Now Reading: Stakeholders in direct-to-device services have to act now to defend their interests at the WRC-27

-

01

Stakeholders in direct-to-device services have to act now to defend their interests at the WRC-27

Stakeholders in direct-to-device services have to act now to defend their interests at the WRC-27

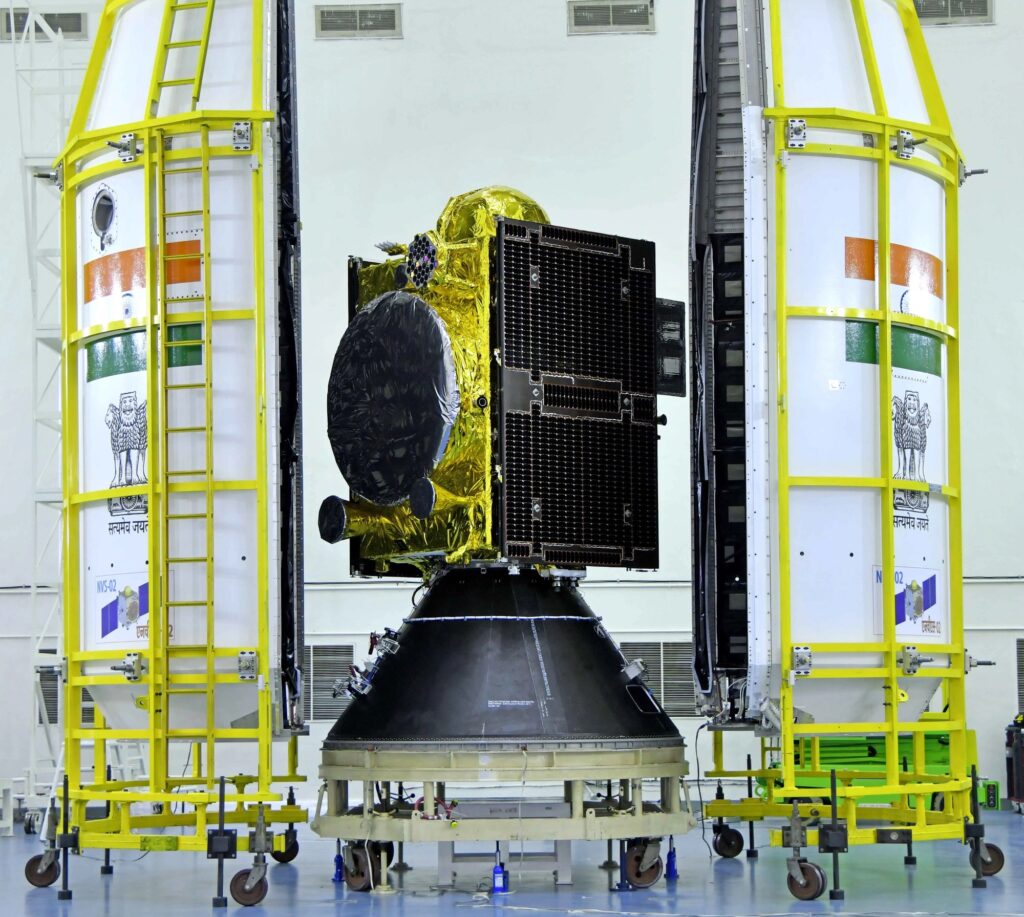

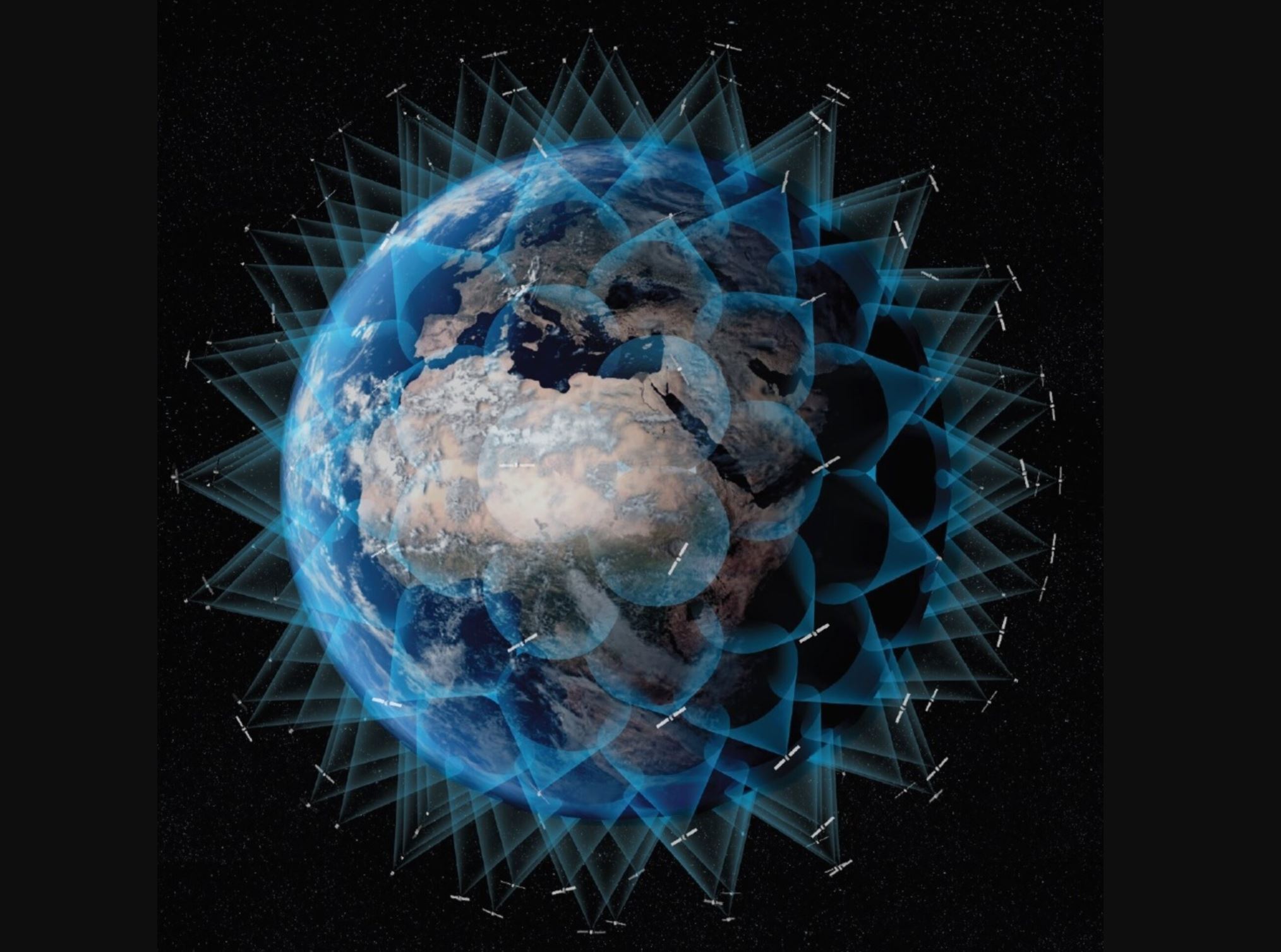

Last February, I wrote that the merger of the satellite and terrestrial cellular industry was not yet a marriage made in heaven. However, at the Mobile World Congress , held last March in Barcelona, I noticed that Non-Terrestrial Network (NTN) and direct-to-device (D2D) services received an exceptional amount of attention from the cellular industry. In the months since that event, I have seen many new announcements of the leading operators of D2D satellite services. It concerned here as well legacy satellite operators that will provide their services using their Mobile Satellite Service (MSS)-spectrum as new market entrants, who have developed their services to leverage Mobile Service (MS) spectrum from their Mobile Network Operator (MNO) partners to deliver their services to unmodified cellular handset and devices.

In most cases, these announcements were focused on news about the funding of their plans, new partnerships and the technical and commercial advances these companies have made in their efforts to prepare for large scale commercial launch of their services.

Because all these issues are drawing so much attention, the importance of the upcoming World Radio Conference in 2027 (WRC-27) for the future of D2D businesses might get less attention or even be largely overlooked, not only by the operators of D2D services but also by MNOs, governments and enterprises around the world.

The importance of the upcoming WRC-27

As most of us who work in telecommunications and satellite communications know, the WRC is a periodic conference organized by the the International Telecommunication Union to review and, as necessary, revise the Radio Regulations, the international treaty governing the use of the radio frequency spectrum, as well as geostationary and non-geostationary satellite orbits.

The WRC cycle allows countries to identify their needs, participate in the international regulatory processes and plan their roadmaps to allow citizens and industry to get full value from new technologies.

The agenda for the next conference in 2027 was already determined during the WRC-23 and contains, besides many spectrum band items, a specific range of D2D related issues.

Because the WRC-27 will set the framework that all providers and operators of D2D, as well as their distribution partners have to comply with, the outcome of this conference will have a profound impact on the feasibility of the plans of all these providers of D2D satellite services.

In an earlier article, I already concluded that the satellite and the cellular industry cannot ignore the huge potential of D2D services. Also, governments all around the world are starting to understand the importance of satellite services to secure their telecommunications needs that best serve their economic interests, sovereignty and security. Therefore, the outcome of D2D related issues at the next WRC-27 will also be of crucial importance for these stakeholders.

Critical WRC-27 issues for D2D satellite services

The main D2D related topics that will be addressed at the WRC-27 are:

- spectrum requirements and allocation of new MSS and MS spectrum for D2D services,

- the technical and operational feasibility of the different D2D systems and

- the regulatory framework which all providers of D2D services will have to comply with.

These topics cover a large number of underlying issues which, together, will define the global framework for all future D2D-services. To demonstrate the importance of these issues, and the consequences of their outcome for the different stakeholders, Ihave worked out in more detail the following two examples:

International Mobile Telecommunications spectrum for MSS operators

Where it comes to the allocation of new MSS and MS spectrum for D2D services, a controversial subject is the proposed possibility for MSS operators to obtain, besides additional MSS spectrum, MS spectrum between the International Mobile Telecommunications (IMT) 694/698 MHz and 2,7 GHZ bands.

For providing D2D services, legacy satellite operators — like, for example, Globalstar and Iridium — so far used their available MSS spectrum with limited bandwidth and satellites which are not purpose-built for seamless integration with terrestrial cellular networks. As a result, these companies so far were only able to provide D2D messaging, SOS and basic IoT services. Because these spectrum and satellite limitations will keep them from expanding their service offerings into the more advanced, valuable and profitable voice and broadband data services, these legacy MS operators are very keen to obtain a big chunk of this IMT spectrum.

However, as this concerns IMT spectrum that is already allocated to and in use by MNOs, this requires changes to the worldwide rules and regulations and impose new post-award conditions on these MNOs.

Because this increased use of IMT frequencies for D2D services also raises the risk of interference with and serious service degradation of D2D, MSS and terrestrial cellular services, this issue requires special attention from both the satellite and terrestrial cellular industry

D2D regulatory framework used to obtain geopolitical dominance

Another crucial issue to be taken into consideration by all the stakeholders are the recent advances made by both the United States and China in defining a regulatory framework which could establish the legal and technical blueprint for global D2D satellite connectivity.

In order to facilitate global market access for their own home-grown D2D systems, each of them is likely to try to impose a regulatory model that best fits the technical and operational capabilities of their own systems, on the rest of the world as the global model.

As their proposed models might limit or complicate initiatives from other countries and continents to develop their own alternative D2D systems, and could conflict with the needs for sovereignty and control over telecommunications infrastructure of governments in other regions of the world, these stakeholders need to carefully assess which global regulatory framework they can accept.

Required actions from the stakeholders

For all the stakeholders to be able to influence a favourable outcome of this conference, which will enable them to implement their preferred D2D strategy, they all have to pass through a process as described below, which takes a considerable amount of time.

So, although the WRC-27 is still two years away, the moment for all stakeholders to start working on this is right now.

Satellite and cellular operators need to define, based on an in-depth market analysis and their competitive position, their most suitable and desired long-term D2D service strategy and service roadmap where they can choose between:

- Already available add-on messaging and SOS services in MSS spectrum from legacy satellite operators like Global Star and Iridium, which are unable to support more advanced voice and data services.

- Partly 3rd Generation Partnership Project (3GPP)-standardized D2D services from new market entrants like Space Mobile, Starlink and Lynk, which leverage MS spectrum form their MNO partners to provide from early 2026 the full range of messaging, voice and wide band data service offered as seamless extension of their MNOs clients’ terrestrial cellular services.

- Fully 3GPP-standardized D2D-services from new providers of D2D-services like, for example, Echostar; which will offer the full portfolio of 5G services, including broadband services fully integrated with the MNOs terrestrial service portfolio available at the earliest from 2030.

Governments need to decide, based on their desire for a higher level of sovereignty with satellite services and the feasibility of launching their own regional satellite systems, if they will favor and support the short-term market entrance of services from U.S. or China-based satellite operators or bet on the long-term availability of their own regional systems.

Based on this, in the run-up to the WRC27, all the stakeholders need to:

- Develop effective strategies to influence the outcome of the WRC-27, in order to facilitate their desired D2D strategy and approach.

- Start participating in all relevant regional interim meetings and preparatory studies.

- Start organizing themselves with allies to obtain from the WRC-27 the results that best fit with their plans and needs.

As we can see, there is a lot at stake at the WRC-27 which demands all attention from all stakeholders to make sure that the decisions that will be taken at this conference will serve their needs in the area of D2D services.

This is quite a challenging task, which requires in-depth knowledge of both the terrestrial cellular and satellite industry, spectrum and radio issues, regulation, consortium building, and lobbying. Because for this the required (temporary) resources might not always be available within the operators and government bodies, requesting support from external sources specialized in handling these issues could be a good option to defend and secure their D2D interest at the WRC-27.

Enrico Ottolini is co-founder and executive director of Planet Earth Connect. He has more than 25 years of extensive international experience in both the mobile and satellite communications industry. Based on this experience, he guides telecom operators and solution providers through the rapidly changing and fragmented LEO-sat landscape. Currently, he and his team are in the process of creating a platform which will merge both these technologies into one fully integrated and seamless TN/NTN enterprise solution.

SpaceNews is committed to publishing our community’s diverse perspectives. Whether you’re an academic, executive, engineer or even just a concerned citizen of the cosmos, send your arguments and viewpoints to opinion@spacenews.com to be considered for publication online or in our next magazine. The perspectives shared in these opinion articles are solely those of the authors.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly