Now Reading: York Space Systems files to go public

-

01

York Space Systems files to go public

York Space Systems files to go public

WASHINGTON — York Space Systems, a supplier to the Pentagon’s next-generation satellite constellation, has taken the formal step toward going public, filing paperwork with U.S. regulators as it looks to tap capital markets.

The Denver manufacturer said Nov. 17 it submitted a Form S-1 registration statement to the Securities and Exchange Commission. The company did not say how many shares it plans to sell or at what price and said it intends to list on the New York Stock Exchange under the symbol YSS. Goldman Sachs, Jefferies and Wells Fargo Securities were named as lead underwriters.

York is majority-owned by AE Industrial Partners, a private equity firm known for investments across aerospace and defense. Its move adds to a pipeline of space firms going public, including Voyager Technologies and Firefly Aerospace.

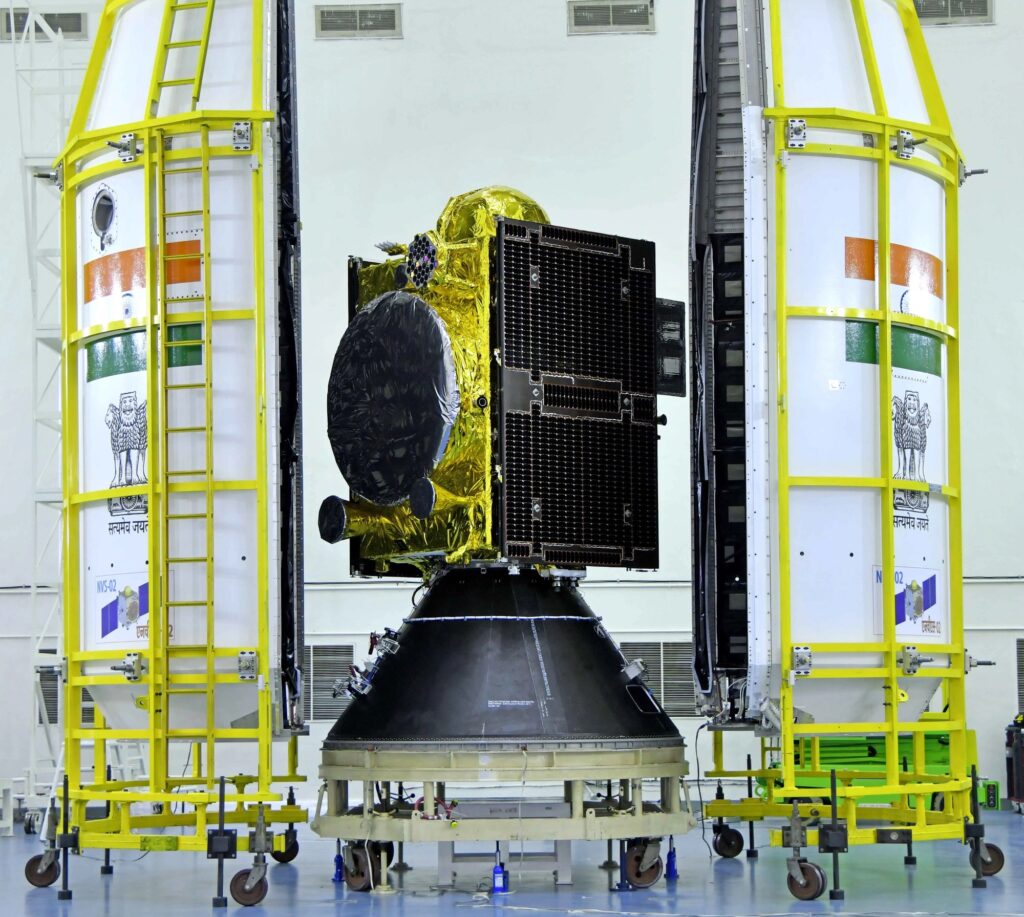

Over the past decade York has shifted from a small-satellite specialist into one of the more prominent builders in the national security space market. York designs and builds satellites, supplies ground systems and operates constellations, an end-to-end setup that has positioned it for larger government programs.

York in 2022 secured a central role in the Space Development Agency’s Transport Layer, a proliferated low Earth orbit network meant to harden U.S. military communications and missile-tracking capabilities. The SDA architecture is a top Pentagon priority as the U.S. seeks resilience against adversary interference.

To handle demand, York has opened a fourth production facility and, through its parent company, moved to acquire Atlas Space Operations to reinforce its space-to-ground communications services.

Financial disclosures in the S-1 show growth tied to national security work. For the nine months ended Sept. 30, 2025, York reported about $280.9 million in revenue, up nearly 59% from a year earlier. The company posted a net loss of roughly $56 million during the period, narrowing from a loss of about $73.6 million a year prior.

The filing marks the regulatory step required before an IPO but leaves several open questions, including valuation, share count and pricing. York still must secure NYSE approval and finalize underwriting terms. Bankers say the available 2025 window is tight as the year-end period approaches, raising the stakes for timing.

Analysts say hardware-focused space companies anchored in government programs are drawing more attention as the Defense Department accelerates plans to modernize satellite fleets. York’s filing suggests those firms see an opportunity to raise capital while the market remains receptive.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Two Black Holes Observed Circling Each Other for the First Time

01Two Black Holes Observed Circling Each Other for the First Time -

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life

02From Polymerization-Enabled Folding and Assembly to Chemical Evolution: Key Processes for Emergence of Functional Polymers in the Origin of Life -

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series)

03Astronomy 101: From the Sun and Moon to Wormholes and Warp Drive, Key Theories, Discoveries, and Facts about the Universe (The Adams 101 Series) -

04True Anomaly hires former York Space executive as chief operating officer

04True Anomaly hires former York Space executive as chief operating officer -

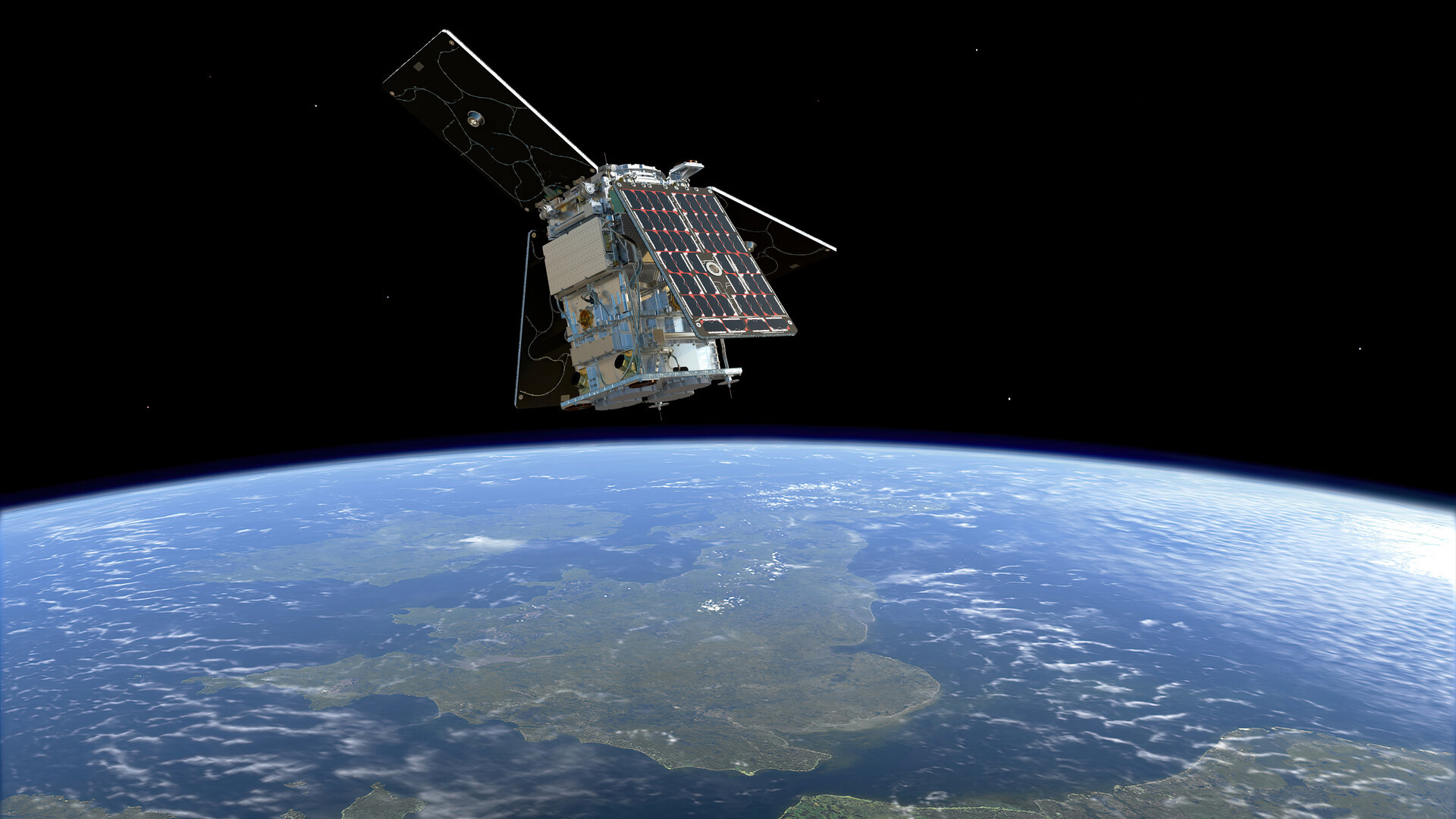

05Φsat-2 begins science phase for AI Earth images

05Φsat-2 begins science phase for AI Earth images -

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters

06Hurricane forecasters are losing 3 key satellites ahead of peak storm season − a meteorologist explains why it matters -

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly

07Binary star systems are complex astronomical objects − a new AI approach could pin down their properties quickly