Now Reading: The space economy isn’t for everyone

-

01

The space economy isn’t for everyone

The space economy isn’t for everyone

Projections for the booming space economy often come with trillion-dollar headlines, but the lion’s share of near-term revenue looks destined for just a handful of massive constellations with the funds to invest in vertical integration. It’s relatively slim pickings for the many other manufacturers, launch providers and technology suppliers hoping to ride the wave.

Manufacturing satellites represents a $316 billion revenue opportunity over the next decade, Analysys Mason principal analyst Dallas Kasaboski said during a recent webinar.

However, of the $179 billion tied to communications satellite production between 2026 and 2034, roughly $153 billion is already earmarked for Starlink, Amazon Leo or the Qianfan and Guowang networks locked behind China. That leaves only $26 billion for the 100 or so other constellations under development.

What’s more, much of the remaining “open market” growth is also likely to come from sovereign constellations looking for domestic suppliers.

It’s a similar story for launch. More than 40,000 satellites are expected to reach orbit over the next decade, yet two-thirds will belong to just four constellations.

The remaining 13,000 satellites still represent far more volume than analysts had expected not long ago, thanks to rapid advances in spacecraft and rockets, but how open is a launch market that competes against SpaceX? The company launched 50% of all orbital rockets over the last three years, covering 50% of all satellite deployments excluding Starlink.

“If you look at everything that’s launched over the next decade, over 80% of everything that’s launched into orbit is launched by SpaceX,” Kasaboski predicted.

“If you exclude Starlink from that opportunity, and you look at everything else, SpaceX is still launching 50% of all satellites.”

That leaves roughly 7,000 satellites for the rest of the launch industry as hungry new entrants also clamber for a piece of the pie.

The manufacturing and launch demand concentration around SpaceX in particular is now a major structural feature of the market, Novaspace principal Maxime Puteaux said.

Puteaux sees the market today split between SpaceX’s closed ecosystem and the limited but comparatively open demand from other commercial operators, including OneWeb, as well as institutional programs such as Europe’s proposed IRIS² constellation.

“This distinction underscores why the satellite boom only partially translates into real opportunities for the wider industry,” he said.

Meanwhile, the path of vertical integration for others is also narrowing as opportunities become more limited, noted Armand Musey, a satellite industry analyst and founder of Summit Ridge Group.

The hardest step remains deployment into specialized enterprise markets such as oil and gas, Musey said, while government-funded development work offers one of the few remaining avenues for smaller players to advance new technology.

“Governments are looking hard for new entrants to compete with SpaceX and throwing a lot of money around to people with even remotely viable technology,” Musey said.

Relying on government funding is not a long-term business, though, “unless there really is a viable strategy to compete, and usually there is not.”

Yet despite SpaceX’s gravitational pull, major investments continue across the broader ecosystem.

In October, Gilat Satellite Networks announced roughly $42 million in additional orders from an undisclosed operator for SkyEdge IV, a multi-orbit ground system, following a separate $40 million contract in June.

“As vertically integrated constellations expand, there is growing recognition that an open and interoperable ground ecosystem remains essential to the industry’s health and innovation pace,” said Hagay Katz, Gilat’s chief product and marketing officer.

According to Katz, operators are increasingly seeking flexibility, open standards and network diversity, which is good news for systems designed to orchestrate multiple constellations rather than lock users into one.

Momentum behind this trend is particularly strong across the inflight connectivity and defense markets, he said, where operators are turning to multi-orbit and hybrid networks to boost resilience.

“Service providers are increasingly prioritizing time to deploy, reliability, and total cost of ownership over raw throughput alone,” he added.

It’s an important trend to keep an eye on as the immense manufacturing scale of megaconstellation players could soon extend into new markets.

This article first appeared in the December 2025 issue of SpaceNews Magazine.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

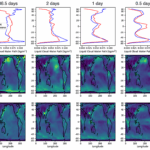

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

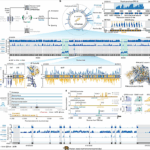

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly