Now Reading: Redwire’s global strategy from space to security

-

01

Redwire’s global strategy from space to security

Redwire’s global strategy from space to security

In this week’s special CEO Series edition of Space Minds, we’re at the World Space Business Week in Paris. In today’s episode, SpaceNews editor Mike Gruss talks with Peter Cannito, CEO of Redwire.

They discuss the future of the European space market, Redwire’s expanding footprint, and the growing intersection of space and defense technology.

From strategic acquisitions in Europe to investments in autonomy and software, Cannito outlines how Redwire is positioning itself as a nimble, mid-sized player bridging the gap between startups and aerospace giants. The conversation also explores avenues in pharmaceutical research in microgravity, the rise of very low Earth orbit missions (VLEO), and how space and drone technologies are converging to reshape national security.

sponsored by

BlackSky empowers defense leaders to see, understand and anticipate change with real-time space-based intelligence. Access on-demand, high-frequency satellite imagery, analytics and dynamic monitoring of the most strategic and critical locations in the world so you can detect threats, verify actions and adapt strategy faster than ever before. Visit blacksky.com to learn more.

Show notes and transcript

Click here for Notes and Transcript

Time Markers

00:00 – Episode introduction

00:59 – Welcome

01:27 – The European market

03:38 – Next ESA ministerial / U.S. direction

05:36 – Agility vs. primes

07:02 – This week’s Industry themes

07:59 – National security

11:57 – Software role

13:42 – Operator complexity

14:52 – M&A strategy

16:34 – Market consolidation

18:12 – Pharmaceuticals in space

21:06 – The New Mexico facility

22:14 – The SkimSat program

Transcript – Peter Cannito Conversation

Mike Gruss – Hello and welcome to the Space Minds podcast here in Paris. I’m Mike Gruss with SpaceNews, and we’re doing our CEO series at World Space Business Week. We have a series of CEOs and leaders we’re talking to this week, sponsored by BlackSky, and I’m starting our conversation today with Pete Cannito, the CEO of Redwire. Pete, thanks for joining us.

Peter Cannito – Happy to be here. Thanks for having me.

Mike Gruss – Let’s start with Paris itself. Talk to me about the European market and what that looks like for you today, and maybe how that’s different from where it was 18 or 36 months ago.

Peter Cannito – Yeah, no, that’s an excellent question. So really excited to be here, very excited about the European market. I feel like Redwire kind of saw what was going to happen in Europe a little bit early. We made an acquisition of a company called Space NV out of Belgium about two years ago, and that was from Kinetic UK. And the reason that we saw that as an opportunity is because we recognized that Europe was really starting to, I think, feel like they needed to invest more in space, yeah, as a collective collection of nations. I think they somewhat felt like they were falling behind the U.S. and China, and from a position of national prestige, and now, quite frankly, from a position of national security, I think they recognized that they wanted to or that they need to invest more.

And then shortly after that, the most recent ministerial happened, which I can’t believe we’re coming up on the next one so quickly. And that ministerial included, I believe it was a 17 to 19 percent increase in space. So that bore out. The acquisition, which is now a number of years old, has been really good for us, as we’ve established ourselves with a European presence. So now we’re looking forward, and we’re super excited about what’s going on. Of course, there’s been a little bit of, I think, anxiety about what the U.S. is doing in space, and that, of course, ripples around the entire planet. But I think that also has underscored for the European space decision-makers how important it is that they have their own programs. So I think we’re going to see a lot of investment as a result. So super bullish about Europe, been here for a number of years now, and excited to continue forward.

Mike Gruss – When the next ministerial is supposed to have another significant increase, another—they’re talking about $22, $23 billion in November. When there are questions, when people say, what is the U.S. doing in space, or where are they headed, how do you respond?

Peter Cannito – Yeah, I usually respond, well, if you—when you find out, let me know. Just kidding. I mean, I think a lot of that is starting to play out, right, where in the early months of our budget process with this new administration, it was a little less clear. We have seen a lot of language from Congress, U.S. Congress, that started to provide clarity about the International Space Station, about Gateway, continued funding. So we think clarity is starting to enter in.

So it’s a little bit of maybe best of both worlds for a company like us, because we see the continued funding around programs like Gateway, which will be healthy for both the U.S. space market as well as Europe. But it also was, I think, a bit of a wake-up call for Europe, where they started to say, we can’t be 100 percent dependent on the United States for all of our space programs. We need to start generating some more organic space programs of our own. And that’s a real opportunity for a company like Redwire, because when you look at the space industry in Europe, you really have the large primes that we’re all familiar with—Thales, Airbus, Leonardo—who are now having their own conversations about potentially combining, and then you have those agile companies like Redwire and OHB, who can also be prime contractors, but in a different, maybe more commercial, more agile way. So it’s a super exciting and kind of dynamic market for us.

Mike Gruss – When you say maybe more dynamic, more agile—what, how do you see that playing out?

Peter Cannito – Well, I can’t speak to that. I mean, I think the primes definitely have a role to play, and they’re, of course, important customers of ours, and we love teaming with them. If you’re going to do a billion-dollar program or higher, you really need the resources of the large primes to do that, right? But there’s a lot of missions that meet that threshold well below, where you might be looking for someone that’s a little bit more commercial, a little bit more modern in their approach to development.

A good example is the next program that The Exploration Company has been highly involved in. They’re a new entrant on the scene here in Europe. And other programs that are in that maybe below a billion dollars, where you’re looking to move fast and get commercial technology up in space. That’s a trend we see a lot of in the United States. Now Europe is starting to pick up on that as well, and companies like Redwire are really well positioned for those—that sweet spot between $50 million to $1 billion, where you can be a prime.

Mike Gruss – Is that one of the themes you expect to hear this week, when you’re chatting with other CEOs, when you’re talking to folks from industry? Is it that moving faster and getting something in orbit quicker?

Peter Cannito – I hope so. I hope so, because I think that’s—

Mike Gruss – Are you listening?

Peter Cannito – Yeah, I’m listening for that. There’s been a lot of talk around that, and I think it’s important. People want to see quick results. And I think rapid results, which is a relative term in space—it’s still a couple of years. But you know, not these decade-long programs, tend to build momentum, to garner additional excitement, and create somewhat of a virtuous cycle where you invest, you see results, you want to invest more, you see more results. And people get really enthusiastic about space and the kinds of things we can do in the near term.

Mike Gruss – You brought this up — Europe is looking to maybe think differently about national security in space, maybe more dual-use technologies. I want to talk about Redwire’s kind of role with national security space. I know there’s some interest in Golden Dome, obviously, which I think everyone has interest in that kind of budget, but you’ve also — you have your subsidiary Edge that’s been kind of the defense tech space, and in space itself. Where’s the merger of all this? Or how do you see all this kind of coming together to work, work for Redwire?

Peter Cannito – Yeah, yeah. Well, there’s a number of really positive trends in the national security space from a business perspective — not necessarily positive trends in national security from a geopolitical perspective. But I think, again, there’s been a fundamental political change inside the United States, from the transition of the Biden administration to the Trump administration, and Europe is reacting to that. And one of the things that has become very clear to them is taking on more responsibility for their own defense.

So we talked a little bit about this idea of not being so dependent on the United States on programs like Gateway and their investments in civil and commercial space. The same thing applies for national security. So now you have also this additional pressure where NATO is looking for countries to invest a greater percentage of their GDP in defense, and space has a really high return on investment when it comes to national security.

It should be a big winner. It should be a big winner because I think a lot of countries, when they look to where they’re going to spend that additional investment as a percent of their GDP in national security, will see that space can be a leap-ahead in things like national security, Earth observation, intelligence, surveillance and reconnaissance, in communications, modern military communications architectures. So we’re really excited about that.

But in addition to that, drones have played a really big role on the modern battlefield, especially in Ukraine. And Redwire Edge Autonomy has hundreds of drones that have flown in the conflict in Ukraine. In fact, we have a 100,000-square-foot facility in Latvia. So we’re not only a European space company, we’re also a European defense tech company. And it’s really complementary.

I don’t think people recognize initially how complementary drones and space are. Sometimes I will, jokingly to prove a point, refer to a satellite as an uncrewed space-borne vehicle, to contrast it with an uncrewed airborne vehicle, because essentially you’re dealing with a vehicle that has some sort of communications, some sort of sensing capability. It’s using similar software from the perspective of AI, autonomy, computer vision.

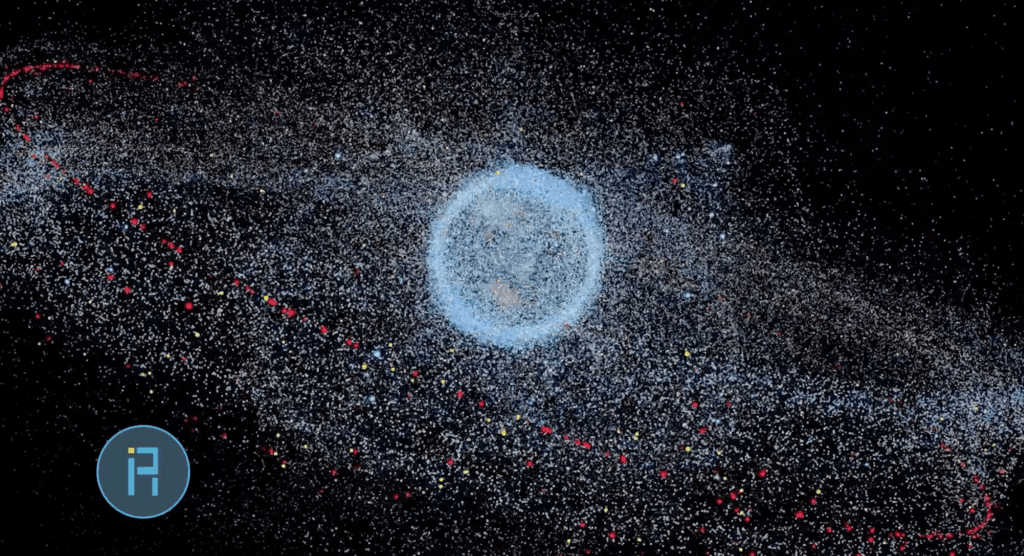

And so there’s a lot of technical — you know, one operates in a vacuum, in space. The other one has to worry about things like lift and atmospheric drag. Although in VLEO, where Redwire is really establishing itself as a leader, you are also dealing with atmospheric drag. And sometimes people will refer to our SaberSat VLEO platform as an orbital drone. So we’re kind of blurring the lines between space and airborne, but both of them have important applicability to national security and are really fast-growing swim lanes in that area. So we’re excited to be positioned well for both of those trends.

Mike Gruss – You brought up software there too, and I think that’s becoming a — or has long been — a differentiator for companies. Where do you see software playing a role in helping Redwire?

Peter Cannito – So we’re investing a lot in software, and there’s three areas our investments are primarily focused on.

One is digital engineering, of which we have a software platform called Acorn 2.0 that is a digital engineering software that helps with that development process.

The other is in autonomy. Of course, we acquired Edge Autonomy, but autonomy software is important to both the operation of satellites as well as drones. So there’s a lot of synergy there. For us, it’s really important — you cannot overload the operator. And in space, as space operations become more complex, as you have future spacecraft that have the ability to maneuver, potentially the ability to refuel, there’s going to be a lot of operational overload. So we have to make those spacecraft as simplified from an operational perspective. That means as autonomous as possible — exactly what we’ve basically seen in the drone business. So a lot of investment in that area of software.

And then the last one is computer vision. Whether you’re doing proximity operations, or trying to get space situational awareness, or trying to do video navigation to land on the moon — all important space-based applications. Or whether you’re operating drones that are trying to identify what’s going on on the surface of the Earth. Computer vision plays a really big role. So we’re investing in those three areas.

Mike Gruss – Are you hearing from operators that this is just — it can be too complicated, it can be too overwhelming, and that this is the — it takes too long then to make decisions?

Peter Cannito – Well, we saw the trend in UAVs, so we’re anticipating the trend longer-term. But yes, especially on the national security side. But it’s relevant to anybody who’s operating a spacecraft. You don’t want to overload the operator. There’s too many things going on.

I think one of the exciting things about being both a space and a drone company is we can take lessons learned from watching drone operations and apply them to space. And autonomy has played a really big role in the effective employment of UAVs, especially as they proliferate in the numbers we’re talking about in terms of satellites that are going to be proliferated in the future.

It’s not just, you know, one really large GEO satellite that makes a maneuver every quarter or something, some small, slight maneuver every quarter. We’re talking about potentially orbital drones, or VLEO spacecraft that are making maneuvers on a regular basis.

Mike Gruss – Right. We talked about software, but Redwire has grown a lot because of acquisitions. What are the types of, or what are the areas, where you see as ripe for potential acquisitions?

Peter Cannito – Yeah, that’s right. Well, so we think about M&A in two ways. One is transformational M&A, where we enter into a new, complementary or adjacent market, and that’s what you saw with Edge. And of course, we’re busy right now in the process of integrating Edge, but we’re organized in a way that we can grow very rapidly. That literally doubled the size of the company through transformational acquisition like that.

We also think about tuck-ins in areas that strengthen where we already are. There’s still a number of companies out there that have maybe one or two products that are complementary to something that Redwire is already doing, maybe in the area of software, for instance, where you look at AI/ML companies or computer vision companies, and that would be a really good tuck-in. So we kind of have the ability to do that really large transformational M&A — we’ve demonstrated that. We also have the ability to do tuck-ins.

And sometimes, like we did with Space NV, you can do M&A to enter in a new market. That was really important to us to establish ourselves as a European player a couple of years ago. There are other areas, geographic areas, that we could use M&A to enter into as well.

Mike Gruss – Where do you see the market for consolidation? I think specifically, there’s been — in Europe, there have been calls that, hey, the market’s been too fragmented. Do you see room for consolidation there? Or are you looking at it differently?

Peter Cannito – Well, for us, we look at it really from our own strategic perspective, in terms of how the industry is. I think that it ebbs and flows. Some aspects — well, some aspects of the industry.

Obviously, Europe believes that in order to compete on a global scale, they need a much larger, integrated entity. And therefore you see this — the pursuit of Airbus, Leonardo, and Thales coming together. On the other hand, the startup community isn’t as robust as you see in the United States. So in that particular area, I think there’s more room for growth.

And of course, we believe that the market needs that middle — sometimes I call it the Goldilocks player: not too large, not too small. You know, large enough to be very dependable, financially stable, lots of spaceflight heritage. But not so large that there’s a lot of bureaucracy or legacy encumbrances that sometimes can slow the large primes down. So it depends on the area, but I think the market is pretty healthy right now, and we like where we’re sitting. We think there’s some competition, but we think there’s also a lot of room to run.

Mike Gruss – You touched on this a little bit, but I wanted to get back to pharmaceuticals and the role that could play in space based on where you see that evolving.

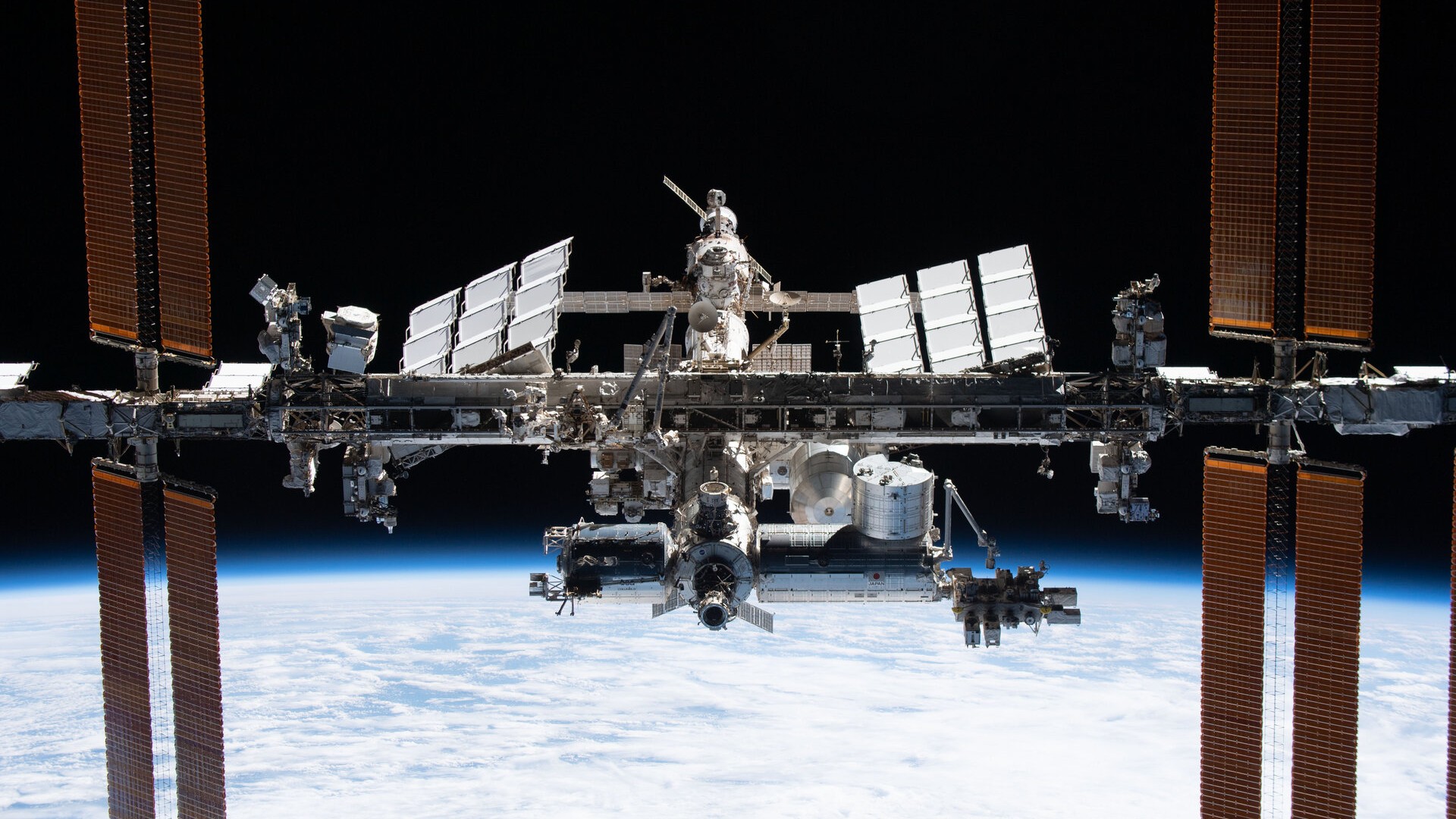

Peter Cannito – Yeah. Yeah. So Redwire, through our legacy programs, has been involved in microgravity research and development for decades now. Sometimes I don’t think people fully appreciate that. At any given time, we have between nine to 11 payloads on the International Space Station doing some sort of research or science.

People have, for the last couple of years, been really looking for the killer app in space. And when you look around at all the excitement around commercial LEO destinations, the one thing that probably doesn’t get talked about enough is: what are we going to do in these things? Right? You can only do somersaults for so long until you’re bored. And there are only so many billionaires in the world that are going to want to go and visit them.

So really, what is going to make these things useful? And at Redwire, we have the benefit of decades of looking at everything from printing fiber optics to — we’ve printed heart cells, we’ve printed a meniscus in space with bioprinting.

But the one area that has really shown the most commercial potential is the idea of manufacturing early-stage crystals, or seed crystals, for the development of pharmaceuticals terrestrially. And we have a program called Pillbox that we have developed and now demonstrated the efficacy of being able to develop better, more pure crystal forms in space that can be brought down to Earth and used as seed crystals to develop new pharmaceuticals or to improve existing pharmaceuticals. And that’s been demonstrated.

This isn’t anymore just research and development — this is, we are now entering, with the Pillbox technology, the phase of commercialization.

Mike Gruss – What comes next?

Peter Cannito – Yeah, the next phase is to move out of research and development into commercialization. In order to do that, we formed a wholly owned subsidiary called SpaceMD, that is going to be the commercialization biotech element of Redwire, to take this capability that we have to manufacture these things in space, and go out and partner with traditional biopharma companies to turn these into drugs.

Absolutely. We just recently signed an agreement with a company called Accerlibero, where we actually — it’s a royalty-based agreement where we share in the upside if the drug performs. So it’s very exciting. And I think a lot of people who have been looking for, you know, the commercial utility of future space stations are watching this closely and are very enthusiastic about the potential from an economic perspective.

Mike Gruss – Two other quick areas I wanted to chat about. One, you opened a new facility in New Mexico recently. Can you talk a little bit about what’s happening there and how that—

Peter Cannito – Yeah, New Mexico is an incredibly important area for space. There’s a lot of capability there. There are a lot of important customers there. We’ve been there for many years with about 8,000 square feet of capability.

We just doubled down on that and built a new rapid response development capability that we call the Firestone facility. And super excited about it. Again, a lot of traditional space is encumbered by a way of doing business, a way of doing engineering, a way of doing development that isn’t necessarily rapid, because the programs used to be 10 years long.

We’re building out modern manufacturing facilities and advanced digital engineering processes in places like Albuquerque to be able to speed that cycle up, to rapidly create capabilities that can go out there and do incredible things for our customers.

Mike Gruss – Yeah. And last question I wanted to check in on — what’s the latest with SkimSat?

Peter Cannito – Yeah, SkimSat has been an exciting program that we’ve been really happy to be a part of with the customer, ESA, and our partner Thales. And we’re really excited that we’re going to be announcing that we’re taking over as the prime contractor. So Redwire provides the actual spacecraft — it’s based on our Phantom spacecraft, which is our European VLEO vehicle — and we’re going to be taking over as prime there.

Which is very complementary to the work we’re doing in the United States with our VLEO spacecraft called SaberSat for U.S. national security. We have a European platform and a U.S. platform, because of the complexity of things like ITAR, but also another example of where the Europeans are going to invest in their own capability despite the direction the U.S. is going into.

So having those two marquee programs, I believe, positions us — we’re getting a ton of attention, a lot of attention, and for a lot of good reason. The performance parameters that are anticipated out of VLEO in terms of things like Earth observation or communications relays, maybe from drones — there’s a lot of great capability that can come as we develop out that new orbit.

And quite frankly, that’s the future. It’s multi-orbit. You’re starting to see enthusiasm come back for GEO again. Everybody declared GEO was dead. Now GEO is hot again, with maybe small GEO. So we don’t believe that it’s going to be any one particular orbit.

And so last time we were here, last year, there was a lot of enthusiasm around proliferated LEO. We think that the same enthusiasm is going to build over time for VLEO. And we’re going to find ourselves really well positioned. We might be a year early, but if we want to start that, let’s do it.

Mike Gruss – Thanks again for joining us.

Peter Cannito – Pleasure to be here.

Mike Gruss – I’d like to thank our partner BlackSky, and a reminder that all of our coverage from WSBW is available on SpaceNews.com.

About Space Minds

Space Minds is a new audio and video podcast from SpaceNews that focuses on the inspiring leaders, technologies and exciting opportunities in space.

The weekly podcast features compelling interviews with scientists, founders and experts who love to talk about space, covers the news that has enthusiasts daydreaming, and engages with listeners. Join David Ariosto, Mike Gruss and journalists from the SpaceNews team for new episodes every Thursday.

Watch a new episode every Thursday on SpaceNews.com and on our YouTube, Spotify and Apple channels.

Be the first to know when new episodes drop! Enter your email, and we’ll make sure you get exclusive access to each episode as soon as it goes live!

Space Minds Podcast

“*” indicates required fields

Note: By registering, you consent to receive communications from SpaceNews and our partners.

Stay Informed With the Latest & Most Important News

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04Φsat-2 begins science phase for AI Earth images

04Φsat-2 begins science phase for AI Earth images -

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

05Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

06True Anomaly hires former York Space executive as chief operating officer

06True Anomaly hires former York Space executive as chief operating officer -

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors

07Thermodynamic Constraints On The Citric Acid Cycle And Related Reactions In Ocean World Interiors