Now Reading: Telesat eyes Golden Dome opportunity for Lightspeed

-

01

Telesat eyes Golden Dome opportunity for Lightspeed

Telesat eyes Golden Dome opportunity for Lightspeed

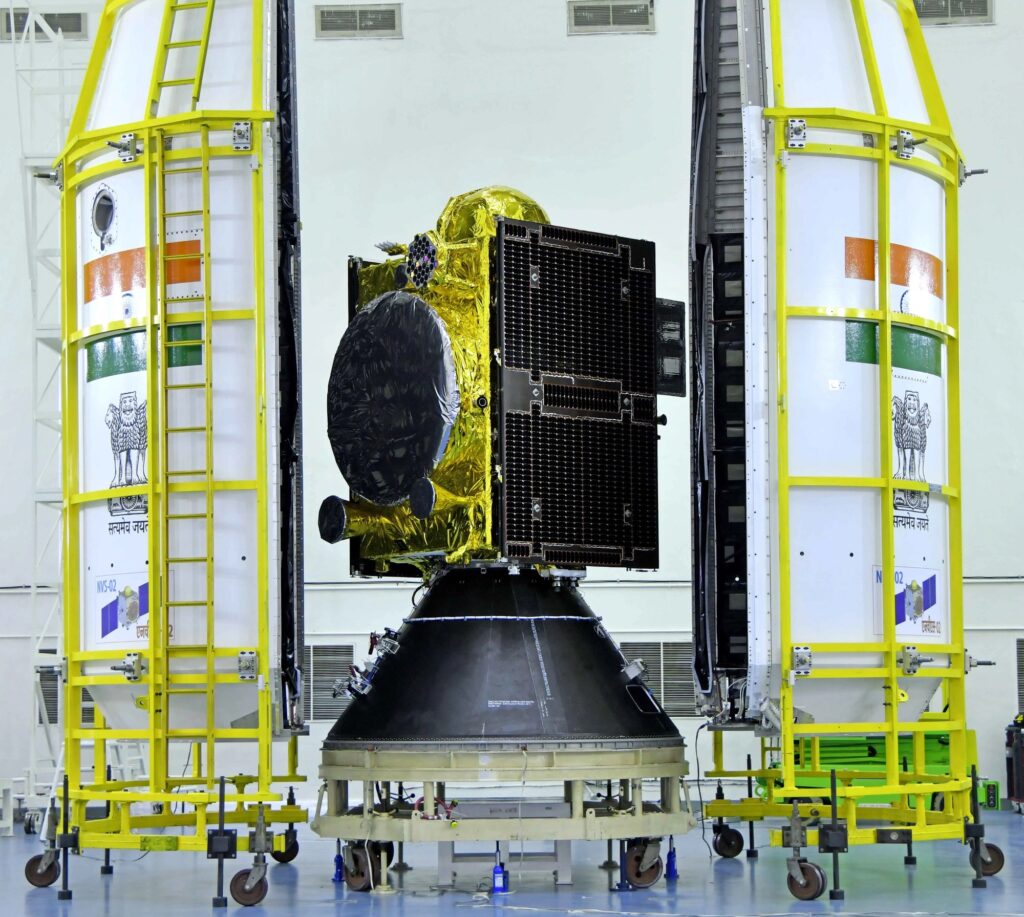

TAMPA, Fla. — Low Earth orbit (LEO) broadband satellites Telesat aims to start deploying next year could support the proposed U.S. Golden Dome missile defense system, the Canadian operator said Aug. 6 while reporting further declines in its geostationary business.

Although Golden Dome is still being defined, and Canada’s involvement remains an open question, Telesat CEO Dan Goldberg said it appears “space-based architectures at various orbits will form an important part” of the $175 billion program.

Set to operate much higher than U.S.-based Starlink and Project Kuiper LEO satellites at around 13,000 kilometers above Earth, Goldberg said “Lightspeed could make … valuable contributions to Golden Dome,” adding that Telesat is working to ensure decision-makers are aware of its potential.

“There’s a reason we’re investing billions of dollars in LEO,” he continued. “We’re absolutely convinced that the world and our industry is moving to LEO,” across government and commercial markets.

“The overall trends are pointing to LEO,” Goldberg said, “and LEO is hard, and there aren’t that many of them, and particularly when you talk about … architectures like Golden Dome, they need to be multiple networks to ensure resiliency.”

LEO surpasses GEO in backlog

Telesat has a 1 billion Canadian dollar revenue backlog for Lightspeed, a planned network of 198 satellites MDA Space is building that SpaceX is slated to deploy over the course of a year, starting in mid-2026.

Meanwhile, the company’s geostationary orbit backlog stood at about 900 million Canadian dollars, marking the first time LEO has overtaken GEO in its pipeline.

Declining GEO satellite TV renewal rates continued to weigh on performance. Telesat reported a 30% year-over-year revenue drop to 106 million Canadian dollars for the three months ending June 30.

Revenues were also impacted by reduced services tied to a rural broadband program in Indonesia.

Adjusted EBITDA — or earnings before interest, taxes, depreciation, and amortization — fell 43% to 59 million Canadian dollars amid heavy Lightspeed investments.

Despite the declines, Telesat reaffirmed its full-year guidance, expecting revenues between 405 million and 425 million Canadian dollars for 2025, and adjusted EBITDA between 170 million and 190 million Canadian dollars.

A broader industry pattern

Telesat’s shift mirrors French multi-orbit operator Eutelsat, where GEO declines offset an 84% surge in LEO revenues in the past 12 months.

Like Telesat, Eutelsat is scaling back GEO investments and redirecting capital toward LEO, reinforcing a growing industry consensus: GEO is increasingly relegated to a supporting role in multi‑orbit architectures.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

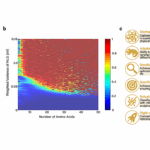

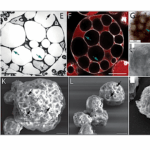

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

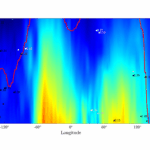

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly