Now Reading: The European space industry’s big merger: lessons for emerging space nations

-

01

The European space industry’s big merger: lessons for emerging space nations

The European space industry’s big merger: lessons for emerging space nations

The Oct. 23 announcement that Airbus, Thales and Leonardo will merge their satellite operations was a historic development for the European space industry. The plan aims to establish a new combined entity by 2027. Historically, the European space industry has been a competent but fragmented market in the form of national champions and competing initiatives. However, Intra-European competition is no longer tenable in the face of strong American and Chinese competitors. Against this backdrop, the merger signals an implicit recognition by European states that scale, specialization and consolidation have become preconditions for both survival and competitiveness in the global space sector. This could offer a case study for emerging space nations that are struggling to take off.

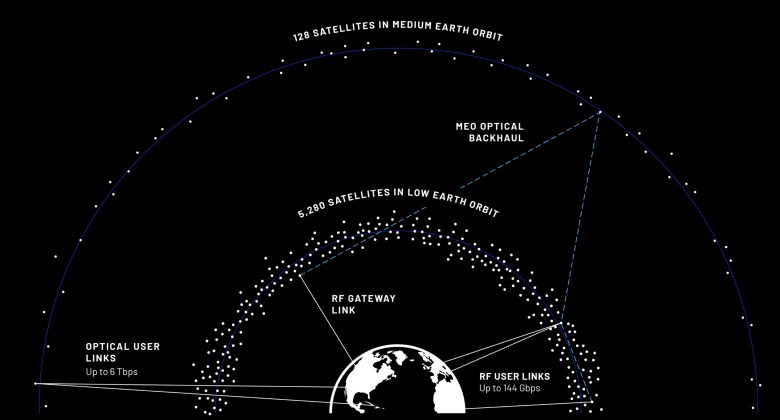

Europe’s long deliberations till the announcement of the merger have been driven by overarching techno-political pressures. The emergence of SpaceX and its constellation of Starlink satellites have altered the economic calculus of accessing space. This disrupted the complacent status quo that European space companies had become accustomed to. Consequently, the traditional European competence in building and launching large, high-tech and expensive geostationary (GEO) satellites has been undermined by the mass production of smaller and cheaper satellites in low Earth orbit (LEO).

Financial reports highlight the severity of the situation: The space division of Airbus has registered losses of close to $700 million last year. Similarly, once-thriving Thales Alenia Space has faced a zero-profit year and had to make substantial job cuts. The broader European industry in general has struggled to keep up, with a contraction of its traditional GEO market. Catalyzed by these developments, the merger, codenamed Project Bromo and modelled on the MBDA, (a multinational European defense company) aims to arrest the decline of European space prowess by pooling resources, setting aside rivalries and achieving the critical mass needed to win global contracts.

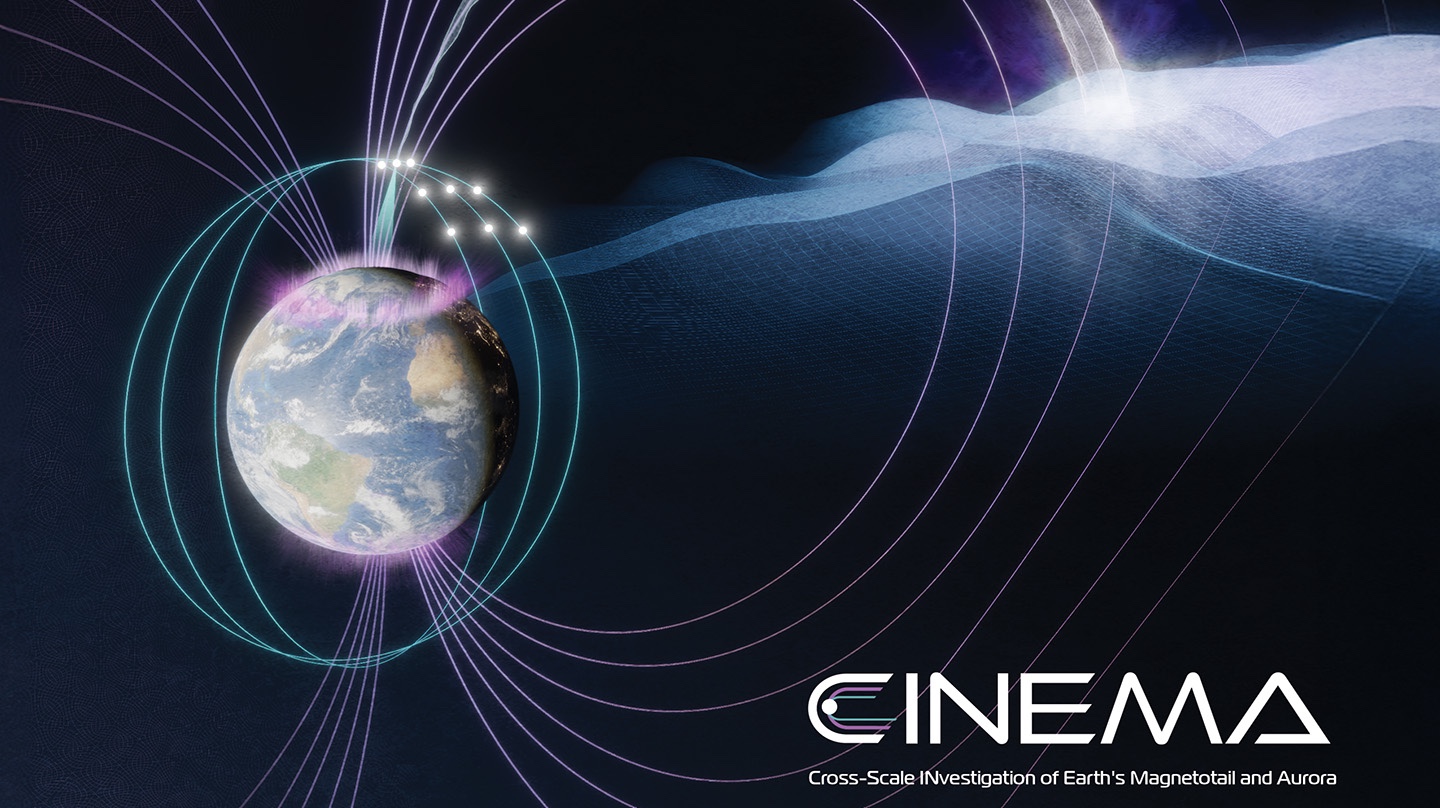

The underlying logic of the merger is deeply interconnected with an emphasis on achieving strategic autonomy. The conflict in Ukraine has highlighted the military utility of space-based assets for communications, imagery and navigation. European governments have thus grown more conscious of the vulnerabilities that stem from the dependence on foreign providers of these vital services. In this context, the new joint venture is the industrial pivot for sovereign European programs, most notably the IRIS² secure satellite constellation. Hence, the merger intends to ensure that Europe remains in control of its own destiny in space.

Nonetheless, the way forward faces challenges that must be keenly observed. Antitrust approval from the European Commission is a major obstacle, as highlighted by a German space firm, which has expressed concern of a monopolistic landscape after the merger. Analysts also question whether the merger has come too late, assessing that Project Bromo is driven by a fear of missing out on getting a slice of the shrinking pie of the global space economy.

The integration process is also expected to take two to three years; some venture capitalists have hinted that SpaceX may reinvent itself three times in the same time. There is also a legitimate concern that consolidation will undermine the very innovation Europe is trying to promote, leading to a lumbering entity incapable of having the agility of smaller newspace companies. Furthermore, negotiations between the three companies on the valuation and the governance have underlined the complexity of uniting different corporate cultures and interests.

For emerging space nations, the dilemma of the European space industry and its response offer an insightful blueprint. Many face similar, if not more acute technopolitical circumstances they are struggling to navigate. The way forward might lie in pragmatic multilateral space cooperation, inspired by the European Space Agency. For instance, the Asia-Pacific Space Cooperation Organisation has shown that it is possible to undertake joint projects, like shared data-service platforms. Multilateral space cooperation can empower emerging space faring nations to collectively negotiate globally from a position of strength, which is also a major objective of Project Bromo.

Under such a cooperative framework, specialization would be a rational strategy considering that even states like France and Germany specialize in certain space technologies. Therefore, emerging spacefaring nations could try to find niches in which they can build competitive advantages. A state with a strong software industry could specialize in data analytics based on Earth observation imagery, while another, with a favorable geographic position, could specialize in hosting ground station services. A multilateral space bloc might even fund its own small satellite programs that could be utilized collectively. It would allow the development of specialized expertise and integration of nascent space industries into worldwide supply chains. This approach would be like the one European states are adopting from the amalgamation of their collective strengths.

Drawing from the preceding discussion, it can be argued that the merger of European space giants seems to be catalyzed by recent technological and geopolitical undercurrents. So, Project Bromo can be considered a space industry consolidation born out of necessity, but it does shed light on a viable way forward for emerging space nations. The merger underscores how multilateral space cooperation can bolster space autonomy, with specialization being the key to maintaining relevance in the global space sector. Hence, through cooperation via existing multilateral frameworks and supply chain specialization, emerging space nations can carve a niche in the global space economy. Scale wins contracts; specialization wins markets, the challenge would be to combine both without stifling innovation.

Mustafa Bilal is a research assistant at the Centre for Aerospace & Security Studies (CASS), Islamabad.

SpaceNews is committed to publishing our community’s diverse perspectives. Whether you’re an academic, executive, engineer or even just a concerned citizen of the cosmos, send your arguments and viewpoints to opinion@spacenews.com to be considered for publication online or in our next magazine. The perspectives shared in these opinion articles are solely those of the authors.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

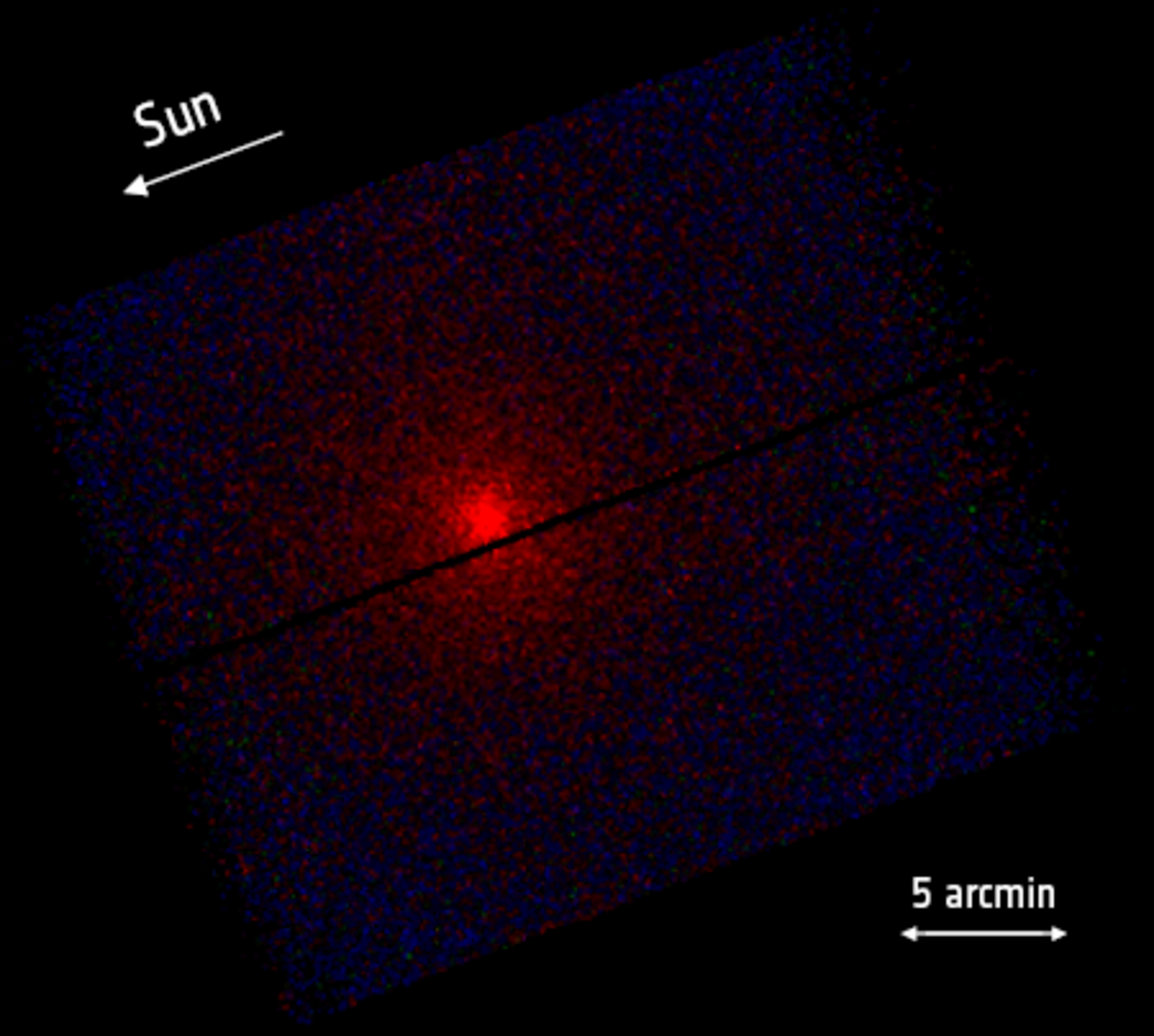

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly