Now Reading: SpaceX executive confirms interest in an IPO

-

01

SpaceX executive confirms interest in an IPO

SpaceX executive confirms interest in an IPO

WASHINGTON — SpaceX’s chief financial officer has confirmed the company is considering an initial public offering as soon as next year to raise money for lunar and Mars missions as well as orbital data centers.

In a message to employees late Dec. 12, Bret Johnsen, SpaceX’s CFO, said the company is preparing for a possible IPO next year, but added that whether and when it would take place remains “highly uncertain,” according to company sources who received the message.

The note capped a week of speculation that SpaceX, one of the world’s most valuable private companies, was weighing an IPO. Such an offering could raise tens of billions of dollars to support the company’s expanding ambitions in space transportation and related services.

Johnsen wrote that “a public offering could raise a significant amount of capital that enables us to ramp Starship to an insane flight rate, deploy AI data centers in space, build Moonbase Alpha and send uncrewed and crewed missions to Mars.”

Recent speculation has focused on orbital data centers to support growing demand for artificial intelligence computing. Elon Musk has recently expressed interest in developing such capabilities, potentially leveraging SpaceX’s Starlink broadband constellation.

“Satellites with localized AI compute, where just the results are beamed back from low-latency, sun-synchronous orbit, will be the lowest cost way to generate AI bitstreams in <3 years,” Musk wrote on social media Dec. 7. “And by far the fastest way to scale within 4 years, because easy sources of electrical power are already hard to find on Earth.”

Musk, responding to an article suggesting SpaceX’s interest in an IPO was tied to orbital data center plans, called that analysis “accurate.”

For years, Musk and other executives said SpaceX would not go public until it was making regular flights to Mars. “At a minimum, we can’t go public until we’re flying regularly to Mars,” SpaceX President Gwynne Shotwell said in a 2018 CNBC interview.

The company has delayed an IPO through periodic tender offers that allow employees and other shareholders to sell shares on secondary markets, providing liquidity. Johnsen’s message about a potential IPO came in a letter informing employees of the latest tender offer, which priced shares at $421 and valued SpaceX at about $800 billion, roughly double the valuation of the previous tender offer.

“For the last several years, there was this idea floated that SpaceX wouldn’t IPO until they make it to Mars or that potentially, upon hitting a certain customer milestone, maybe Starlink would spin off,” said Andrew Chanin, co-founder and chief executive of ProcureAM, which manages the Procure Space ETF, an exchange-traded fund focused on space industry companies.

Chanin said speculation around orbital data centers may be one reason SpaceX would consider going public. “It’s tough to say exactly what the company is seeing, but given the kind of technology the company has already developed, it puts them in a good position to take advantage of space-related opportunities that are out there,” he said.

If SpaceX goes public, Chanin expects strong demand for the stock. “We hear interest from investors on a regular basis looking for access to the stock,” he said. “This is something many retail and institutional investors have been interested in for a while.”

Chanin’s fund does not own SpaceX stock directly but has indirect exposure through EchoStar, which announced in September a deal to sell spectrum to SpaceX for $17 billion in cash and stock. EchoStar’s share price has risen 54% in the past month, in part because of the growing value of the SpaceX stock it is slated to receive.

The increased value of that deal could benefit other companies, Louie DiPalma of investment bank William Blair noted in a Dec. 8 research note. He cited Globalstar, Iridium and Viasat as firms with global satellite spectrum allocations that could see those assets gain value.

An IPO could also reshape the broader space sector, Chanin said, by giving SpaceX more capital for acquisitions and creating new opportunities in adjacent markets. “There’s a lot of need for various technologies, some that SpaceX may have no interest in building out,” he said. “That will potentially create opportunities for other space companies.”

Still, Johnsen cautioned employees that an IPO is far from certain. “Whether it actually happens, when it happens and at what valuation are still highly uncertain,” he wrote.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

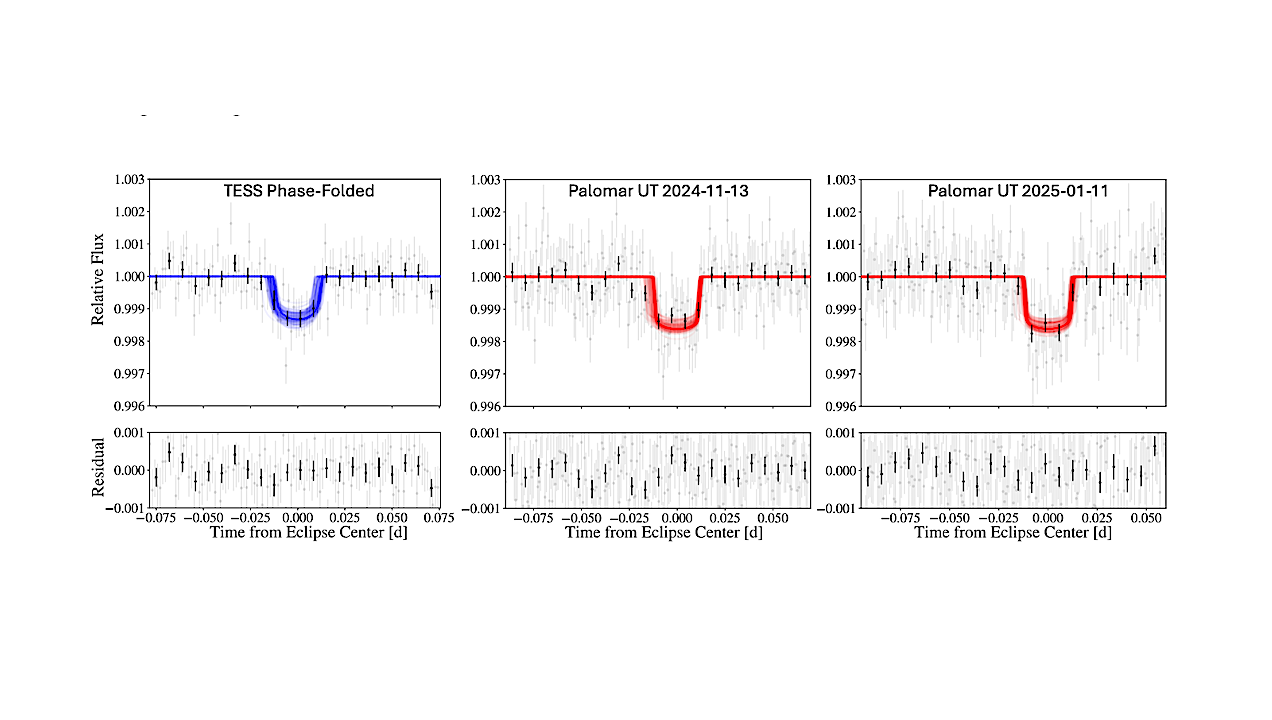

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly