of six satellites launched in three pairs from May 2024 to February 2025.

“One of the key things about the platform,” Wilczynski said of Tensorglobe, is that it relies on having access to a constellation. “You wouldn’t buy Amazon Web Services without their servers.”

Vantor also partners with other satellite imaging firms including Umbra and Satellogic to create what it calls a “virtual constellation” that incorporates different types of sensors and space architectures.

The company will remain focused on U.S. government and commercial customers while continuing to push international growth, reflecting a trend across the Earth observation satellite industry of increasingly serving foreign nations seeking their own surveillance capabilities. “We are continuing to focus on being a dual-use company,” Wilczynski said.

Lanteris eyes growth in defense and commercial

The satellite manufacturing business now known as Lanteris has undergone its own transformation after decades of relying on orders for large geostationary orbit (GEO) satellites.

Before Advent International’s 2023 acquisition, Maxar’s satellite manufacturing arm — formerly Space Systems/Loral — was hit hard by a global slump in commercial GEO communications satellites, long the backbone of its Palo Alto, California, operations.

Order volumes fell as operators faced excess capacity, shifting customer demands and the rise of low Earth orbit (LEO) constellations that drew investment away from traditional GEO platforms.

These headwinds led to financial strains including rising debt loads and the sale of non-core assets to refocus the company and stabilize operations. By the time of the Advent acquisition, the Palo Alto operations needed fresh capital, strategic realignment and operational reforms to remain competitive and support new growth areas such as proliferated LEO, space robotics and defense satellites.

Five years ago, about 95% of revenues came from the commercial market, said Chris Johnson, the company’s chief executive who took over Maxar’s satellite business in 2021.

Today, commercial and government revenues are evenly split — “the most balanced it has been in decades,” he said.

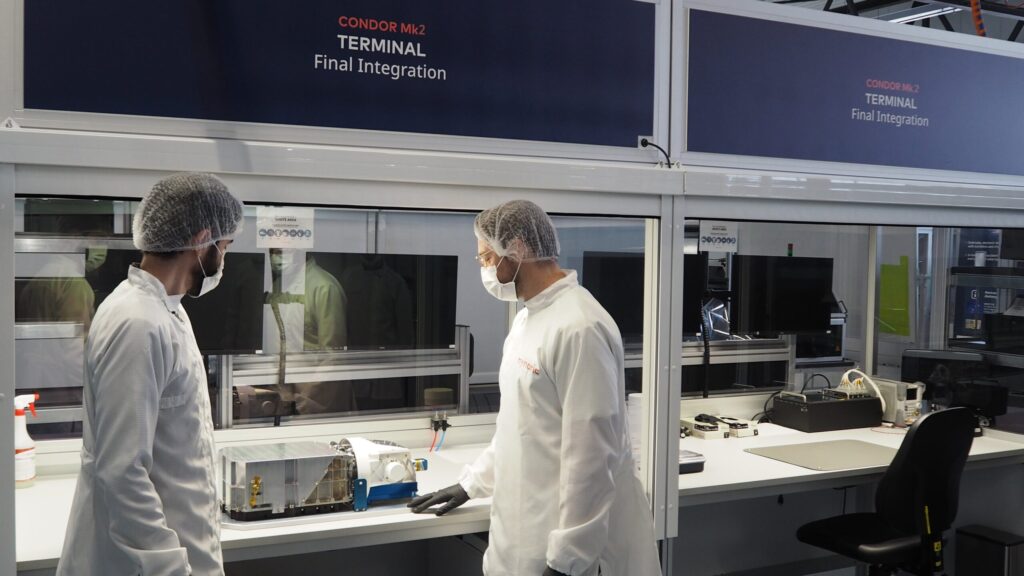

The company shifted its focus toward government work and smaller satellites, including buses it is producing for defense contractor L3Harris Technologies for a constellation of missile-tracking satellites being built for the U.S. Space Force’s Space Development Agency.

While the surge in LEO constellations has overshadowed the GEO market, Johnson told SpaceNews he believes strong demand remains for the massive spacecraft that once dominated the industry.

“I’m still a strong believer that geostationary orbit is an ideal place to do a lot of things,” he said. “And while it hasn’t been cool to be a GEO provider for a couple of years …there’s still just a lot of core [demand for] big things with big aperture and big power capabilities to support multi-orbit, whether it’s communications or sensing.”

Upcoming heavy-lift rockets such as SpaceX’s Starship will also create new opportunities for GEO satellites, Johnson said. He also pointed to the company’s work on the Power and Propulsion Element for NASA’s lunar Gateway, its cislunar capabilities and the potential to one day autonomously assemble spacecraft in orbit.

A more balanced revenue base, Johnson said, positions Lanteris to pursue growth across commercial and government markets.

The company’s innovation roadmap focuses on three core areas:

- National security and defense technologies, such as missile tracking, secure communications and resilient constellations

- Space infrastructure, including AI-enabled systems and advanced power and propulsion for mobility, defense, energy and communications.

- Connectivity and exploration, with satellites and deep-space platforms designed to extend global reach and support missions to the moon and beyond.

Maxar’s Evolution: From MDA to Vantor and Lanteris

- 1969 – MacDonald, Dettwiler and Associates (MDA) is founded in British Columbia, Canada. The company becomes known for space robotics, including work on Canada’s Canadarm for the Space Shuttle and later the International Space Station.

- 1990s–2000s – MDA expands into satellite communications and Earth observation, acquiring Richmond, B.C.–based Spar Aerospace and other assets.

- 2012 – MDA acquires Space Systems/Loral (SS/L) in Palo Alto, California, a leading manufacturer of large geostationary communications satellites.

- 2017 – MDA rebrands as Maxar Technologies and moves its corporate headquarters to the United States. The company integrates MDA, SS/L, and Colorado-based DigitalGlobe, a pioneer in high-resolution satellite imagery.

- 2019 – MDA is sold back to Canadian investors, leaving Maxar focused on DigitalGlobe’s imagery business and SS/L’s satellite manufacturing operations.

- 2023 – Private equity firm Advent International acquires Maxar in a $6.4 billion deal and takes the company private, splitting it into two separate entities: Maxar Intelligence (imagery and analytics) and Maxar Space Systems (satellite manufacturing).

- 2025 – Both businesses are rebranded: Maxar Intelligence becomes Vantor, and Maxar Space Systems becomes Lanteris.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06True Anomaly hires former York Space executive as chief operating officer

06True Anomaly hires former York Space executive as chief operating officer -

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors