Now Reading: Telesat to offer blocks of satellite bandwidth to DoD for Golden Dome

-

01

Telesat to offer blocks of satellite bandwidth to DoD for Golden Dome

Telesat to offer blocks of satellite bandwidth to DoD for Golden Dome

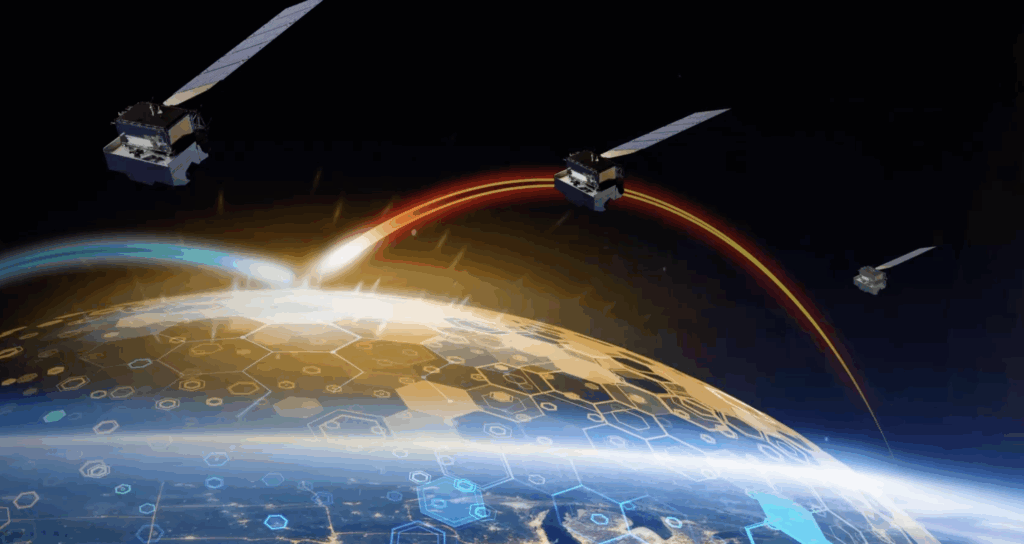

WASHINGTON — As the space industry watches what analysts describe as a “gold rush” around the Pentagon’s projected $175 billion Golden Dome missile defense program, Canadian satellite operator Telesat is spelling out how it intends to compete for a role in the program.

Telesat’s CEO Dan Goldberg revealed last month the company is eyeing opportunities in the Golden Dome program for the company’s low Earth orbit satellite broadband service known as Lightspeed.

Following Goldberg’s comments, Telesat Government Solutions president Chuck Cynamon told SpaceNews that the company’s strategy centers on selling the Pentagon satellite capacity in bulk that it can tap on demand — a “capacity pool model” designed to give the military access to significant bandwidth without the cost of procuring or leasing satellites, while providing more flexible surge communications capabilities.

Cynamon, a retired U.S. Air Force colonel who managed military satellite programs, leads Telesat’s U.S. proxy subsidiary that interfaces with DoD. He said that while Lightspeed is a commercial system, it has been engaging with defense users for years. The company is working to establish a foothold in the military market for Lightspeed, which is set to begin launching in 2026. The planned 198-satellite network is projected to start providing global services by late 2027 — timing that Cynamon argues aligns with Golden Dome’s demonstration timeline.

The Golden Dome challenge

The Pentagon has released few specifics about Golden Dome so far. It is widely described as a multi-layered “system of systems” missile shield. The plan is to knit together sensors, interceptors, satellites and radars into a unified four-layer defense architecture capable of detecting, tracking, and intercepting threats across multiple domains.

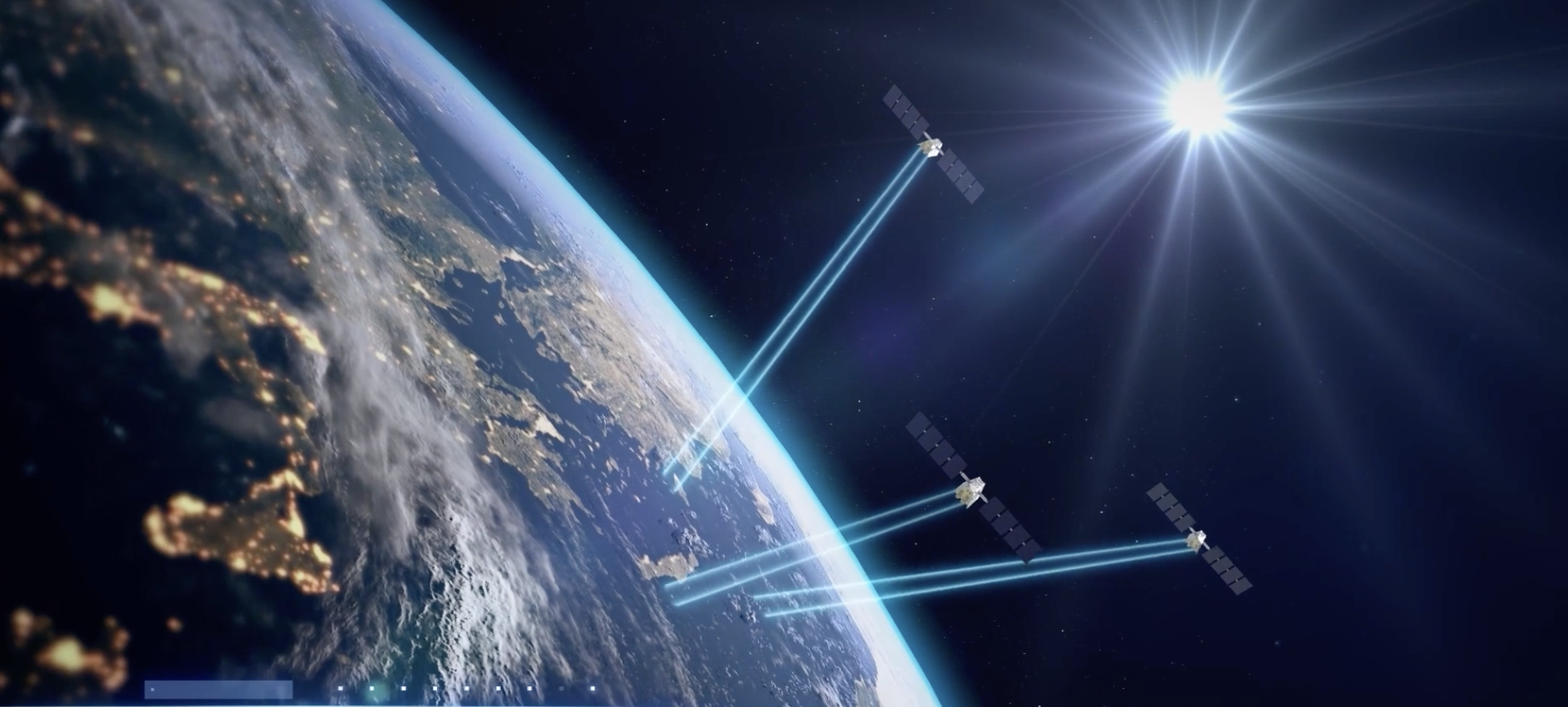

The linchpin is data. Golden Dome will need a global command-and-control system to fuse information from disparate sources and feed it to weapons with minimal latency. That kind of architecture requires enormous bandwidth and redundant transport layers, said Cynamon.

“To me, the biggest issue is going to be the tremendous amount of information that needs to be transported, then assimilated and communicated,” he added. “So that first problem is one of space data transport for moving large amounts of information to where they need to be … so low latency and large comms pipes are going to be needed.”

In anticipation of a large demand for data transport capabilities, DoD needs to secure satellite communications capacity from multiple sources, he argued.

The projected timeline for Golden Dome demonstrations by the end of Trump’s presidential term, said Cynamon, means existing Pentagon satellite programs may not be ready in time to support the ambitious schedule.

The Space Development Agency (SDA) is currently launching satellites for the first tranche of its transport layer that would support Golden Dome, but even if SDA meets its intended schedule, the transport layer may not be fully deployed and ready to support global operations by 2027.

With the MILNET program, DoD is also planning to buy data-transport satellites from SpaceX to provide capacity using a government-owned, contractor-operated model.

“When you buy the satellites, you don’t have a global capability until you launch every satellite,” Cynamon noted. “My opinion is that in order to get there between now and 2028, they really don’t have time to be putting up many more tranches … or buying a new system based upon DoD requirements.”

Market positioning

The Lightspeed constellation will compete in a market currently dominated by SpaceX’s Starlink and Starshield military products, with Amazon’s Project Kuiper representing another emerging competitor. Cynamon said Lightspeed’s architecture, with satellites at higher altitudes than Starlink and Project Kuiper, provides some advantages as it will require fewer satellites and each satellite will cover a larger area of Earth’s surface.

He said the company is offering to work directly with the military’s satellite terminal suppliers to ensure Lightspeed is compatible with the terminals that the military services are already acquiring or developing.

“We’re trying to give them the confidence to just buy pools of capacity, own the capacity, bring their own terminals,” Cynamon said. “We will help the terminal manufacturers put our waveform in their terminals … We want the users to pick their terminals, and we will help make them Lightspeed capable.”

Capacity pool model

This approach would allow DoD to “use procurement dollars for long term capacity that doesn’t require them to buy satellites,” said Cynamon. Military field commands wouldn’t have to rely on Telesat to operate the network, he said, and DoD would maintain complete control over how and where that capacity is deployed.

The cybersecurity in Lightspeed approaches that of dedicated military networks, according to Cynamon. Customers can keep their data entirely within the private satellite network, never touching public networks, limiting exposure to adversary interception.

To secure capacity, DoD could adopt the contracting model currently used by the Defense Information Systems Agency (DISA) to procure fiber optic capability from the telecommunications industry, he said. These agreements, known as Indefeasible Rights of Use (IRU), secure long-term and exclusive access to fiber optic infrastructure for Department of Defense networks.

IRU contracts are an alternative to short-term leasing, offering DISA greater control and predictable costs. The agency uses these arrangements for long-haul and high-capacity backbone routes, paying upfront costs for long-term control and secure use of fiber between key points. Cynamon suggested similar agreements for satellite capacity would allow DoD to own the bandwidth for the contract’s duration and use it when needed.

Telesat has already applied this model in the commercial sector with a deal signed in April to provide satellite operator Viasat long-term capacity from Lightspeed. This agreement allows Viasat to integrate LEO satellite services into its multi-orbit network serving aviation, maritime, enterprise and defense markets.

The company’s strategy, he said, represents a bet that the Pentagon’s aggressive timeline for Golden Dome demonstrations will favor commercial solutions. The fact that many companies are vying for opportunities is beneficial for DoD, Cynamon added. “We think they’re going to need every asset that is there in non-geostationary orbit to make it robust and resilient enough.”

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly