Now Reading: Non-venture space startup investment hits post-SPAC high

-

01

Non-venture space startup investment hits post-SPAC high

Non-venture space startup investment hits post-SPAC high

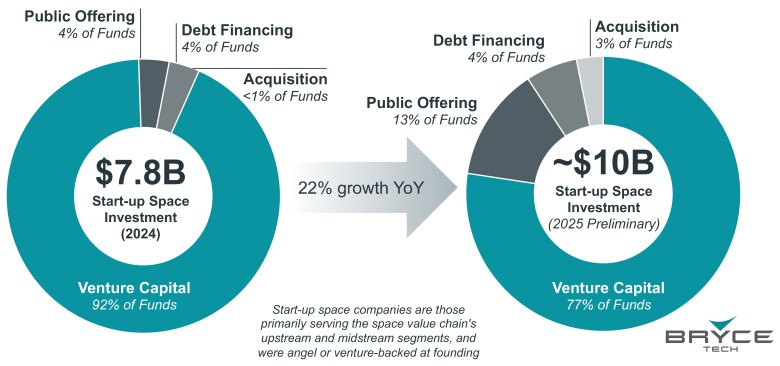

TAMPA, Fla. — Non-venture investment in space startups surged last year to its highest level since a 2021 spike driven by a wave of special purpose acquisition company (SPAC) mergers, according to BryceTech analysis.

BryceTech deputy director of analytics Fletcher Franklin said 2025 was likely the biggest period of non-venture investment in space startups on record when excluding SPACs, cash-rich shell companies offering startups a fast track to the public market.

The firm defines startup space companies as those that primarily serve the industry’s upstream and midstream segments, and were angel or venture-backed at founding. Its preliminary data shows total startup investment rose about 22% year-over-year to roughly $10 billion in 2025, boosted by traditional initial public offerings (IPOs) and greater reliance on debt financing.

“The increase in non-venture funding in 2025 appears to be a sign of industry maturing,” Franklin said, “though there were other prevailing positive conditions for going public, such as high investor sentiment in defense tech.”

U.S. companies surged to more than two-thirds of the total investment in 2025 amid expectations of growing national security demand for commercial space capabilities, including military communications, intelligence and surveillance.

There is still a large portion of the market that relies heavily on venture capital for growth. Traditional private equity buyouts and wholesale acquisitions of startups also remain limited in the space industry, with these institutional investors preferring to invest through venture deals.

“What stuck out to us was that the amount of venture investment in terms of dollars was not down year-on-year, Franklin said, “it was up to $8.6 billion from $7.3 billion.

“So, we don’t view there being any retreat, just an increase in other fundraising mechanisms last year, primarily a couple large IPOs.”

Industry maturation

Launch was the largest recipient of non-venture investment, according to the data, mainly due to Firefly’s IPO.

“The startup space companies coming to market in 2025 were more mature and internally diversified than some of those during the 2021 SPAC wave,” Franklin added, noting growing investor appetite for firms poised to take advantage of growing defense technology opportunities.

The preliminary findings also show companies across the sector are increasingly leaning on debt as the industry matures, noted BryceTech analyst and lead report author Ryan Puleo, helping them grow capital-intensive businesses without diluting shareholder interests.

BryceTech anticipates at least one major IPO in 2026 with SpaceX, following a handful of large venture deals that have already closed this year.

The firm expects to finalize its annual report on the health of the space startup market later this month.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly