Now Reading: The global space economy hits a new record

-

01

The global space economy hits a new record

The global space economy hits a new record

In this week’s special episode of Space Minds coming to you a day early, host Mike Gruss speaks with Heather Pringle, CEO of the Space Foundation on the just released Space Report 2025 Q2 edition and the top three takeaways including the news that the global space economy hit a new record in 2024.

They discuss the remarkable 7.8% annual growth rate, the rise of commercial space, and how key developments like Golden Dome, launch frequency acceleration, and international investment are driving the industry forward.

Show notes and transcript

Click here for Notes and Transcript

Time Markers

00:00 – Episode introduction

00:23 – Welcome

00:42 – How big is the global space economy?

01:40 – What’s the value of this number?

02:54 – The trillion dollar market

05:03 – Reliance on government contracts

08:33 – Global investments increase

09:49 – Launch and the global space economy

11:35 – What are the opportunities?

13:33 – Golden Dome budget

15:37 – Golden Dome trickle down effect

16:52 – Golden Dome launch infrastructure funding

Transcript – Heather Pringle Conversation

Mike Gruss – Hi everyone, and welcome to Space Minds podcast. My name is Mike Gruss, and I’m joined today by Heather Pringle, the CEO of the Space Foundation. There are a lot of big numbers in space. The Space Foundation announced this week a new figure on the size of the International Space economy. So let’s start there, Heather, what is that figure and what does it mean to you? Why is this? Why is this something that’s so important that the space community cares about?

Heather Pringle – Well, first, good morning, and thanks so much for having me, Mike. It’s a real pleasure, and it is an honor to be able to report that for the first time in the global space economy’s history, we are exceeding the $600 billion mark. The new global space economy is valued at $613 billion so that represents all the commercial activity, civil government, military government, the whole ecosystem, US and abroad. And so what’s particularly significant about this number is that we’ve been seeing continuous growth year over year, and it’s truly remarkable.

Mike Gruss – I think the number last year was around around $570B so this is pretty, like you said, this is, this is pretty steady growth, when you talk to folks, you know, whether it’s one of the events that you’re holding or, you know, just in day to day throughout the space community, what, what do they say about this number? Why does it, why does it matter to them? Or, what, what kind of what kind of value do they put in it?

Heather Pringle – Well, I think the first thing to note is that, as you mentioned, we’re seeing a 7.8% year over year growth. That’s remarkable, and this trend of positive growth goes back at least to 2010 so the space economy is very resilient. It shows consistent growth year over year. And when we look at the five year average compound annual growth rate, or the CAGR, we estimate that we can achieve a $1 trillion market by 2032

Mike Gruss – Yeah, and that’s, that’s a number that I think folks have have talked about a lot. I know there’s, you know, we certainly see from from analysts and some of the boutique firms that are looking there. It’s like, Hey, can we hit this by 2030 2035 and now you guys have this number of 2032 which you know it, it seems, that seems within reach, if we’re looking at the current growth levels that that we’re talking about right now. I think what you mentioned growth since 2010 that that seems to be one of those points that kind of goes under the radar, right, that people, as much as we think space is growing. You’ve there haven’t been, there haven’t been a lot of hiccups.

Heather Pringle – That’s right, and the space ecosystem shows remarkable resiliency, even through perturbations as significant as COVID. And so the fact that we’ve seen this consistent growth year over year really does suggest that positive trend. Now there’s a couple reasons that we can put some value and put some confidence in this number, in this trend, and part of it has to do with the decreasing cost of launch, of course, the reusability of launch vehicles, but we’re also seeing quite a bit of investor competence in the space ecosystem and real return on investment. What I mean by that is, across all the commercial sectors that we look at, there are companies who are getting real ROI return on investment. They’re in the profit zone, because they are both vertically integrated across the value chain, and they have diversified their customer set to military, national security and civil side.

Mike Gruss – Yeah. And so let’s, let’s talk about that for a while, for a minute, because I think there is a sense, and you can correct me here, but there is a sense that a lot of the space industry is is dependent on government, and that the government contracts are what fuels a lot of the growth in space. Obviously, right now, particularly for NASA, there’s an administration that does not seem interested in larger budgets. For NASA, in fact, a pretty big hit, although we’re seeing late last week that Senate appropriators restored, you know, a lot of funding, a lot of the funding for those science missions and their versions of those bills. So it’s a long it’s a long process there, but there’s been some, you know, legislative acrobatics for for the Space Force funding as well. And that was, you know, could be a giant year, could be a down year, depending on who you talk to. So, so how do you make sense of this? Where there is this growing there is this, this growing space economy, but there’s also maybe not the same appetite for it right now in government. And how do you square those two, those two elements?

Heather Pringle – Well, let’s start with the whole global space economy, and then I’ll break it down so that we a clear picture of each of the elements. So again, that $613 billion number is a new watershed moment. And the way that we look at it, we divide the global space economy into a commercial sector and the overall government, civil and military. So on the commercial side, that is 78% of this $613 billion number $480 billion is the commercial enterprise. It’s companies getting out there with a profit motive design. And so it’s a very exciting sector to be focused on, and we can delve into where there are gains and losses, etc.

On the other side is the government picture, and what we have is an overall estimate of, well, $132 billion for the overall government estimate where the United States is the number one lead investor on the government side. So kind of capturing that entire picture of the US government investment in space is $77 billion across both national security and the civil side. So when that’s a very significant number, it outpaces other international countries that are out there, and it shows that the United States really wants to be a leader in the space community, on both sides. We are the number one leader in the world on both national security and civil government investment. So I would say that the United States is still very serious about its role in space and its role as a global leader.

Mike Gruss – One, I know, one thing that you guys looked at in the report is, obviously there’s this, there’s this drive, I think, particularly in Europe right now, to have a little bit more more space. Systems that are considered sovereign, and I would imagine that’s driving some of that, the government spending figures that we’ll see maybe in next year’s report, and a little bit in this year’s as well.

Heather Pringle – Absolutely, and we’ve seen growth on the international side and their government investments. And we take this as a real positive in fact, well over 50% of the countries that are investing in space continue to increase their overall investment. So I think that’s a very exciting and positive trend. And when you look at the whole around the world, there are 93 countries that are operating in space. So it’s not just the very few who have launch capabilities, which you know, we know there are about 10 countries that launch, but 93 have actual assets and payloads that are actively operating in space.

Mike Gruss – You mentioned launch in there. That’s one of the other big figures, I think, in this report. Not that it necessarily took me by surprise, but it is a fun way to think about this, and I’ll let you kind of walk through the numbers. But you guys calculated how often, how many hours it takes before, on average, before we see another launch. So walk through those numbers and how they’re they’re coming down

Heather Pringle – Absolutely, so again, when you look at launch as a piece of the whole $613 billion it amounts to about $4 billion dollars of this overall space economy. And yet, this is a sector that punches well above its weight. Of course, it is the access point to space. Now, last year, we saw over 259 launches across the entire globe, which is a very significant overall number. And you know your point about how frequently that is happening? Well, as as early as we’re seeing this year, it’s one every 28 hours. That’s an incredible pace at which we can get capability both up and down from space, and it opens new opportunities for companies and customers to benefit from space capabilities, space data and technologies as well.

Mike Gruss – So let’s talk about that 28. It just, I mean, I guess I hadn’t really done the math, and I should have known it was somewhere about there. But that did surprise me a little bit. You know, what are you talked a little bit about the opportunity. Let’s, let’s discuss that a little bit more. But what are some of the questions that come with that too? Obviously, there’s, you know, we’re hearing a lot about orbital traffic management. That’s been an issue, I think, for, for a long time, obviously, a lot of opportunity, particularly for smaller companies that might not be able to have a dedicated launch. You know, what, what do you make of that number? And how did, how does launch still kind of stay, I don’t want to say stay relevant, but there’s, there used to be something incredibly appealing about, oh, I’m going to launch, or I’m seeing a launch, and now it’s, it’s becoming routine, which is, which is great for what we’re here to talk about today, which is this the space economy.

Heather Pringle – Well, I would say a launch is never boring, and it will continue to be an exciting and inspiring way to get the next generation involved in the space ecosystem. And the thing that’s so remarkable about launch and the lowering cost of launch is the increased competition that we’re seeing across the board, and I think that’s a good thing, because that makes space more viable. It makes it more tangible in our daily lives, because more people can have access to space at lower rates. And this is both on both on the human space flight side as well as the payload side, where we don’t have humans going into space. So we see over 14 companies that have this launch capability, and even more are going to grow, and that will open new opportunities for companies to get involved.

Mike Gruss – One other, one other area, I think I wanted to talk a little bit about that. You know, like I said, I saw three big numbers throughout this report that that I’m glad we can chat about. One is this $613 billion , two is the launch every 28 hours, and the third is not a surprise, something I think that comes up it feels like almost every week on our podcast, which is the $25 billion for Golden Dome. And you know, that is a giant defense program, but how do you think about it, specifically for space and the space of economy and in what are you telling folks about Golden Dome and what it what it can mean for industry?

Heather Pringle – Well, I start by looking at the United States national security budget, which is which is $49 billion overall for the space ecosystem, which is a pretty hefty number. And when you look at the size of what will be the golden dome investment, $25 billion in just one year. That is clearly a national priority. It is a scope that we haven’t seen in many, many years. And so golden dome is going to be a watershed moment for the space industry. It’s going to enable all layers of it, from sensing to tracking to intercepting and really excited to see that General Mike gutline has been confirmed, and looking forward to hearing more about what he says about this overall effort. But one thing we already know is that golden dome will spur innovation in the commercial industry, they’re looking for proven capabilities on short timelines. And I know that the space ecosystem, the space industry, is going to step up.

Mike Gruss – Do you expect a trickle down effect here? Is this something that we’re going to see maybe with, with some of the big primes and or larger companies, and then we’ll see, you know, lots and lots of sub or sub sub contracts going to folks. And that’s how this could that’s how this could really be felt throughout, throughout the space community.

Heather Pringle – Absolutely, this isn’t all of community effort. So from the bigs to the entrepreneurs, and that’s a real great way that the US military, the US government, can seed innovation across a particular industry that that’s been done in the past across other types of markets. And I see golden dome as another opportunity for seeding new types of space capabilities, new ways of sensing, new ways of tracking. And there’s a whole host of companies and sizes who will be partnering together to deliver all layers of the Golden Dome capability.

Mike Gruss – Last thing I wanted to touch on there, there’s also, as part of this, this funding, or proposed funding, you know, $500 million for some launch infrastructure. Talk about what that, what that could mean to.

Heather Pringle – As far as the conciliation bill that was?

Mike Gruss – Yeah.

Heather Pringle – Absolutely so where they’re pushing, the launch of infrastructure, as we know, space ports and getting to space is a key capability to leveraging those capabilities for us here on Earth. So that infusion into the five states is really going to help modernize the launch capabilities. It’s going to amplify that once every 28 hours capability. We see that going down in the future. But you know, it’s it’s not just about launching capabilities from the coast. There’s a whole series of ground infrastructure that supports space capabilities. And our analysis really shows that the whole global ecosystem is about $123 billion for ground infrastructure and support, and so as you know there, there are tracking and operating in more central to the United States that are still critical to getting that space capability out there in addition to the launch that we need, right?

Mike Gruss – All right. Last question, do you want to put a prediction on what this number could the big number could be for next year, $613 billion right now, seems like $650 billion is within reach. Do you have a guess for where you might. Be next year?

Heather Pringle – Well, I would say that I am, I do have confidence that the space economy will continue to grow, and with that real consistency that we’ve seen at over 7% I would say that that’s a good bet, and I’d be willing to make it

Mike Gruss – Great. Heather, thanks so much for joining us. This was a lot of fun. I know you have a big conference this week. I appreciate you making time to join us. Thanks so much.

Heather Pringle – Thanks for having me, appreciate it.

About Space Minds

Space Minds is a new audio and video podcast from SpaceNews that focuses on the inspiring leaders, technologies and exciting opportunities in space.

The weekly podcast features compelling interviews with scientists, founders and experts who love to talk about space, covers the news that has enthusiasts daydreaming, and engages with listeners. Join David Ariosto, Mike Gruss and journalists from the SpaceNews team for new episodes every Thursday.

Watch a new episode every Thursday on SpaceNews.com and on our YouTube, Spotify and Apple channels.

Be the first to know when new episodes drop! Enter your email, and we’ll make sure you get exclusive access to each episode as soon as it goes live!

Space Minds Podcast

“*” indicates required fields

Note: By registering, you consent to receive communications from SpaceNews and our partners.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

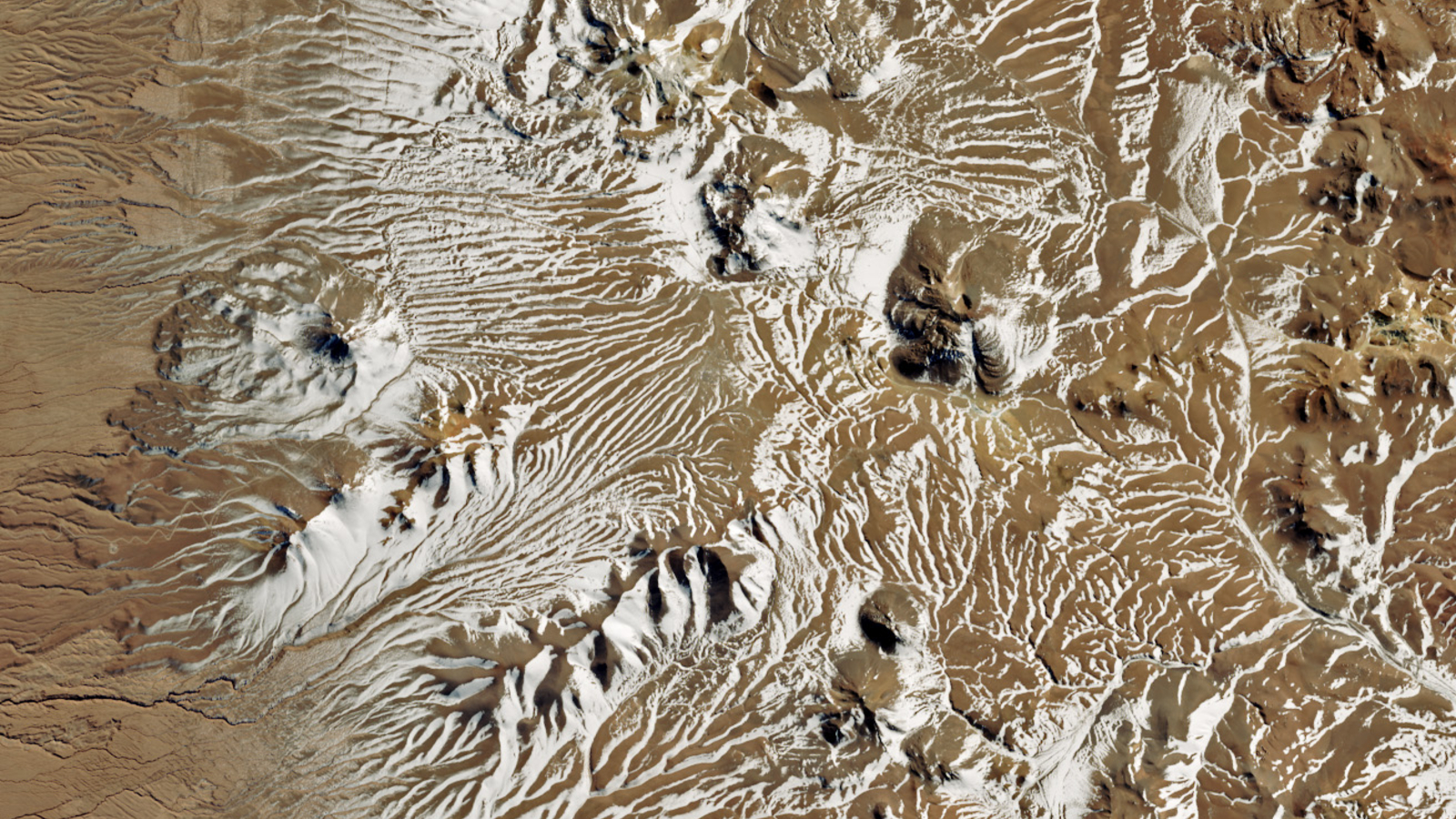

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly