Now Reading: SpaceX IPO plan sets stage for a surge of other space listings

-

01

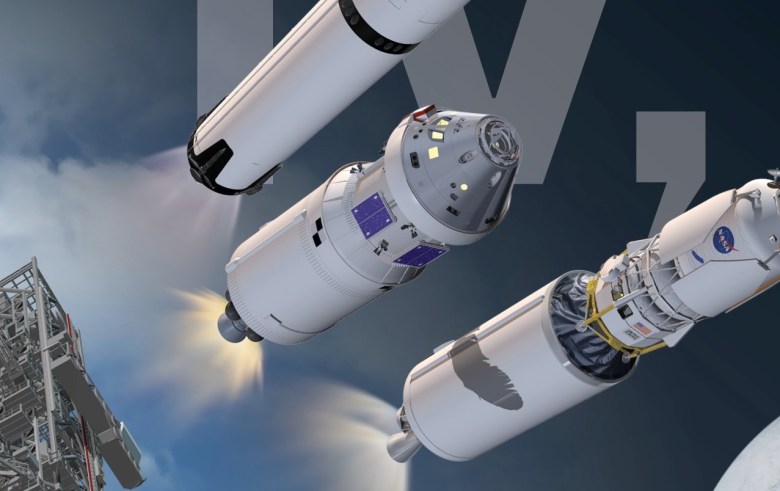

SpaceX IPO plan sets stage for a surge of other space listings

SpaceX IPO plan sets stage for a surge of other space listings

TAMPA, Fla. — Other space companies are likely to move toward the public markets now that Elon Musk is openly signaling plans to pursue a SpaceX IPO next year, hoping to ride the wave of momentum behind a potentially record-breaking listing.

Cape Canaveral–based Starfighters Space, which is developing a small satellite air-launch system using a fleet of supersonic F-104 fighter jets, said Dec. 10 it is increasing the size of its planned offering next week by $5 million to $40 million.

“2026 is going to be a great year for everything space,” early Starfighters investor Justus Parmar told SpaceNews.

“The spotlight that’s going to be on the industry because of the largest IPO in the history of the world is extremely exciting, and yes there will be massive tailwinds for everyone, including Starfighters.”

Starfighters plans to use the capital to support its first suborbital launch, part of a broader effort to demonstrate a rapid-turnaround, air-launched alternative for reaching low Earth orbit.

The venture ultimately aims to offer a more flexible and less infrastructure-dependent launch for solution, similar to an approach once pursued by Virgin Orbit, which flew orbital missions from beneath a modified Boeing 747 before filing for bankruptcy in 2023.

A debut commercial launch was slated by the end of 2025, but it is still awaiting key regulatory approvals, including from the Federal Aviation Administration.

Business to date has come from services built around the supersonic aircraft fleet, such as pilot and astronaut training. In a regulatory filing, the company reported net losses of $7.9 million in 2024 and $4.7 million in 2023, and said it expects increased net losses for the next several years as it invests in developing a payload launch capability.

The NYSE American listing, subject to the stock exchange’s approval, values Starfighters at $143 million.

Growing IPO drumbeat

The Wall Street Journal and The Information first reported Dec. 5 that SpaceX was exploring a 2026 listing, following years of speculation. Bloomberg later reported the company could raise more than $30 billion at a valuation of around $1.5 trillion.

Reuters reported in October that OpenAI, which competes with Musk’s AI efforts and reportedly overtook SpaceX as the world’s most valuable private company recently, is considering a 2026 IPO at a potential valuation of around $1 trillion.

SpaceX has for years avoided becoming a public company and the regulatory scrutiny and disclosures that come with it, aiming to establish a sustained human presence on Mars first.

However, the company may now be motivated by the capital needed for large-scale data centers in orbit, Ars Technica reported citing people familiar with Musk and his thinking, amid rising interest in moving energy-hungry artificial intelligence computing off Earth. Musk validated the report’s accuracy on X Dec. 10.

Ross Carmel, a partner at Sichenzia Ross Ference Carmel, said a listing would likely trigger a “flurry of other space-related companies looking to capitalize on the momentum and go public to access capital markets,” particularly if SpaceX enjoys a strong debut.

“The space industry is very capital-intensive and the public market gives these companies the access to capital they will need to fund the business moving forward,” he said.

A SpaceX IPO “would be a seismic event for the space economy,” said Mark Boggett, CEO of early-stage investor Seraphim Space.

“SpaceX has been at the forefront of the transformation of the Space sector that has now spawned a thriving ecosystem of many thousands of other space start-ups and scale-ups around the world.”

Boggett noted how SpaceX has expanded well beyond launching and operating satellites, developing an integrated technology platform spanning connectivity, infrastructure projects and increasingly powerful AI.

“That level of activity will create unprecedented opportunities across the broader space economy, from in-orbit servicing, satellite constellations, data analytics, to global security and sustainability solutions,” he added.

The global space economy is worth about $600 billion today, according to Seraphim, and is projected to reach $1.8 trillion by 2035 on a trajectory Boggett said a SpaceX IPO could accelerate by opening new pools of institutional capital.

SpaceNews recently detailed how the company’s rise has reshaped the competitive dynamics of launch, communications and the wider space sector in a two-part series examining the SpaceX-era economy.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly